Question: QUESTION 1 On 1 January 2 0 2 1 , Jazlan Berhad issues at 1 0 0 , 0 0 0 , 0 0 0

QUESTION

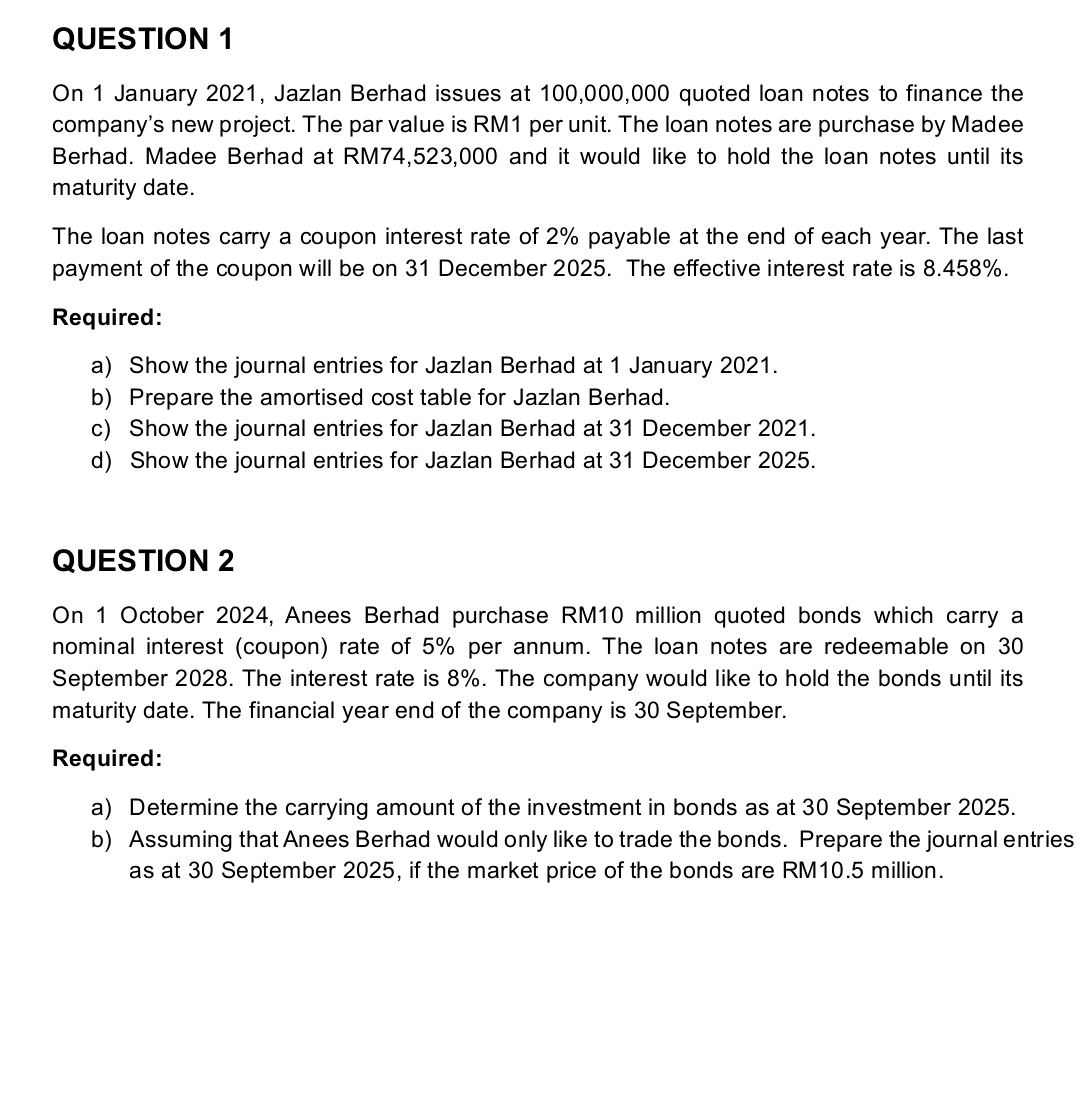

On January Jazlan Berhad issues at quoted loan notes to finance the company's new project. The par value is RM per unit. The loan notes are purchase by Madee Berhad. Madee Berhad at RM and it would like to hold the loan notes until its maturity date.

The loan notes carry a coupon interest rate of payable at the end of each year. The last payment of the coupon will be on December The effective interest rate is

Required:

a Show the journal entries for Jazlan Berhad at January

b Prepare the amortised cost table for Jazlan Berhad.

c Show the journal entries for Jazlan Berhad at December

d Show the journal entries for Jazlan Berhad at December

QUESTION

On October Anees Berhad purchase RM million quoted bonds which carry a nominal interest coupon rate of per annum. The loan notes are redeemable on September The interest rate is The company would like to hold the bonds until its maturity date. The financial year end of the company is September.

Required:

a Determine the carrying amount of the investment in bonds as at September

b Assuming that Anees Berhad would only like to trade the bonds. Prepare the journal entries as at September if the market price of the bonds are RM million.

show the cakculation ananda explanation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock