Question: Question 1 On 1st September 2008. Copula, a mutual fund, approaches a trading desk to sell $100 million face value of a 90-day T-bill currently

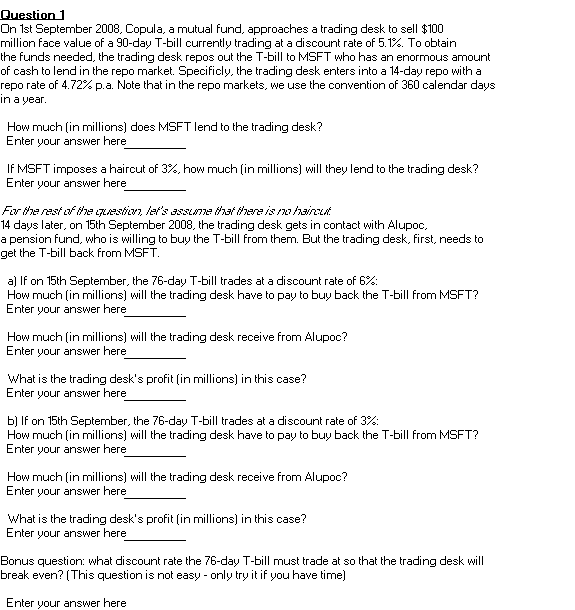

Question 1 On 1st September 2008. Copula, a mutual fund, approaches a trading desk to sell $100 million face value of a 90-day T-bill currently trading at a discount rate of 5.1%. To obtain the funds needed, the trading desk repos out the T-bill to MSFT who has an enormous amount of cash to lend in the repo market. Specificly, the trading desk enters into a 14-day repo with a repo rate of 4.72% p.a. Note that in the repo markets, we use the convention of 360 calendar days in a year. How much (in millions) does MSFT lend to the trading desk? Enter your answer here IF MSFT imposes a haircut of 3%, how much (in millions) will they lend to the trading desk? Enter your answer here Fiv tre sette gesin. /'S 388472e time is 117/11/2U 14 days later, on 15th September 2008, the trading desk gets in contact with Alupoc, a pension fund, who is willing to buy the T-bill from them. But the trading desk, first, needs to get the T-bill back from MSFT. a) If on 15th September, the 76-day T-bill trades at a discount rate of 6%: How much (in millions) will the trading desk have to pay to buy back the T-bill from MSFT? Enter your answer here How much (in millions) will the trading desk receive from Alupoc? Enter your answer here What is the trading desk's profit (in millions) in this case? Enter your answer here b) If on 15th September, the 76-day T-bill trades at a discount rate of 3%: How much (in millions) will the trading desk have to pay to buy back the T-bill from MSFT? Enter your answer here How much (in millions) will the trading desk receive from Alupoc? Enter your answer here What is the trading desk's profit (in millions) in this case? Enter your answer here Bonus question: what discount rate the 76-day T-bill must trade at so that the trading desk will break even? (This question is not easy - only try it if you have time) Enter your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts