Question: Question 1 OneUSF, a U . S . MNC based in Florida, is considering making a fixed direct investment in Italy. The Italian government has

Question

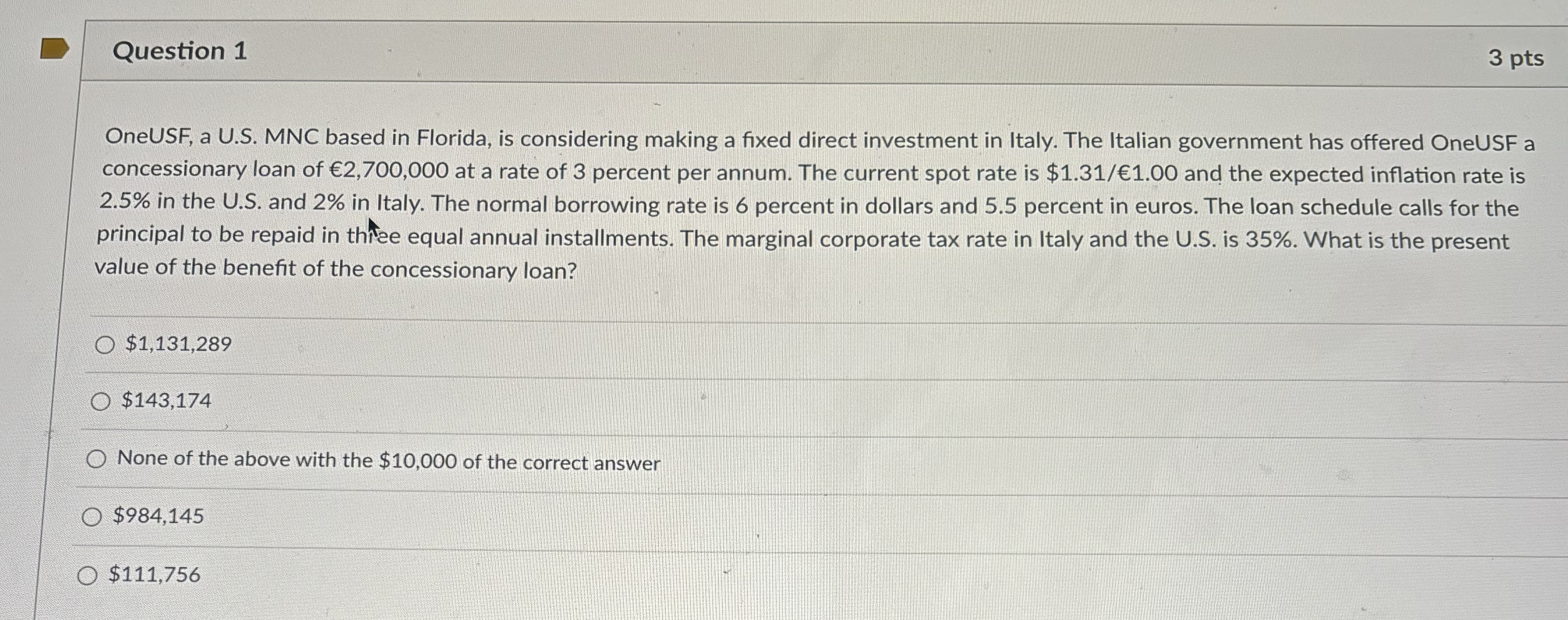

OneUSF, a US MNC based in Florida, is considering making a fixed direct investment in Italy. The Italian government has offered OneUSF a

concessionary loan of at a rate of percent per annum. The current spot rate is $ and the expected inflation rate is

in the US and in Italy. The normal borrowing rate is percent in dollars and percent in euros. The loan schedule calls for the

principal to be repaid in three equal annual installments. The marginal corporate tax rate in Italy and the US is What is the present

value of the benefit of the concessionary loan?

$

$

None of the above with the $ of the correct answer

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock