Question: Question 1. Page 1 and page two DELL LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 R ASSETS Non-current assets Property, plant &

Question 1. Page 1 and page two

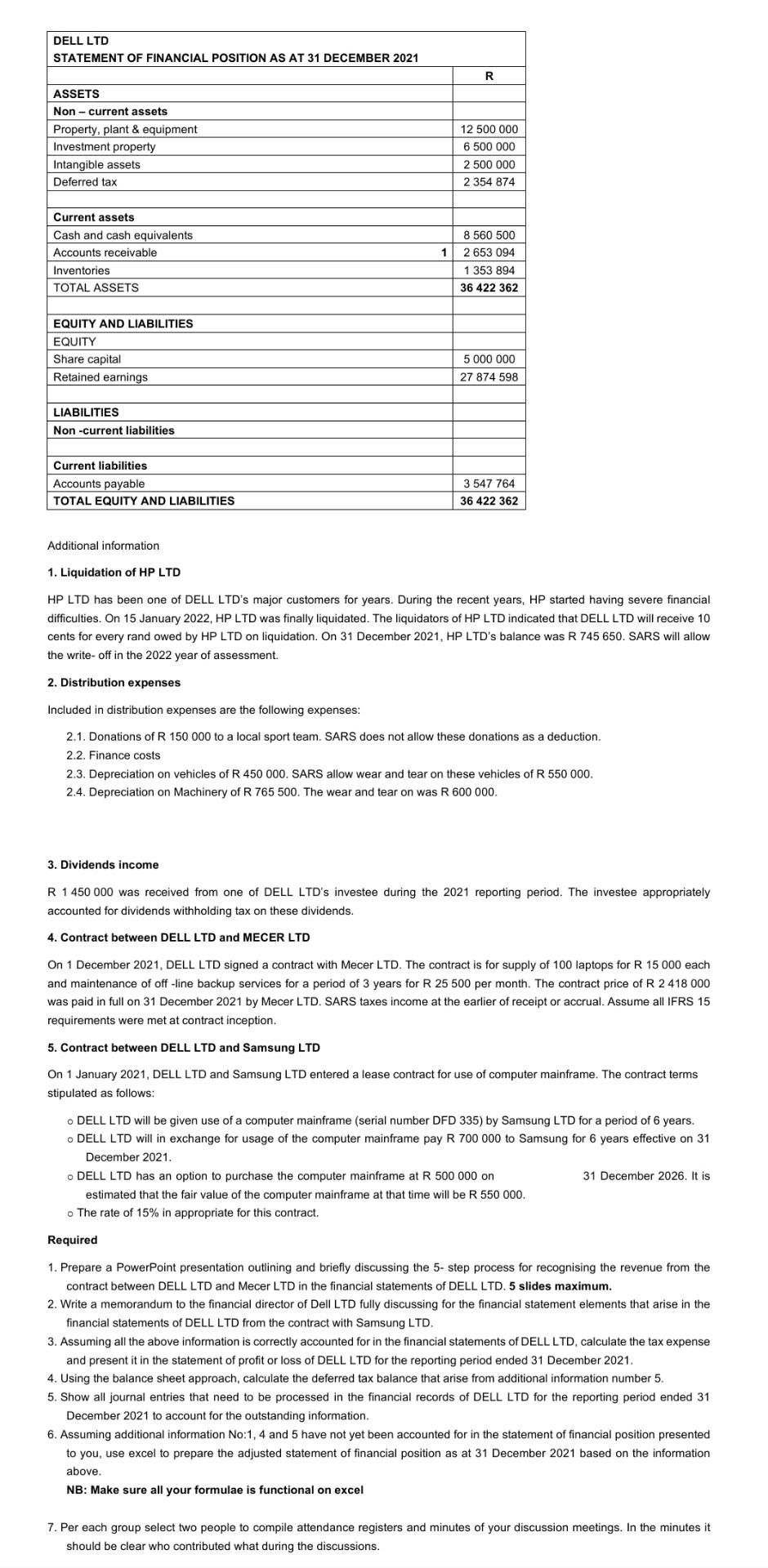

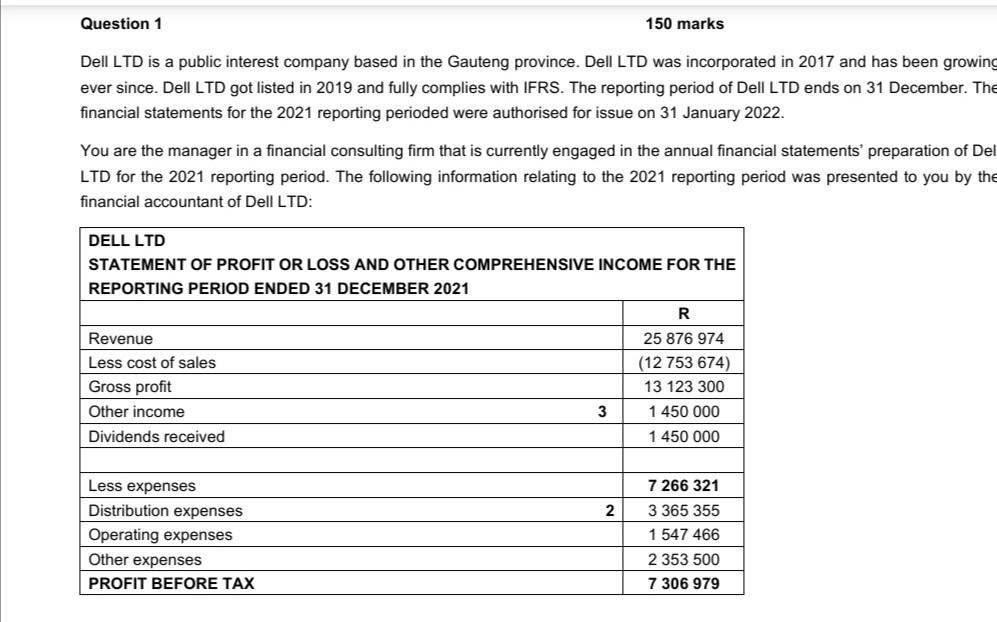

DELL LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 R ASSETS Non-current assets Property, plant & equipment Investment property Intangible assets Deferred tax 12 500 000 6 500 000 2 500 000 2 354 874 Current assets Cash and cash equivalents Accounts receivable Inventories TOTAL ASSETS 1 8 560 500 2 653 094 1 353 894 36 422 362 EQUITY AND LIABILITIES EQUITY Share capital Retained earnings 5 000 000 27 874 598 LIABILITIES Non-current liabilities Current liabilities Accounts payable TOTAL EQUITY AND LIABILITIES 3547 764 36 422 362 Additional information 1. Liquidation of HP LTD HP LTD has been one of DELL LTD's major customers for years. During the recent years, HP started having severe financial difficulties. On 15 January 2022, HP LTD was finally liquidated. The liquidators of HP LTD indicated that DELL LTD will receive 10 cents for every rand owed by HP LTD on liquidation. On 31 December 2021, HP LTD's balance was R 745 650. SARS will allow the write-off in the 2022 year of assessment. 2. Distribution expenses Included in distribution expenses are the following expenses: 2.1. Donations of R 150 000 to a local sport team. SARS does not allow these donations as a deduction. 2.2. Finance costs 2.3. Depreciation on vehicles of R 450 000. SARS allow wear and tear on these vehicles of R 550 000. 2.4. Depreciation on Machinery of R 765 500. The wear and tear on was R 600 000. 3. Dividends income R 1 450 000 was received from one of DELL LTD's investee during the 2021 reporting period. The investee appropriately accounted for dividends withholding tax on these dividends. 4. Contract between DELL LTD and MECER LTD On 1 December 2021, DELL LTD signed a contract with Mecer LTD. The contract is for supply of 100 laptops for R 15 000 each and maintenance of off-line backup services for a period of 3 years for R 25 500 per month. The contract price of R 2418 000 was paid in full on 31 December 2021 by Mecer LTD. SARS taxes income at the earlier of receipt or accrual. Assume all IFRS 15 requirements were met at contract inception. 5. Contract between DELL LTD and Samsung LTD On 1 January 2021, DELL LTD and Samsung LTD entered a lease contract for use of computer mainframe. The contract terms stipulated as follows: DELL LTD will be given use of a computer mainframe (serial number DFD 335) by Samsung LTD for a period of 6 years. DELL LTD will in exchange for usage of the computer mainframe pay R 700 000 to Samsung for 6 years effective on 31 December 2021. DELL LTD has an option to purchase the computer mainframe at R 500 000 on 31 December 2026. It is estimated that the fair value of the computer mainframe at that time will be R 550 000. The rate of 15% in appropriate for this contract. Required 1. Prepare a PowerPoint presentation outlining and briefly discussing the 5-step process for recognising the revenue from the contract between DELL LTD and Mecer LTD in the financial statements of DELL LTD. 5 slides maximum. 2. Write a memorandum to the financial director of Dell LTD fully discussing for the financial statement elements that arise in the financial statements of DELL LTD from the contract with Samsung LTD. 3. Assuming all the above information is correctly accounted for in the financial statements of DELL LTD, calculate the tax expense and present it in the statement of profit or loss of DELL LTD for the reporting period ended 31 December 2021. 4. Using the balance sheet approach, calculate the deferred tax balance that arise from additional information number 5. 5. Show all journal entries that need to be processed in the financial records of DELL LTD for the reporting period ended 31 December 2021 to account for the outstanding information. 6. Assuming additional information No:1, 4 and 5 have not yet been accounted for in the statement of financial position presented to you, use excel to prepare the adjusted statement of financial position as at 31 December 2021 based on the information above. NB: Make sure all your formulae is functional on excel 7. Per each group select two people to compile attendance registers and minutes of your discussion meetings. In the minutes it should be clear who contributed what during the discussions. Question 1 150 marks Dell LTD is a public interest company based in the Gauteng province. Dell LTD was incorporated in 2017 and has been growing ever since. Dell LTD got listed in 2019 and fully complies with IFRS. The reporting period of Dell LTD ends on 31 December. The financial statements for the 2021 reporting perioded were authorised for issue on 31 January 2022. You are the manager in a financial consulting firm that is currently engaged in the annual financial statements preparation of Del LTD for the 2021 reporting period. The following information relating to the 2021 reporting period was presented to you by the financial accountant of Dell LTD: DELL LTD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE REPORTING PERIOD ENDED 31 DECEMBER 2021 R Revenue 25 876 974 Less cost of sales (12 753 674) Gross profit 13 123 300 Other income 3 1 450 000 Dividends received 1 450 000 2 Less expenses Distribution expenses Operating expenses Other expenses PROFIT BEFORE TAX 7 266 321 3 365 355 1 547 466 2 353 500 7 306 979 DELL LTD STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 R ASSETS Non-current assets Property, plant & equipment Investment property Intangible assets Deferred tax 12 500 000 6 500 000 2 500 000 2 354 874 Current assets Cash and cash equivalents Accounts receivable Inventories TOTAL ASSETS 1 8 560 500 2 653 094 1 353 894 36 422 362 EQUITY AND LIABILITIES EQUITY Share capital Retained earnings 5 000 000 27 874 598 LIABILITIES Non-current liabilities Current liabilities Accounts payable TOTAL EQUITY AND LIABILITIES 3547 764 36 422 362 Additional information 1. Liquidation of HP LTD HP LTD has been one of DELL LTD's major customers for years. During the recent years, HP started having severe financial difficulties. On 15 January 2022, HP LTD was finally liquidated. The liquidators of HP LTD indicated that DELL LTD will receive 10 cents for every rand owed by HP LTD on liquidation. On 31 December 2021, HP LTD's balance was R 745 650. SARS will allow the write-off in the 2022 year of assessment. 2. Distribution expenses Included in distribution expenses are the following expenses: 2.1. Donations of R 150 000 to a local sport team. SARS does not allow these donations as a deduction. 2.2. Finance costs 2.3. Depreciation on vehicles of R 450 000. SARS allow wear and tear on these vehicles of R 550 000. 2.4. Depreciation on Machinery of R 765 500. The wear and tear on was R 600 000. 3. Dividends income R 1 450 000 was received from one of DELL LTD's investee during the 2021 reporting period. The investee appropriately accounted for dividends withholding tax on these dividends. 4. Contract between DELL LTD and MECER LTD On 1 December 2021, DELL LTD signed a contract with Mecer LTD. The contract is for supply of 100 laptops for R 15 000 each and maintenance of off-line backup services for a period of 3 years for R 25 500 per month. The contract price of R 2418 000 was paid in full on 31 December 2021 by Mecer LTD. SARS taxes income at the earlier of receipt or accrual. Assume all IFRS 15 requirements were met at contract inception. 5. Contract between DELL LTD and Samsung LTD On 1 January 2021, DELL LTD and Samsung LTD entered a lease contract for use of computer mainframe. The contract terms stipulated as follows: DELL LTD will be given use of a computer mainframe (serial number DFD 335) by Samsung LTD for a period of 6 years. DELL LTD will in exchange for usage of the computer mainframe pay R 700 000 to Samsung for 6 years effective on 31 December 2021. DELL LTD has an option to purchase the computer mainframe at R 500 000 on 31 December 2026. It is estimated that the fair value of the computer mainframe at that time will be R 550 000. The rate of 15% in appropriate for this contract. Required 1. Prepare a PowerPoint presentation outlining and briefly discussing the 5-step process for recognising the revenue from the contract between DELL LTD and Mecer LTD in the financial statements of DELL LTD. 5 slides maximum. 2. Write a memorandum to the financial director of Dell LTD fully discussing for the financial statement elements that arise in the financial statements of DELL LTD from the contract with Samsung LTD. 3. Assuming all the above information is correctly accounted for in the financial statements of DELL LTD, calculate the tax expense and present it in the statement of profit or loss of DELL LTD for the reporting period ended 31 December 2021. 4. Using the balance sheet approach, calculate the deferred tax balance that arise from additional information number 5. 5. Show all journal entries that need to be processed in the financial records of DELL LTD for the reporting period ended 31 December 2021 to account for the outstanding information. 6. Assuming additional information No:1, 4 and 5 have not yet been accounted for in the statement of financial position presented to you, use excel to prepare the adjusted statement of financial position as at 31 December 2021 based on the information above. NB: Make sure all your formulae is functional on excel 7. Per each group select two people to compile attendance registers and minutes of your discussion meetings. In the minutes it should be clear who contributed what during the discussions. Question 1 150 marks Dell LTD is a public interest company based in the Gauteng province. Dell LTD was incorporated in 2017 and has been growing ever since. Dell LTD got listed in 2019 and fully complies with IFRS. The reporting period of Dell LTD ends on 31 December. The financial statements for the 2021 reporting perioded were authorised for issue on 31 January 2022. You are the manager in a financial consulting firm that is currently engaged in the annual financial statements preparation of Del LTD for the 2021 reporting period. The following information relating to the 2021 reporting period was presented to you by the financial accountant of Dell LTD: DELL LTD STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE REPORTING PERIOD ENDED 31 DECEMBER 2021 R Revenue 25 876 974 Less cost of sales (12 753 674) Gross profit 13 123 300 Other income 3 1 450 000 Dividends received 1 450 000 2 Less expenses Distribution expenses Operating expenses Other expenses PROFIT BEFORE TAX 7 266 321 3 365 355 1 547 466 2 353 500 7 306 979

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts