Question: Question 1 Part 1 : Income Statement Preparation Mountain Peak Retailers has the following financial information for the year ended December 3 1 , 2

Question Part : Income Statement Preparation Mountain Peak Retailers has the following financial information for the year ended December : Gross Sales: $ Sales Returns & Allowances: $ Cost of Goods Sold: $ Rent Expense: $ Utilities Expense: $ Salaries Expense: $ Interest Expense: $ Depreciation Expense: $ Income Tax Expense: $ Required: Prepare a complete multistep income statement. Format: for positive numbers, enter whole dollars and no cents, egFormat: for negative numbers, enter minus sign, whole dollars and no cents, eg Mountain Peak Retailers Income Statement For the Year Ended December Gross Sales $ Less: Sales Returns & Allowances $ Net Sales $ Less: Cost of Goods Sold $ Gross Profit $ Operating Expenses: Rent Expense $ Utilities Expense $ Salaries Expense $ Depreciation Expense Total Operating Expenses $ Operating Income $ Other Expenses: Interest Expense Income Before Taxes $ Income Tax Expense f Net Income $

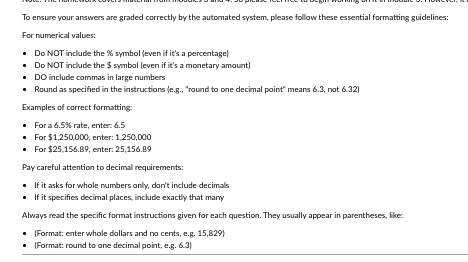

To ensure your answers are graded correctly by the automated system, please follow these essential formatting guidelines:

For numerical values:

Do NOT include the symbol even if it's a percentage

Do NOT include the $ symbol even if it's a monetary amount

DO include commas in large numbers

Round as specified in the instructions eg "round to one decimal point" means not

Examples of correct formatting:

For a rate, enter:

Question

Part : Income Statement Preparation

Mountain Peak Retailers has the following financial information for the year ended December :

Gross Sales: $

Sales Returns & Allowances: $

Cost of Goods Soldt $

Rent Expense: $

Utilities Expense: $

Salaries Expense: $

Interest Expense: $

Depreciation Expense: $

Income Tax Expense: $

Required:

Prepare a complete multistep income statement.

Format: for positive numbers, enter whole dollars and no cents, eg

Format: for negative numbers, enter minus sign, whole dollars and no cents, eg

Mountain Peak Retailers

Income Statement

For the Year Ended December

Gross Sales $

Less: Sales Returns & Allowances $

Net Sales $

Less: Cost of Goods Sold

Gross Profit

Operating Expenses:

Rent Expense

Utilities Expense $

Salaries Expense $

Depreciation Expense $

Total Operating Expenses $

Operating Income $

Other Expenses:

Interest Expense $

Income Before Taxes $

Income Tax Expense $

Net Income $

Part : Balance Shect Construction

Mountain Peak Retailers has the following account balances as of December :

Cash: $

Accounts Receivable: $

Irventory: $

Equipment: $

Accumulated Depreciation: $

Land: $

Accounts Payable: $

Notes Payable due in years: $

Wages Payable: $

Common Stock: $

Retained Earnings: beginning balance $Nate: Retained Earnings will need to be adjusted for net income and dividends

Dividencs paid during : $

Required:

Prepare a classified balance sheet

Format: for positive numbers, enter whole dollars and no cents, eg

Format: for negative numbers, enter minus sign, whole dollars and no cents, eg

Mountain Peak Retailers

Balance Sheet

As of December

ASSETS

Current Assets:

Cash

Accounts Receivable

Inventory

Total Current Assets q

Noncurrent Assets:

Land:

Equipment $

Less: Accumulated Deprec.

Total Noncurrent Assets :

Total Assets $

LLABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts Payable:

Wages Payable $

Total Current Liabilities

Noncurrent Liablities:

Notes Payable &

Total Liabilities $

Stockholders' Equity:

Common Stock :

Retained Earnings

Total Stockholders' Equity

Total Liabilities and Stocloholders' Equity

Question

Part : Statement of Owner's Equity

Using the information from Parts and prepare a Statement of Owner's Equity for Mountain Peak Retailers for the year ended December

Required:

Prepare a complete Statement of Owner's Equity.

Format: for positive numbers, enter whole dollars and no cents, eg

Format: for negative numbers, enter minus sign, whole dollors and no cents, eg

Mountain Peak Retailers

Statement of Owner's Equity

For the Year Ended December

Common Stock:

Beginning Balance!

Changes During Year

Ending Balonce

Retained Earning:

Beginning Balance!

Add: Net Income

Less: Dividends $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock