Question: question 1: part 1 part 2 question 2: question 3: Required information Exercise 23-9 (Static) Segment elimination LO P4 [The following information applies to the

![to the questions displayed below.] Suresh Company reports the following segment (department)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717b3168f3d8_4226717b3160d386.jpg)

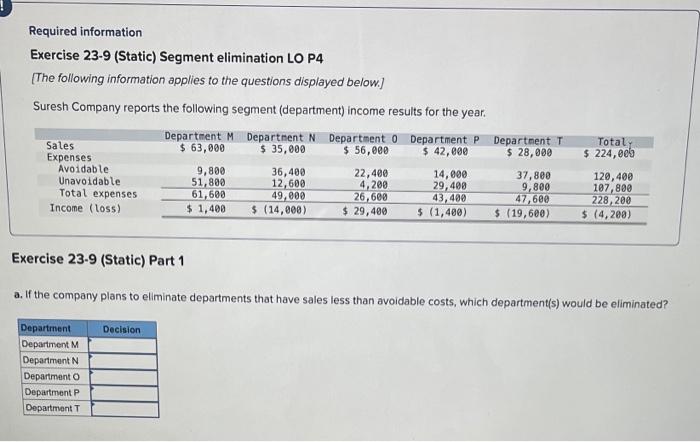

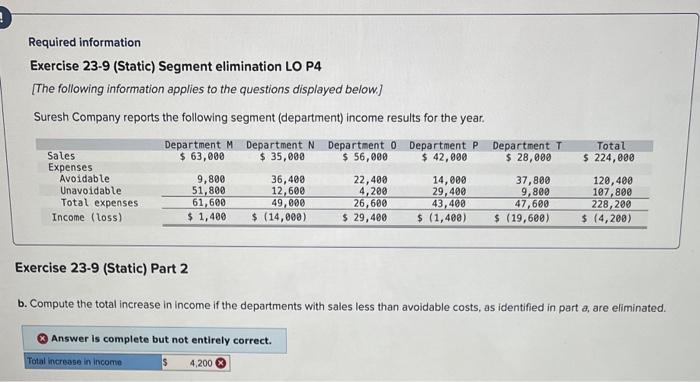

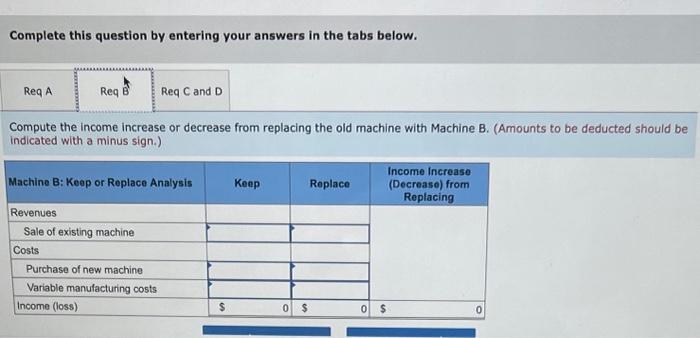

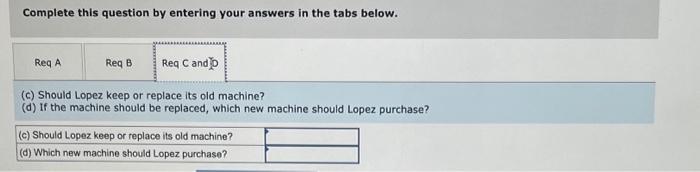

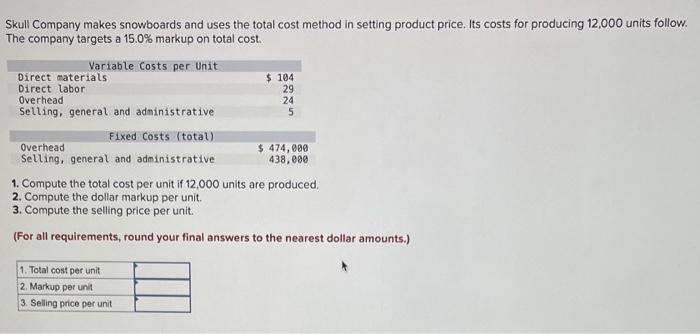

Required information Exercise 23-9 (Static) Segment elimination LO P4 [The following information applies to the questions displayed below.] Suresh Company reports the following segment (department) income results for the year. Exercise 23-9 (Static) Part 1 a. If the company plans to eliminate departments that have sales less than avoidable costs, which department(s) would be eliminated? Required information Exercise 23-9 (Static) Segment elimination LO P4 [The following information applies to the questions displayed below.] Suresh Company reports the following segment (department) income results for the year. Exercise 23-9 (Static) Part 2 b. Compute the total increase in income if the departments with sales less than avoidable costs, as identified in part a, are eliminated. Answer is complete but not entirely correct. Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $49,000 and a remaining useful life of five years. It can be sold now for $59,000. Variable manufacturing costs are $44,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted should be indicated with a minus sign.) Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine B. (Amounts to be deducted should be indicated with a minus sign.) Complete this question by entering your answers in the tabs below. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Skull Company makes snowboards and uses the total cost method in setting product price. Its costs for producing 12,000 units follow. The company targets a 15.0% markup on total cost. 1. Compute the total cost per unit if 12,000 units are produced. 2. Compute the dollar markup per unit. 3. Compute the selling price per unit. (For all requirements, round your final answers to the nearest dollar amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts