Question: QUESTION 1 PART A ( 3 0 marks, 5 4 minutes ) Defendify ( Pty ) Ltd ( Defendify ) manufactures self -

QUESTION

PART A marks, minutes

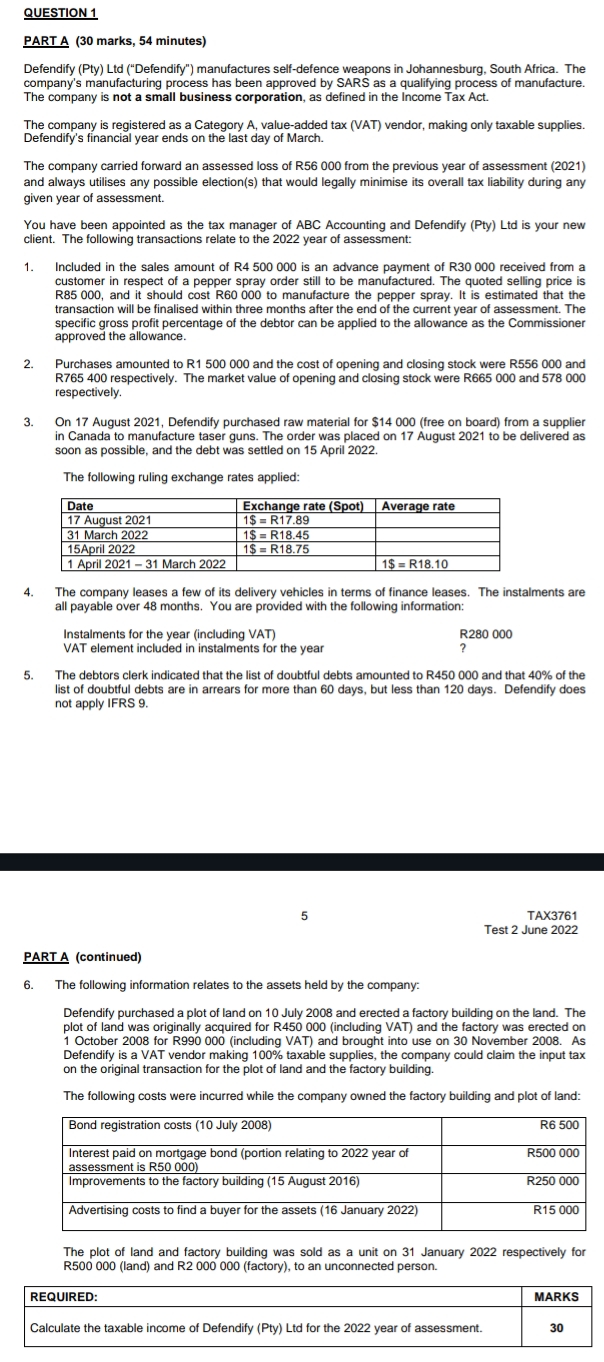

Defendify Pty Ltd Defendify manufactures selfdefence weapons in Johannesburg, South Africa. The company's manufacturing process has been approved by SARS as a qualifying process of manufacture. The company is not a small business corporation, as defined in the Income Tax Act.

The company is registered as a Category A valueadded tax VAT vendor, making only taxable supplies. Defendify's financial year ends on the last day of March.

The company carried forward an assessed loss of R from the previous year of assessment and always utilises any possible elections that would legally minimise its overall tax liability during any given year of assessment.

You have been appointed as the tax manager of ABC Accounting and Defendify Pty Ltd is your new client. The following transactions relate to the year of assessment:

Included in the sales amount of is an advance payment of received from a customer in respect of a pepper spray order still to be manufactured. The quoted selling price is R and it should cost R to manufacture the pepper spray. It is estimated that the transaction will be finalised within three months after the end of the current year of assessment. The specific gross profit percentage of the debtor can be applied to the allowance as the Commissioner approved the allowance.

Purchases amounted to R and the cost of opening and closing stock were R and R respectively. The market value of opening and closing stock were R and respectively.

On August Defendify purchased raw material for $free on board from a supplier in Canada to manufacture taser guns. The order was placed on August to be delivered as soon as possible, and the debt was settled on April

The following ruling exchange rates applied:

tableDateExchange rate SpotAverage rate August $ R March $April $ R April March $ $ R

The company leases a few of its delivery vehicles in terms of finance leases. The instalments are all payable over months. You are provided with the following information:

Instalments for the year including VAT

R

VAT element included in instalments for the year

The debtors clerk indicated that the list of doubtful debts amounted to R and that of the list of doubtful debts are in arrears for more than days, but less than days. Defendify does not apply IFRS

TAX

Test June

PART A continued

The following information relates to the assets held by the company:

Defendify purchased a plot of land on July and erected a factory building on the land. The plot of land was originally acquired for Rincluding VAT and the factory was erected on October for Rincluding VAT and brought into use on November As Defendify is a VAT vendor making taxable supplies, the company could claim the input tax on the original transaction for the plot of land and the factory building.

The following costs were incurred while the company owned the factory building and plot of land:

tableBond registration costs July RtableInterest paid on mortgage bond portion relating to year ofassessment is RRImprovements to the factory building August RAdvertising costs to find a buyer for the assets January R

The plot of land and factory building was sold as a unit on January respectively for Rland and Rfactory to an unconnected person.

tableREQUIRED:MARKSCalculate the taxable income of Defendify Pty Ltd for the year of assessment.,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock