Question: Question 1 Part A Ashley wanted to save up for deposit of $60,000 to buy a house in 5-year time. Her first saving will start

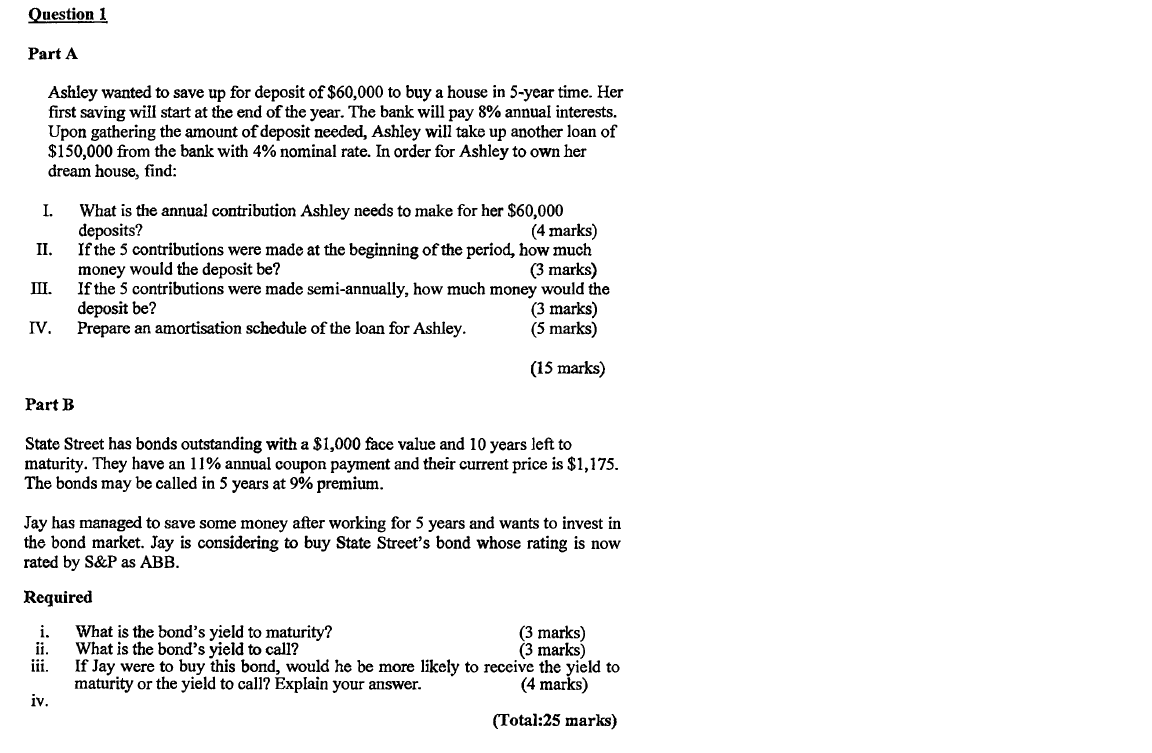

Question 1 Part A Ashley wanted to save up for deposit of $60,000 to buy a house in 5-year time. Her first saving will start at the end of the year. The bank will pay 8% annual interests. Upon gathering the amount of deposit needed, Ashley will take up another loan of $150,000 from the bank with 4% nominal rate. In order for Ashley to own her dream house, find: What is the annual contribution Ashley needs to make for her $60,000 deposits? If the 5 contributions were made at the beginning of the period, how much money would the deposit be? If the 5 contributions were made semi-annually, how much money would the deposit be? Prepare an amortisation schedule of the loan for Ashley I. (4 marks) II. (3 marks) . (3 marks) (5 marks) IV (15 marks) Part B State Street has bonds outstanding with a $1,000 face value and 10 years left to maturity. They have an 11% annual coupon payment and their current price is $1,175 The bonds may be called in 5 years at 9% premium. Jay has managed to save some money after working for 5 years and wants to invest in the bond market. Jay is considering to buy State Street's bond whose rating is now rated by S&P as ABB. Required What is the bond's yield to maturity? What is the bond's yield to call? ii (3 marks) (3 marks) If Jay were to buy this bond, would he be more likely to receive the yield to maturity or the yield to call? Explain your answer. (4 marks) iv (Total:25 marks) Question 1 Part A Ashley wanted to save up for deposit of $60,000 to buy a house in 5-year time. Her first saving will start at the end of the year. The bank will pay 8% annual interests. Upon gathering the amount of deposit needed, Ashley will take up another loan of $150,000 from the bank with 4% nominal rate. In order for Ashley to own her dream house, find: What is the annual contribution Ashley needs to make for her $60,000 deposits? If the 5 contributions were made at the beginning of the period, how much money would the deposit be? If the 5 contributions were made semi-annually, how much money would the deposit be? Prepare an amortisation schedule of the loan for Ashley I. (4 marks) II. (3 marks) . (3 marks) (5 marks) IV (15 marks) Part B State Street has bonds outstanding with a $1,000 face value and 10 years left to maturity. They have an 11% annual coupon payment and their current price is $1,175 The bonds may be called in 5 years at 9% premium. Jay has managed to save some money after working for 5 years and wants to invest in the bond market. Jay is considering to buy State Street's bond whose rating is now rated by S&P as ABB. Required What is the bond's yield to maturity? What is the bond's yield to call? ii (3 marks) (3 marks) If Jay were to buy this bond, would he be more likely to receive the yield to maturity or the yield to call? Explain your answer. (4 marks) iv (Total:25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts