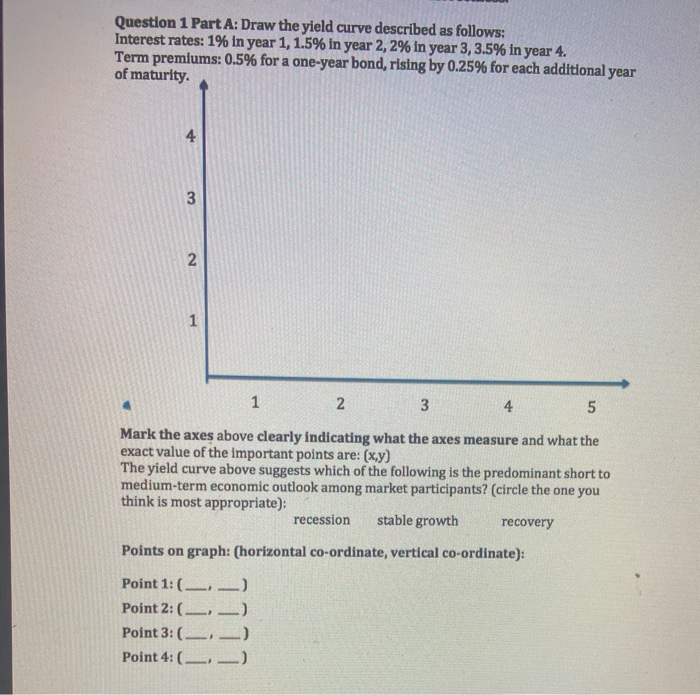

Question: Question 1 Part A: Draw the yield curve described as follows: Interest rates: 1% in year 1, 1.5% in year 2,2% in year 3, 3.5%

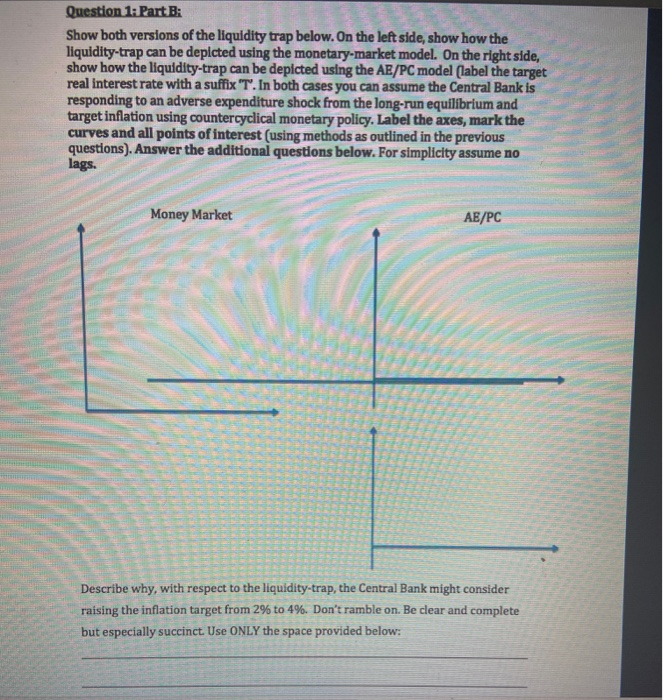

Question 1 Part A: Draw the yield curve described as follows: Interest rates: 1% in year 1, 1.5% in year 2,2% in year 3, 3.5% in year 4. Term premiums: 0.5% for a one-year bond, rising by 0.25% for each additional year of maturity. wo Mark the axes above clearly indicating what the axes measure and what the exact value of the important points are: (x,y) The yield curve above suggests which of the following is the predominant short to medium-term economic outlook among market participants? (circle the one you think is most appropriate): recession stable growth recovery Points on graph: (horizontal co-ordinate, vertical co-ordinate): Point 1:( Point 2:( _ ) Point 3:( _,-) Point 4:( _,-) Question 1: Part B: Show both versions of the liquidity trap below. On the left side, show how the liquidity-trap can be depicted using the monetary-market model. On the right side, show how the liquidity-trap can be depicted using the AE/PC model (label the target real interest rate with a suffix "T. In both cases you can assume the Central Bank is responding to an adverse expenditure shock from the long-run equilibrium and target inflation using countercyclical monetary policy. Label the axes, mark the curves and all points of interest (using methods as outlined in the previous questions). Answer the additional questions below. For simplicity assume no lags. Money Market AE/PC Describe why, with respect to the liquidity-trap, the Central Bank might consider raising the inflation target from 2% to 4%. Don't ramble on. Be clear and complete but especially succinct. Use ONLY the space provided below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts