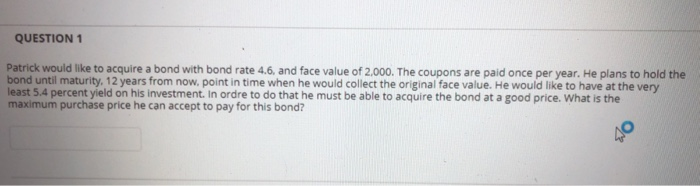

Question: QUESTION 1 Patrick would like to acquire a bond with bond rate 4.6, and face value of 2,000. The coupons are paid once per year.

QUESTION 1 Patrick would like to acquire a bond with bond rate 4.6, and face value of 2,000. The coupons are paid once per year. He plans to hold the bond until maturity, 12 years from now, point in time when he would collect the original face value. He would like to have at the very least 5.4 percent yield on his investment. In ordre to do that he must be able to acquire the bond at a good price. What is the maximum purchase price he can accept to pay for this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts