Question: Question 1 - Payout Policy / Dividend payments (20 points) Seashore Salt Co. has surplus cash. Its CFO decides to pay back $4 per share

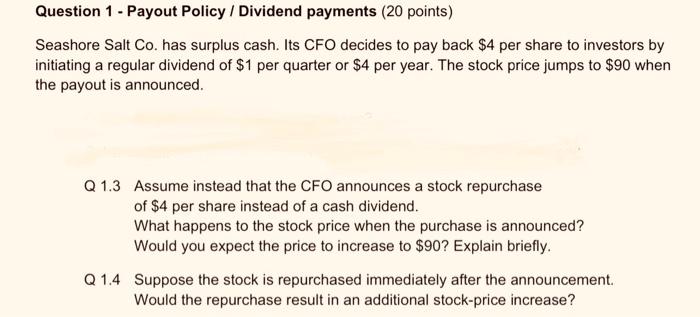

Question 1 - Payout Policy / Dividend payments (20 points) Seashore Salt Co. has surplus cash. Its CFO decides to pay back $4 per share to investors by initiating a regular dividend of $1 per quarter or $4 per year. The stock price jumps to $90 when the payout is announced. Q1.3 Assume instead that the CFO announces a stock repurchase of $4 per share instead of a cash dividend. What happens to the stock price when the purchase is announced? Would you expect the price to increase to $90? Explain briefly. Q1.4 Suppose the stock is repurchased immediately after the announcement. Would the repurchase result in an additional stock-price increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts