Question: Question 1 Please answer only letter D please. You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for

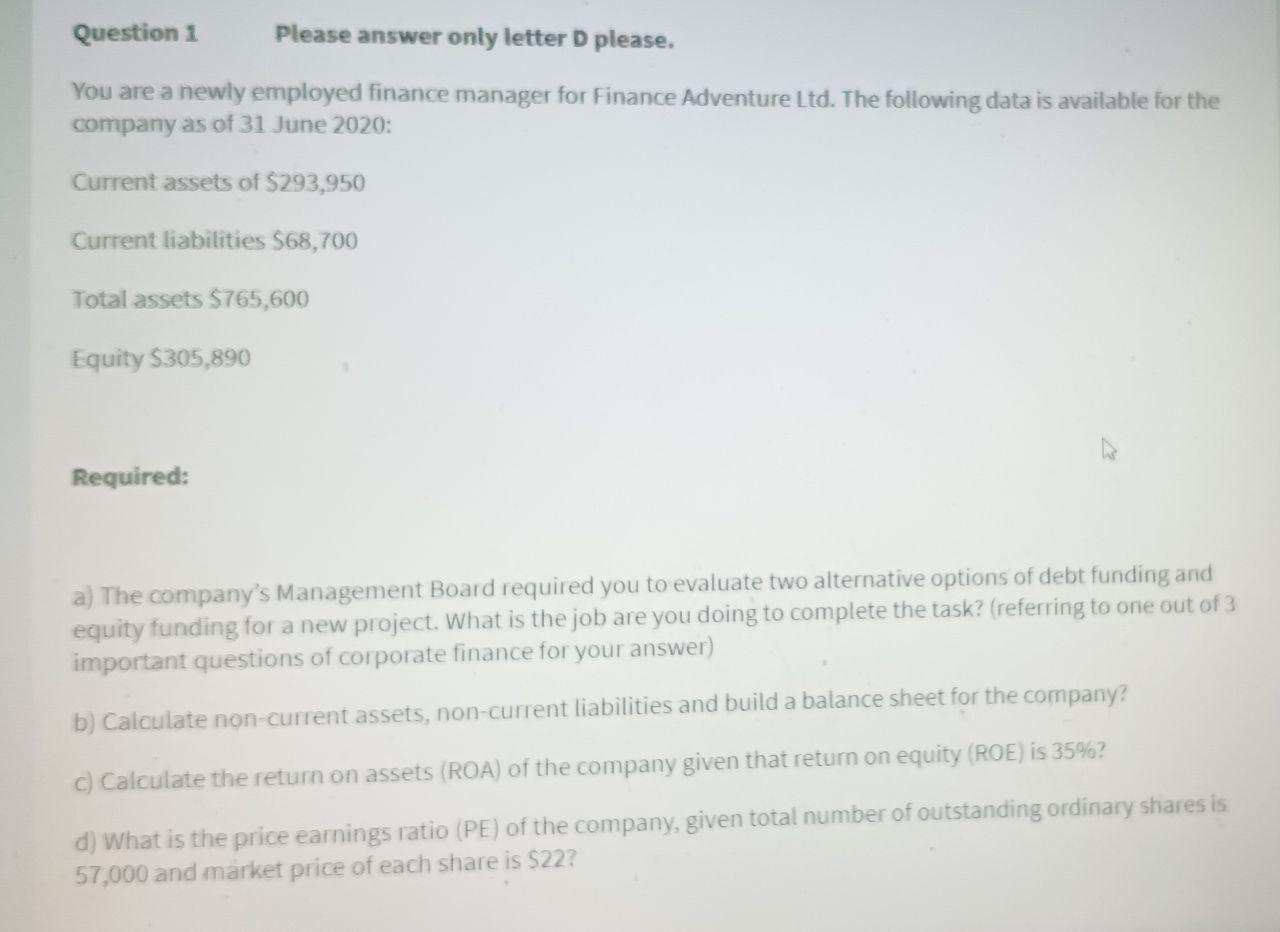

Question 1 Please answer only letter D please. You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for the company as of 31 June 2020: Current assets of $293,950 Current liabilities $68,700 Total assets 5765,600 Equity 5305,890 Required: a) The company's Management Board required you to evaluate two alternative options of debt funding and equity funding for a new project. What is the job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) a b) Calculate non-current assets, non-current liabilities and build a balance sheet for the company c) Calculate the return on assets (ROA) of the company given that retum on equity (ROE) is 35%? d) What is the price earnings ratio (PE) of the company, given total number of outstanding ordinary shares is 57,000 and market price of each share is $22? Question 1 Please answer only letter D please. You are a newly employed finance manager for Finance Adventure Ltd. The following data is available for the company as of 31 June 2020: Current assets of $293,950 Current liabilities $68,700 Total assets 5765,600 Equity 5305,890 Required: a) The company's Management Board required you to evaluate two alternative options of debt funding and equity funding for a new project. What is the job are you doing to complete the task? (referring to one out of 3 important questions of corporate finance for your answer) a b) Calculate non-current assets, non-current liabilities and build a balance sheet for the company c) Calculate the return on assets (ROA) of the company given that retum on equity (ROE) is 35%? d) What is the price earnings ratio (PE) of the company, given total number of outstanding ordinary shares is 57,000 and market price of each share is $22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts