Question: Question 1 please do both parts Question 2 please do both parts Roybus, Inc., a manufacturer of flash memory, just reported that its main production

Question 1 please do both parts

Question 2 please do both parts

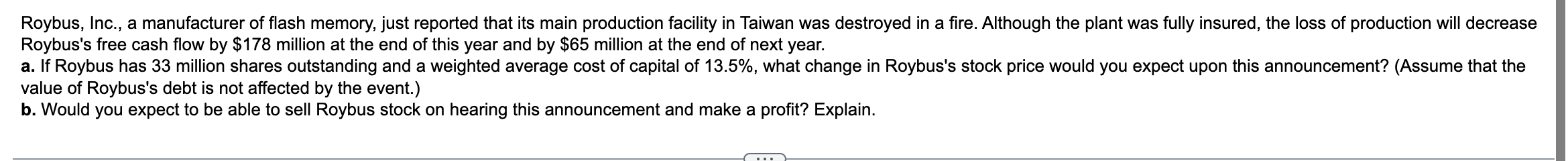

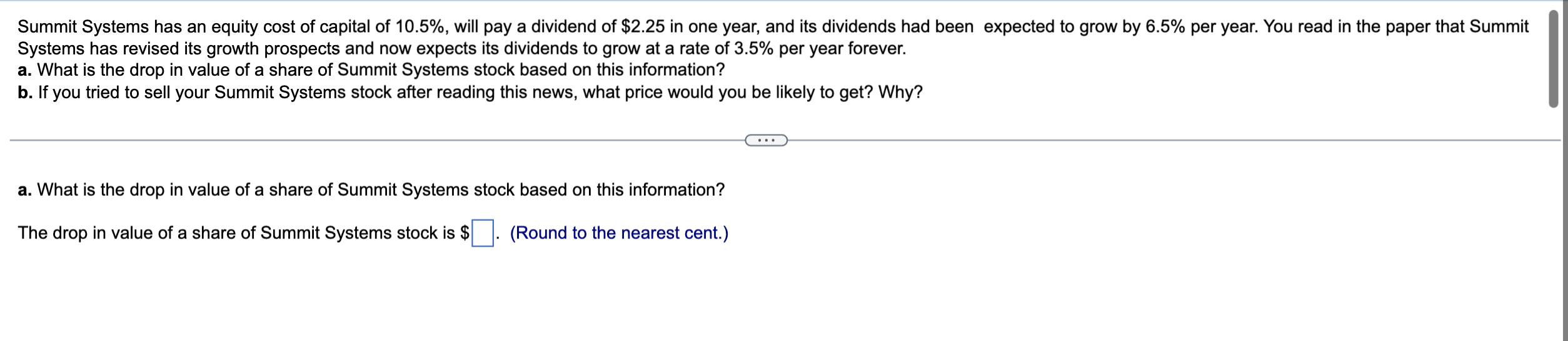

Roybus, Inc., a manufacturer of flash memory, just reported that its main production facility in Taiwan was destroyed in a fire. Although the plant was fully insured, the loss of production will decrease Roybus's free cash flow by $178 million at the end of this year and by $65 million at the end of next year. a. If Roybus has 33 million shares outstanding and a weighted average cost of capital of 13.5%, what change in Roybus's stock price would you expect upon this announcement? (Assume that the value of Roybus's debt is not affected by the event.) b. Would you expect to be able to sell Roybus stock on hearing this announcement and make a profit? Explain. Summit Systems has an equity cost of capital of 10.5%, will pay a dividend of $2.25 in one year, and its dividends had been expected to grow by 6.5% per year. You read in the paper that Summit Systems has revised its growth prospects and now expects its dividends to grow at a rate of 3.5% per year forever. a. What is the drop in value of a share of Summit Systems stock based on this information? b. If you tried to sell your Summit Systems stock after reading this news, what price would you be likely to get? Why? a. What is the drop in value of a share of Summit Systems stock based on this information? The drop in value of a share of Summit Systems stock is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts