Question: QUESTION 1 PLEASE DO NOT USE EXCEL TO SOLVE THIS QUESTION. THANK YOU! b. Cik Emma has bought an under construction property valued at RM455,000

QUESTION 1

PLEASE DO NOT USE EXCEL TO SOLVE THIS QUESTION. THANK YOU!

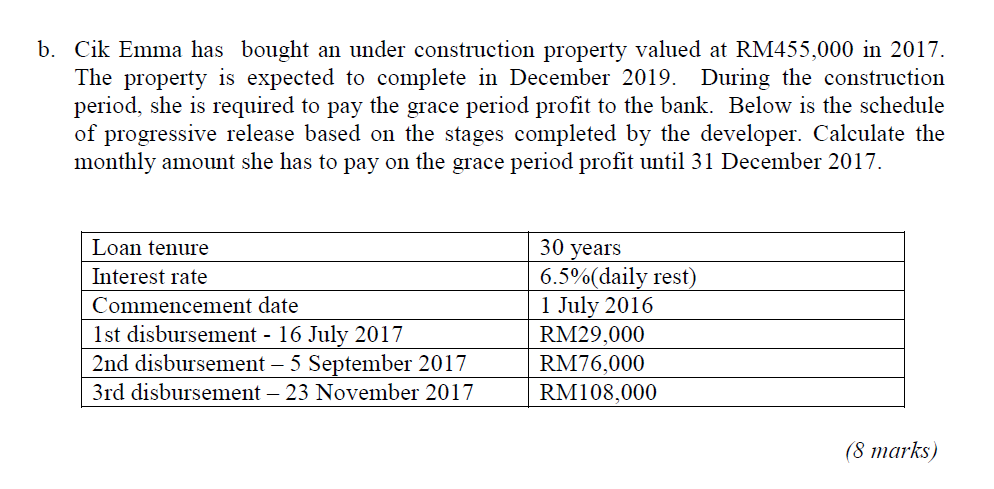

b. Cik Emma has bought an under construction property valued at RM455,000 in 2017. The property is expected to complete in December 2019. During the construction period, she is required to pay the grace period profit to the bank. Below is the schedule of progressive release based on the stages completed by the developer. Calculate the monthly amount she has to pay on the grace period profit until 31 December 2017. 30 years Loan tenure Interest rate Commencement date 1st disbursement - 16 July 2017 2nd disbursement 5 September 2017 3rd disbursement - 23 November 2017 6.5%(daily rest) 1 July 2016 RM29,000 RM76,000 RM108,000 (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts