Question: QUESTION 1 (Please ignore the $ sign when you insert your answer and round your answer to two decimal places if needed). If net financial

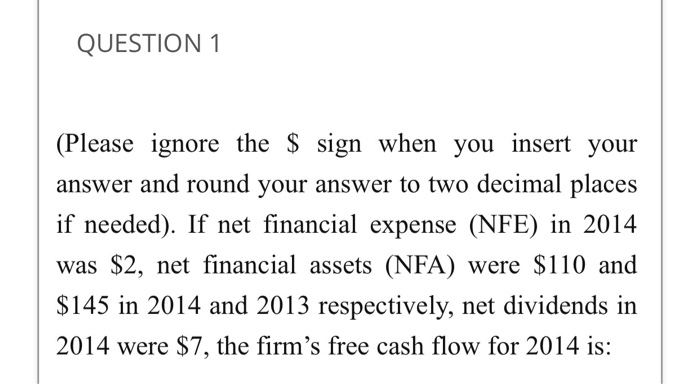

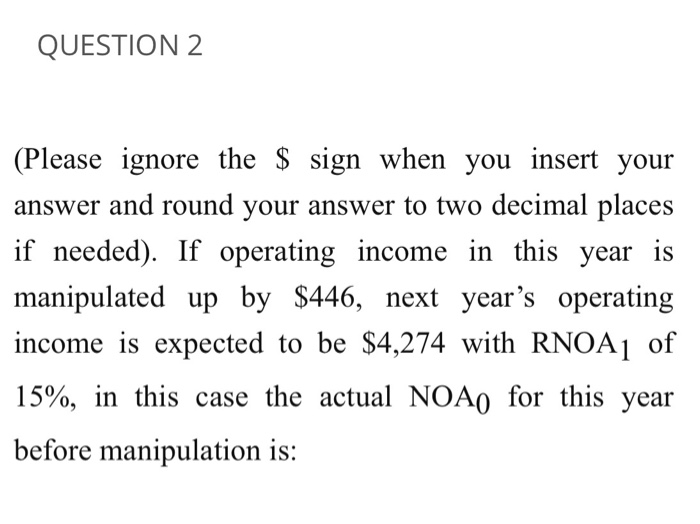

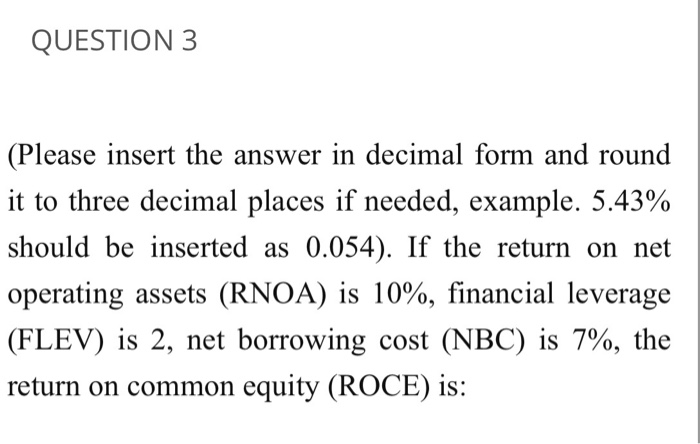

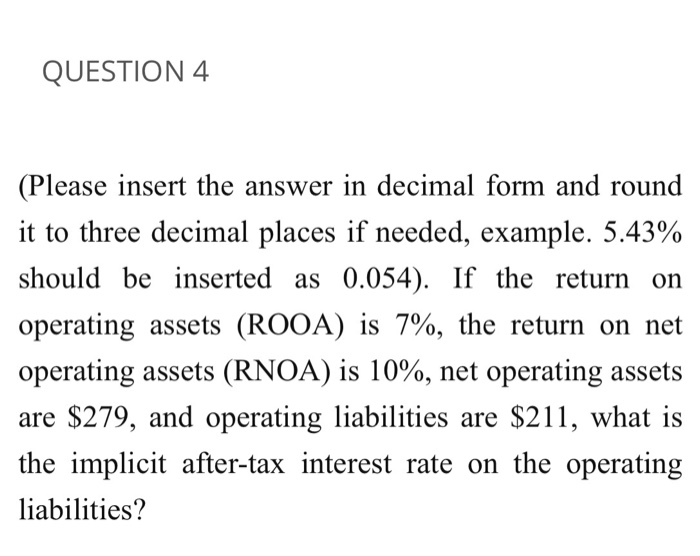

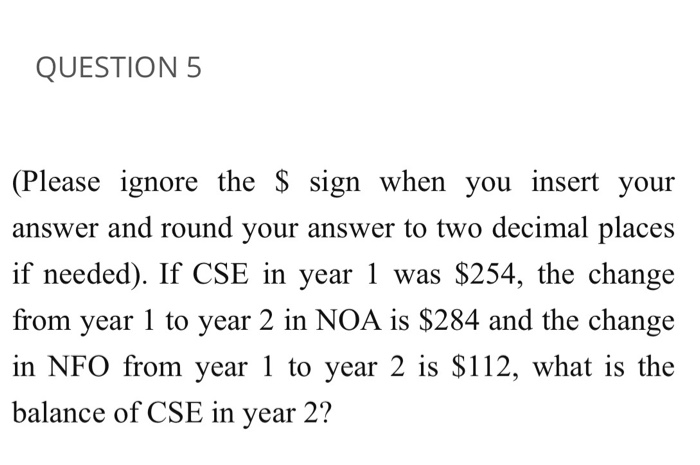

QUESTION 1 (Please ignore the $ sign when you insert your answer and round your answer to two decimal places if needed). If net financial expense (NFE) in 2014 was $2, net financial assets (NFA) were $110 and $145 in 2014 and 2013 respectively, net dividends in 2014 were $7, the firm's free cash flow for 2014 is: QUESTION 2 (Please ignore the $ sign when you insert your answer and round your answer to two decimal places if needed). If operating income in this year is manipulated up by $446, next year's operating income is expected to be $4,274 with RNOA1 of 15%, in this case the actual NOA0 for this year before manipulation is: QUESTION 3 (Please insert the answer in decimal form and round it to three decimal places if needed, example. 5.43% should be inserted as 0.054). If the return on net operating assets (RNOA) is 10%, financial leverage (FLEV) is 2, net borrowing cost (NBC) is 7%, the return on common equity (ROCE) is: QUESTION 4 (Please insert the answer in decimal form and round it to three decimal places if needed, example. 5.43% should be inserted as 0.054). If the return on operating assets (ROOA) is 7%, the return on net operating assets (RNOA) is 10%, net operating assets are $279, and operating liabilities are $211, what is the implicit after-tax interest rate on the operating liabilities? QUESTION 5 (Please ignore the $ sign when you insert your answer and round your answer to two decimal places if needed). If CSE in year 1 was $254, the change from year 1 to year 2 in NOA is $284 and the change in NFO from year 1 to year 2 is $112, what is the balance of CSE in year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts