Question: QUESTION 1 Please indicate the only TRUE statement about hard currency debt portfolio management in Latin American markets a. An active bond portfolio manager could

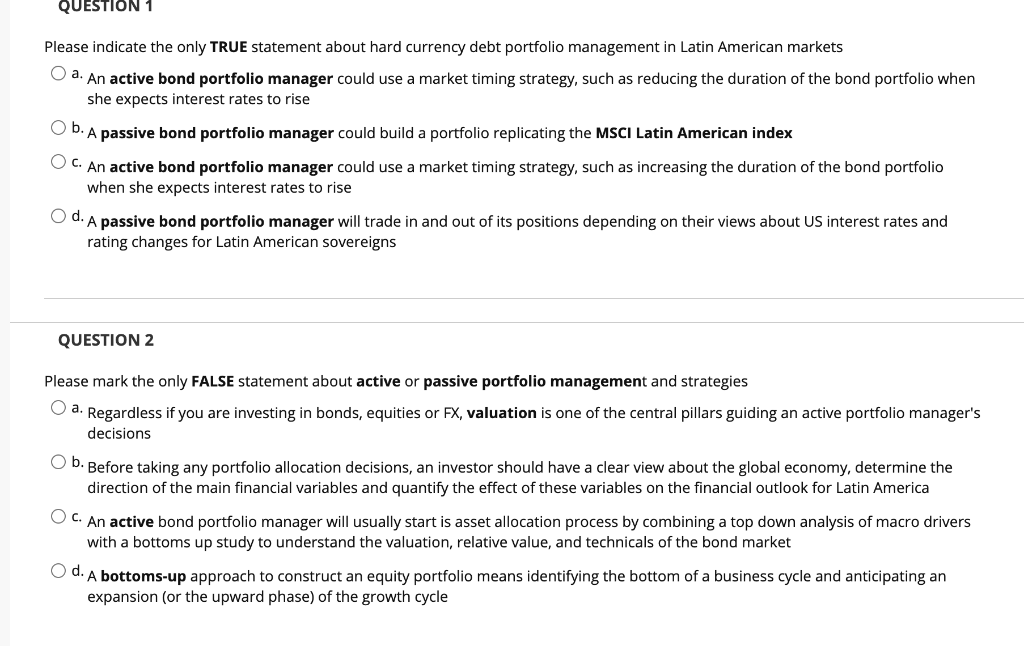

QUESTION 1 Please indicate the only TRUE statement about hard currency debt portfolio management in Latin American markets a. An active bond portfolio manager could use a market timing strategy, such as reducing the duration of the bond portfolio when she expects interest rates to rise b. A passive bond portfolio manager could build a portfolio replicating the MSCI Latin American index C. An active bond portfolio manager could use a market timing strategy, such as increasing the duration of the bond portfolio when she expects interest rates to rise O d. A passive bond portfolio manager will trade in and out of its positions depending on their views about US interest rates and rating changes for Latin American sovereigns QUESTION 2 Please mark the only FALSE statement about active or passive portfolio management and strategies a. Regardless if you are investing in bonds, equities or FX, valuation is one of the central pillars guiding an active portfolio manager's decisions O Before taking any portfolio allocation decisions, an investor should have a clear view about the global economy, determine the direction of the main financial variables and quantify the effect of these variables on the financial outlook for Latin America OC. An active bond portfolio manager will usually start is asset allocation process by combining a top down analysis of macro drivers with a bottoms up study to understand the valuation, relative value, and technicals of the bond market Od. A bottoms-up approach to construct an equity portfolio means identifying the bottom of a business cycle and anticipating an expansion (or the upward phase) of the growth cycle QUESTION 1 Please indicate the only TRUE statement about hard currency debt portfolio management in Latin American markets a. An active bond portfolio manager could use a market timing strategy, such as reducing the duration of the bond portfolio when she expects interest rates to rise b. A passive bond portfolio manager could build a portfolio replicating the MSCI Latin American index C. An active bond portfolio manager could use a market timing strategy, such as increasing the duration of the bond portfolio when she expects interest rates to rise O d. A passive bond portfolio manager will trade in and out of its positions depending on their views about US interest rates and rating changes for Latin American sovereigns QUESTION 2 Please mark the only FALSE statement about active or passive portfolio management and strategies a. Regardless if you are investing in bonds, equities or FX, valuation is one of the central pillars guiding an active portfolio manager's decisions O Before taking any portfolio allocation decisions, an investor should have a clear view about the global economy, determine the direction of the main financial variables and quantify the effect of these variables on the financial outlook for Latin America OC. An active bond portfolio manager will usually start is asset allocation process by combining a top down analysis of macro drivers with a bottoms up study to understand the valuation, relative value, and technicals of the bond market Od. A bottoms-up approach to construct an equity portfolio means identifying the bottom of a business cycle and anticipating an expansion (or the upward phase) of the growth cycle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts