Question: question 1 please Question 1(15 points) You have been offered $150 one year from now, $600 two years from now, and $500 three years from

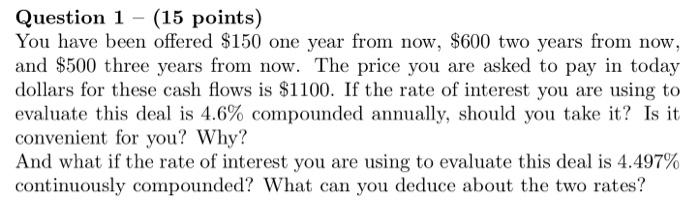

Question 1(15 points) You have been offered $150 one year from now, $600 two years from now, and $500 three years from now. The price you are asked to pay in today dollars for these cash flows is $1100. If the rate of interest you are using to evaluate this deal is 4.6% compounded annually, should you take it? Is it convenient for you? Why? And what if the rate of interest you are using to evaluate this deal is 4.497% continuously compounded? What can you deduce about the two rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts