Question: Question# 1: Please show calculations and explanations too: Weighted Average Method, Single Department Analysis, Uniform Costs Hatch Company produces a product that passes through three

Question# 1: Please show calculations and explanations too:

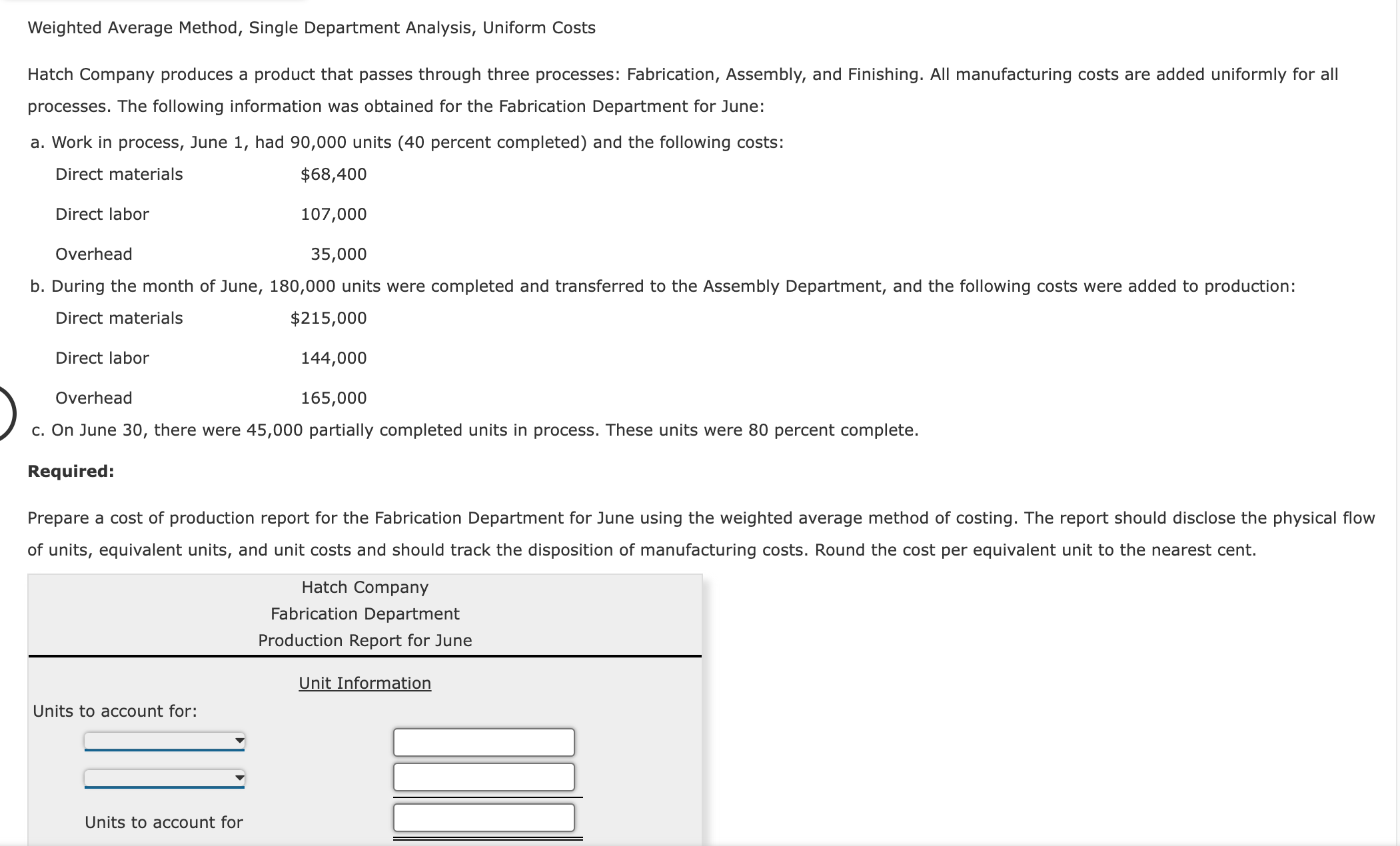

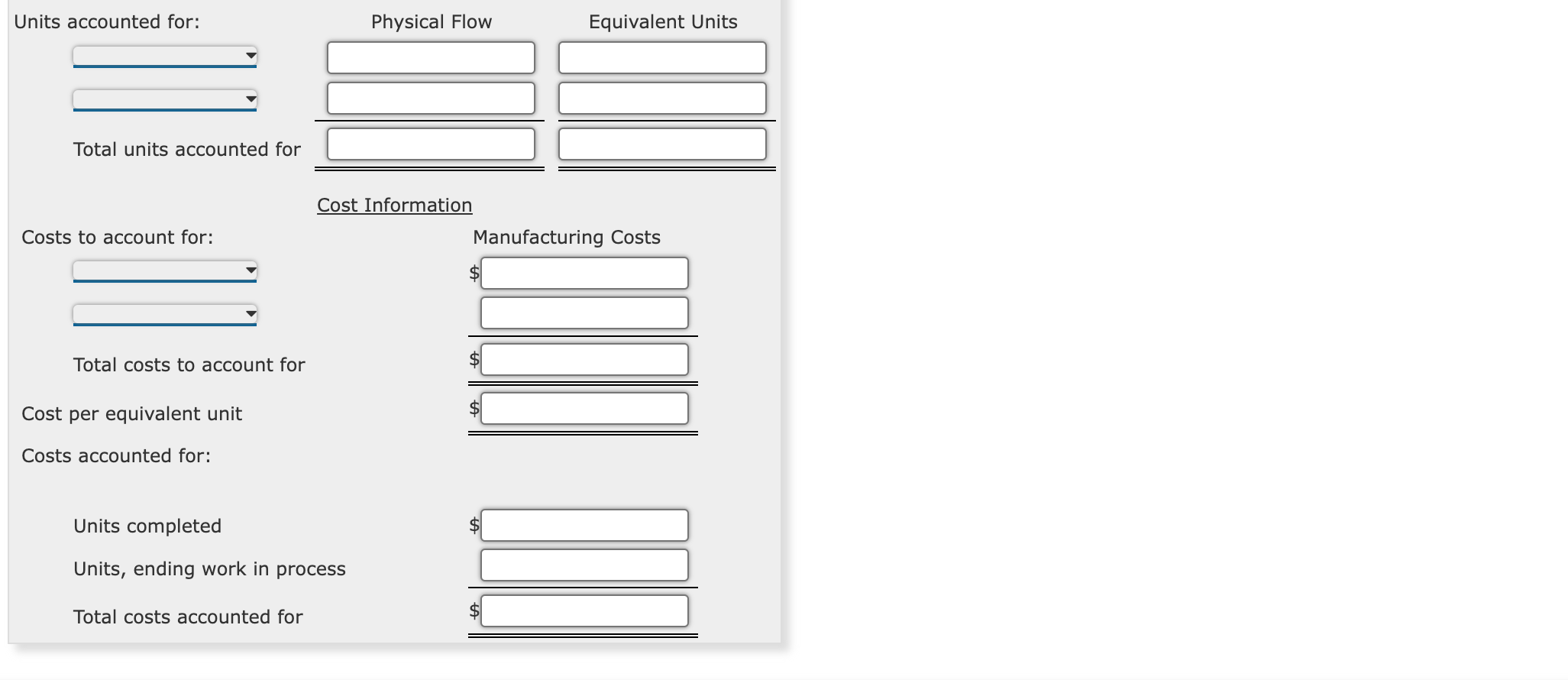

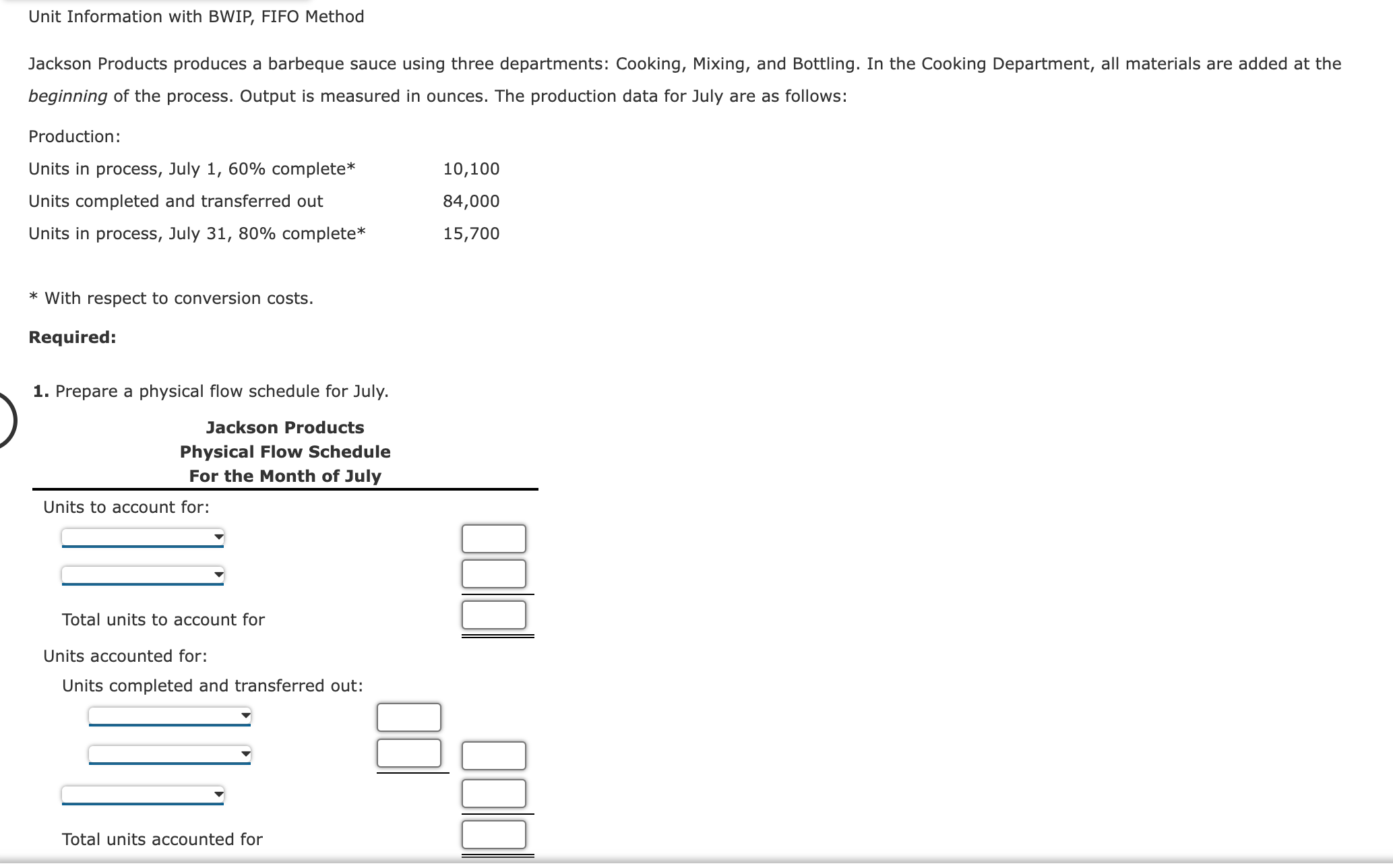

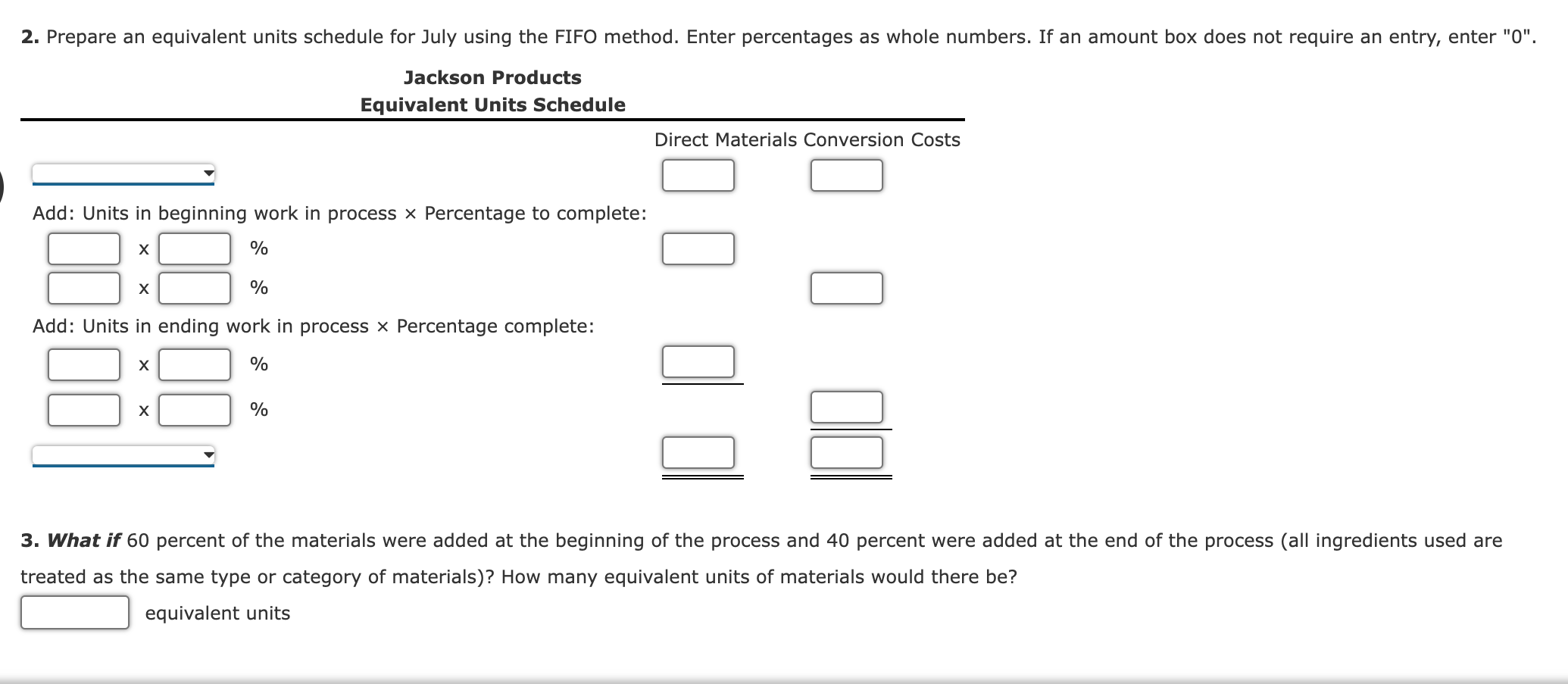

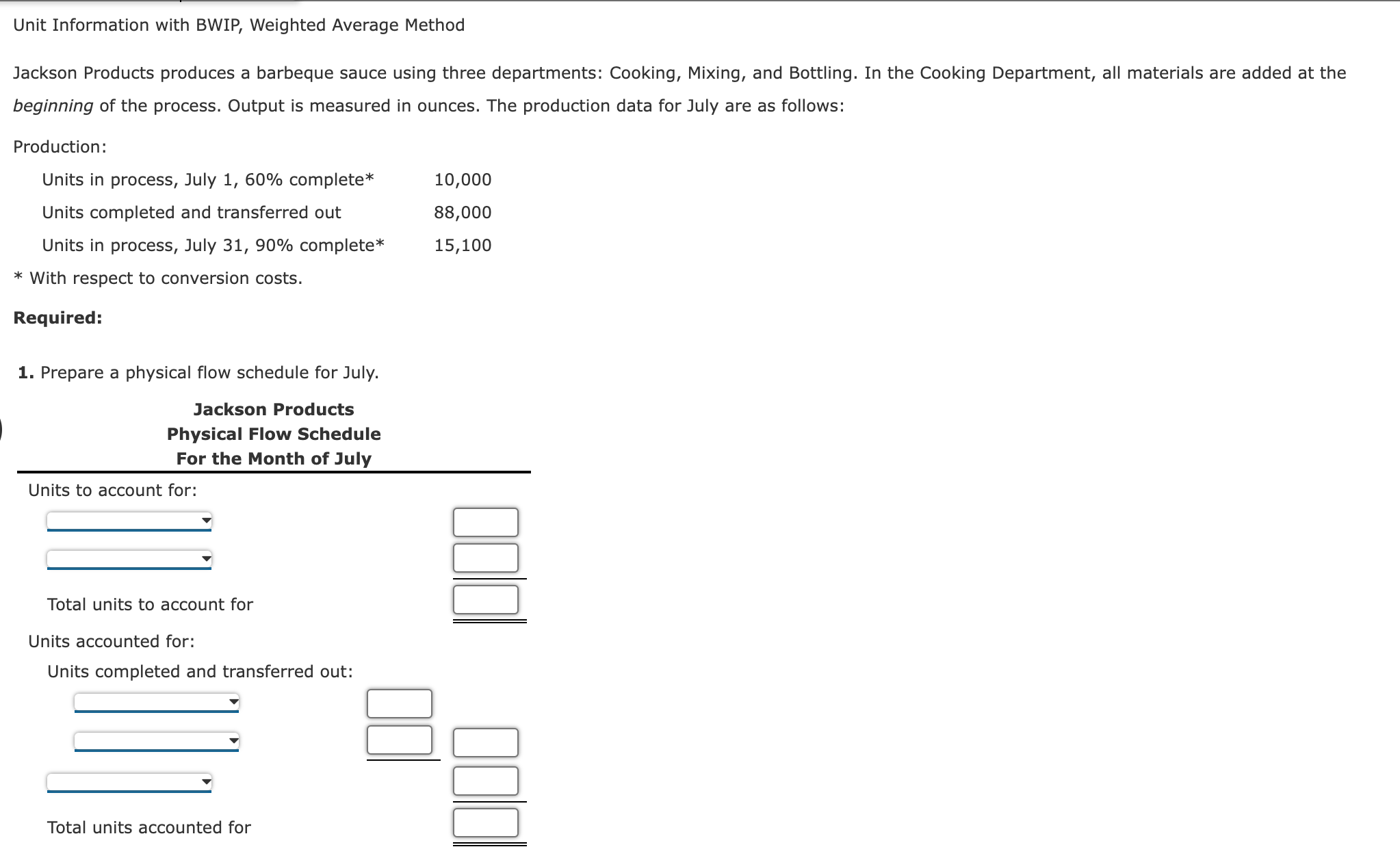

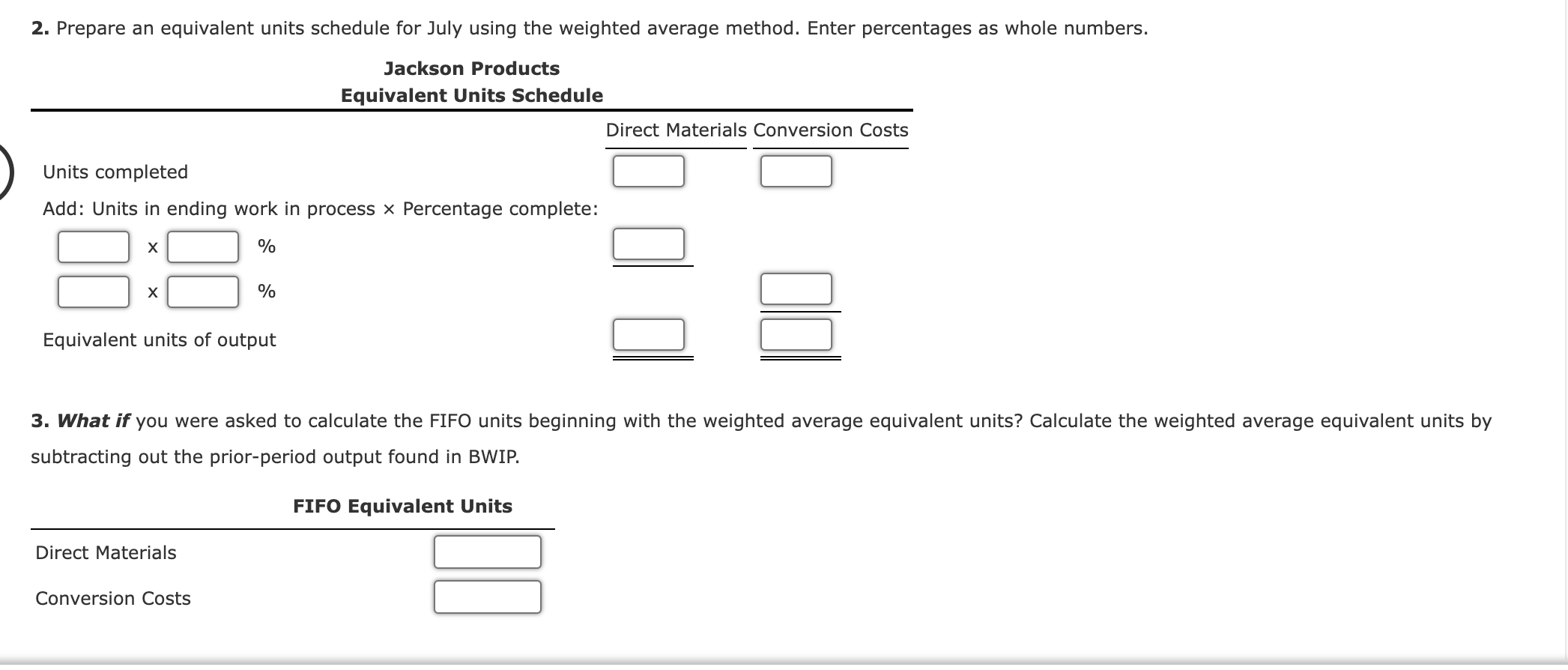

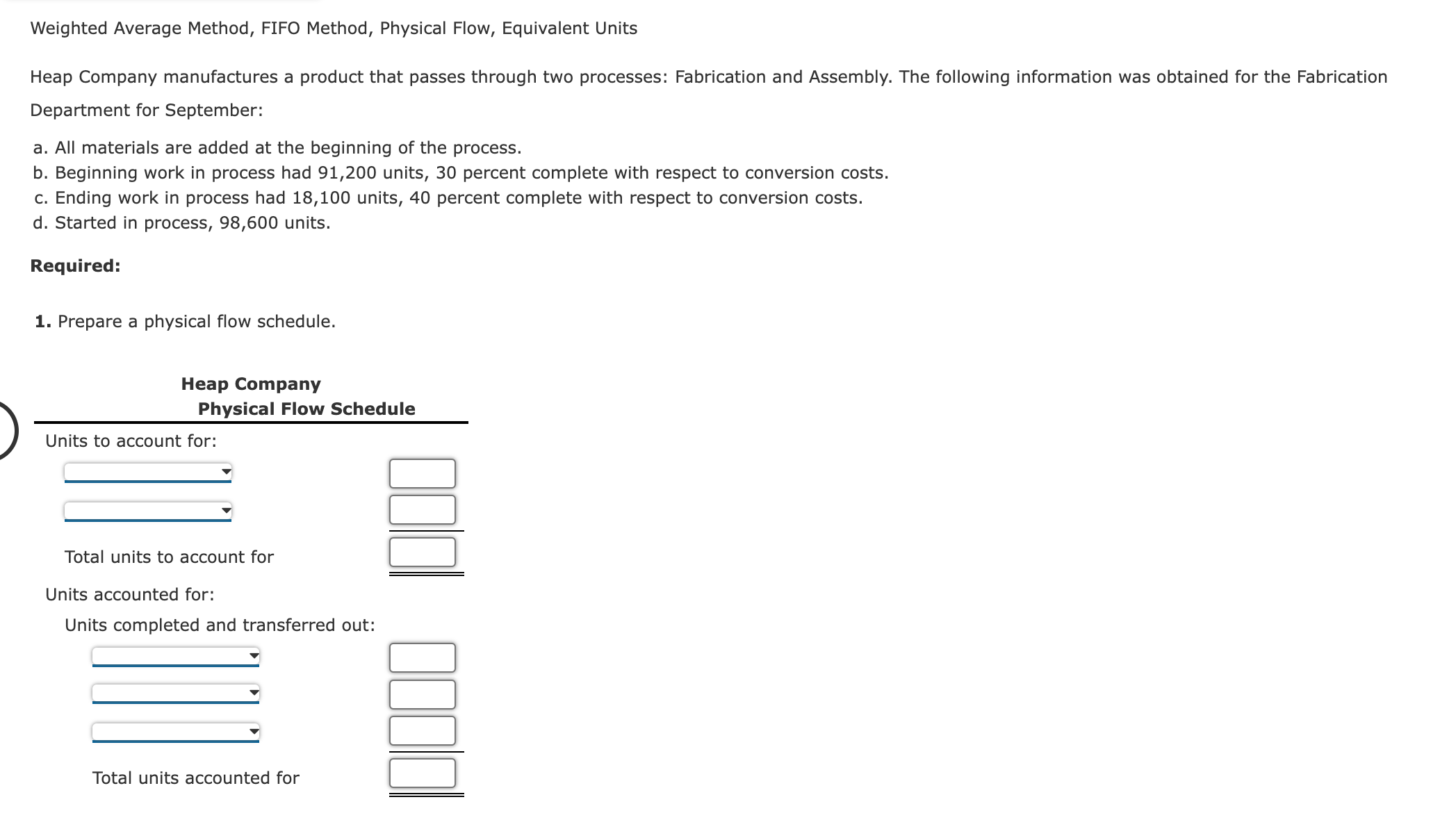

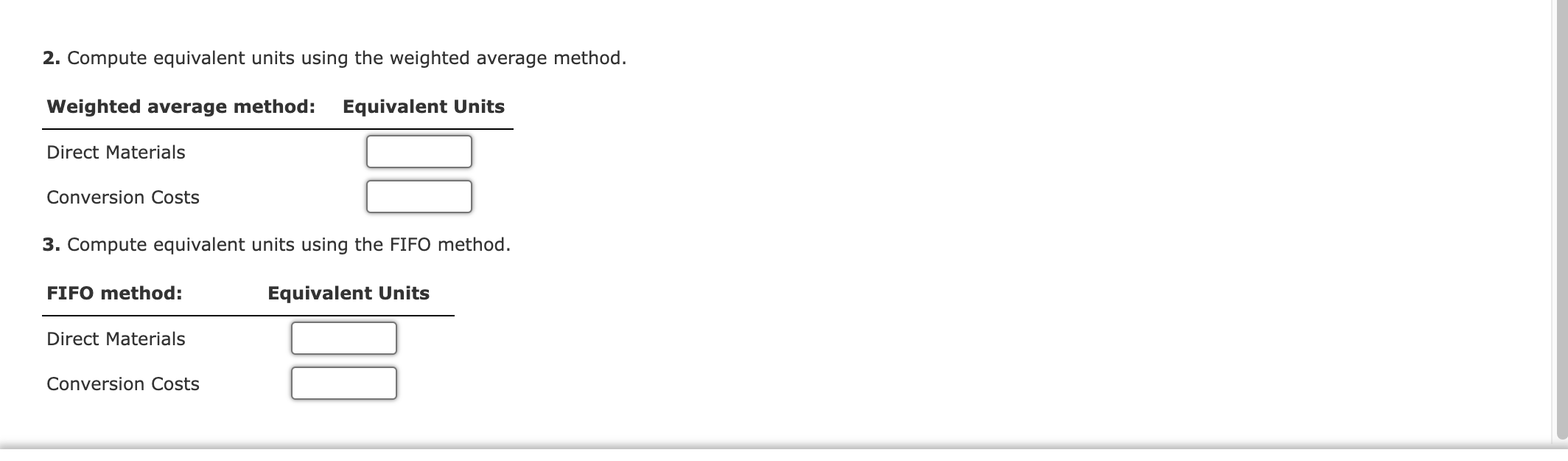

Weighted Average Method, Single Department Analysis, Uniform Costs Hatch Company produces a product that passes through three processes: Fabrication, Assembly, and Finishing. All manufacturing costs are added uniformly for all processes. The following information was obtained for the Fabrication Department for June: a. Work in process, June 1, had 90,000 units (40 percent completed) and the following costs: Direct materials $68,400 Direct labor 107,000 Overhead 35,000 b. During the month of June, 180,000 units were completed and transferred to the Assembly Department, and the following costs were added to production: Direct materials $215,000 Direct labor 144,000 Overhead 165,000 c. On June 30, there were 45,000 partially completed units in process. These units were 80 percent complete. Required: Prepare a cost of production report for the Fabrication Department for June using the weighted average method of costing. The report should disclose the physical flow of units, equivalent units, and unit costs and should track the disposition of manufacturing costs. Round the cost per equivalent unit to the nearest cent. Hatch Company Fabrication Department Production Report for June Unit Information Units to account for: Units to account for [ ] Units accounted for: Physical Flow Equivalent Units Total units accounted for ' | | Cost Information Costs to account for: Manufacturing Costs = Total costs to account for $ Cost per equivalent unit $ Costs accounted for: Units completed $ Units, ending work in process Total costs accounted for $ Unit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* 10,100 Units completed and transferred out 84,000 Units in process, July 31, 80% complete* 15,700 * With respect to conversion costs. Required: Jackson Products Physical Flow Schedule For the Month of July Units to account for: ) 1. Prepare a physical flow schedule for July. Total units to account for i Units accounted for: Units completed and transferred out: S [ L) Total units accounted for UL 2. Prepare an equivalent units schedule for July using the FIFO method. Enter percentages as whole numbers. If an amount box does not require an entry, enter "0". Jackson Products Equivalent Units Schedule Direct Materials Conversion Costs Add: Units in beginning work in process x Percentage to complete: X % X % il 1l Add: Units in ending work in process x Percentage complete: X % % 10 i 00 00 o 0 0 3. What if 60 percent of the materials were added at the beginning of the process and 40 percent were added at the end of the process (all ingredients used are treated as the same type or category of materials)? How many equivalent units of materials would there be? l:] equivalent units Unit Information with BWIP, Weighted Average Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* 10,000 Units completed and transferred out 88,000 Units in process, July 31, 90% complete* 15,100 * With respect to conversion costs. Required: 1. Prepare a physical flow schedule for July. Jackson Products Physical Flow Schedule For the Month of July Units to account for: Total units to account for i Units accounted for: Units completed and transferred out: ] = [ Total units accounted for 1 2. Prepare an equivalent units schedule for July using the weighted average method. Enter percentages as whole numbers. Jackson Products Equivalent Units Schedule Direct Materials Conversion Costs Units completed Add: Units in ending work in process x Percentage complete: Equivalent units of output U o[ 3. What if you were asked to calculate the FIFO units beginning with the weighted average equivalent units? Calculate the weighted average equivalent units by subtracting out the prior-period output found in BWIP. FIFO Equivalent Units Direct Materials [ Conversion Costs :] Weighted Average Method, FIFO Method, Physical Flow, Equivalent Units Heap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 91,200 units, 30 percent complete with respect to conversion costs. . Ending work in process had 18,100 units, 40 percent complete with respect to conversion costs. d. Started in process, 98,600 units. Required: 1. Prepare a physical flow schedule. Heap Company Physical Flow Schedule Units to account for: Total units to account for Units accounted for: Units completed and transferred out: v Total units accounted for il 2. Compute equivalent units using the weighted average method. Weighted average method: Equivalent Units 3. Compute equivalent units using the FIFO method. Direct Materials Conversion Costs FIFO method: Equivalent Units [ ] [ ] Direct Materials Conversion Costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts