Question: question: 1 point(s) possible Submit test Nuclear power plants are required to have full decommissioning costs accumulated during the useful life of the plant. The

question: 1 point(s) possible

Submit test

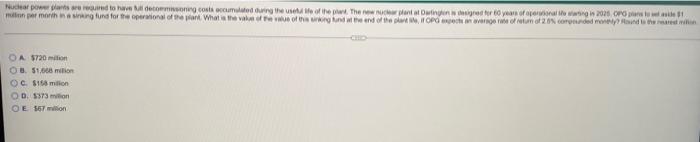

Nuclear power plants are required to have full decommissioning costs accumulated during the useful life of the plant. The new nuclear plant at Darlington is designed for 60 years of operational life starting in 2025. OPG plans to set aside $1

million per month in a sinking fund for the operational of the plant. What is the value of the value of this sinking fund at the end of the plant life, if OPG expects an average rate of return of 2.5% compounded monthly? Round to the nearest million.

O A. $720 million

B. $1,668 million

O C. $158 million

O D. $373 million

O E. $67 million

N

A. 5720=imn 1. 51,628 milisn C. $163 milion D. i $773 mition E. \$ milion

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock