Question: Question 1: Portfolio risk and diversification (5 marks) In this course you have learned about systematic risks, unsystematic risks, beta, standard deviation and the measuring

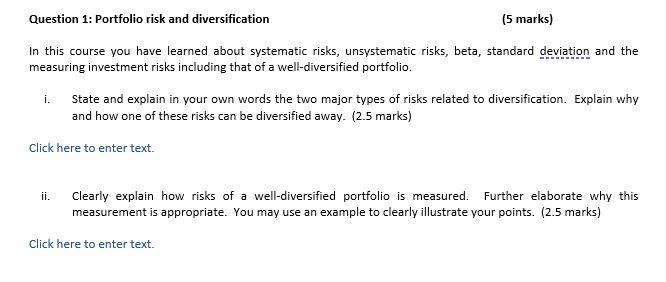

Question 1: Portfolio risk and diversification (5 marks) In this course you have learned about systematic risks, unsystematic risks, beta, standard deviation and the measuring investment risks including that of a well-diversified portfolio. i. State and explain in your own words the two major types of risks related to diversification. Explain why and how one of these risks can be diversified away. ( 2.5 marks) Click here to enter text. ii. Clearly explain how risks of a well-diversified portfolio is measured. Further elaborate why this measurement is appropriate. You may use an example to clearly illustrate your points. (2.5 marks) Click here to enter text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts