Question: Question 1 possible answers: 1.32 , 1.13 , 1.26 , 1.39 Question 2 possible answers: .91 , .82 , 1.09 , 1.00 Question 3 possible

Question 1 possible answers: 1.32 , 1.13 , 1.26 , 1.39

Question 2 possible answers: .91 , .82 , 1.09 , 1.00

Question 3 possible answers: 1.73 , 1.56 , 1.90 , 1.64

Question 4 possible answers: 19.3% , 16.8% , 15.1%, 13.4%

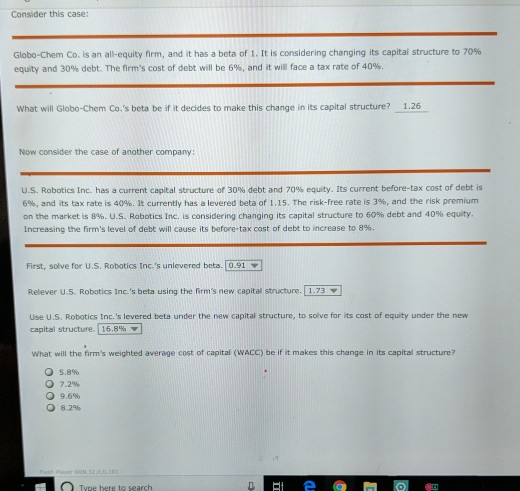

Consider this case: Globo-Chem Co. is an all-equity firm, and it has a beta of 1. It is considering changing its capital structure to 70% equity and 30% debt. The firm's cost of debt will be 6%, and it will face a tax rate of 40%. What will Globo-Chem Co.'s beta be if it decides to make this change in its capital structure? 1.26 Now consider the case of another company: US. Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 40%, it currently has a levered beta of 1.15. The risk-free rate is 3%, and the risk premium on the market is 8%. US. Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. increasing the firm's level of debt will cause its before-tax cost of debt to increase to 8% First, solve for U.S. Robotics Inc 's unlevered beta. 0.91 Relever U.S. Robotics Inc.'s beta using the firm's new capital structure. |1.73 Use U.S. Robotics Inc. 's levered beta under the new capital structure, to solve for its cost of equity under the new capital structure.| 16.8% What will the firm's weighted average cost of capital (WACC) be if it makes this change in its capital structure? O s.890 7.296 9.6% 8.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts