Question: Question 1: Prepare a proforma balance sheet and income statement for 2014 Forecasting assumptions: Growth rate of sales 50% Tax rate 40% Cost of new

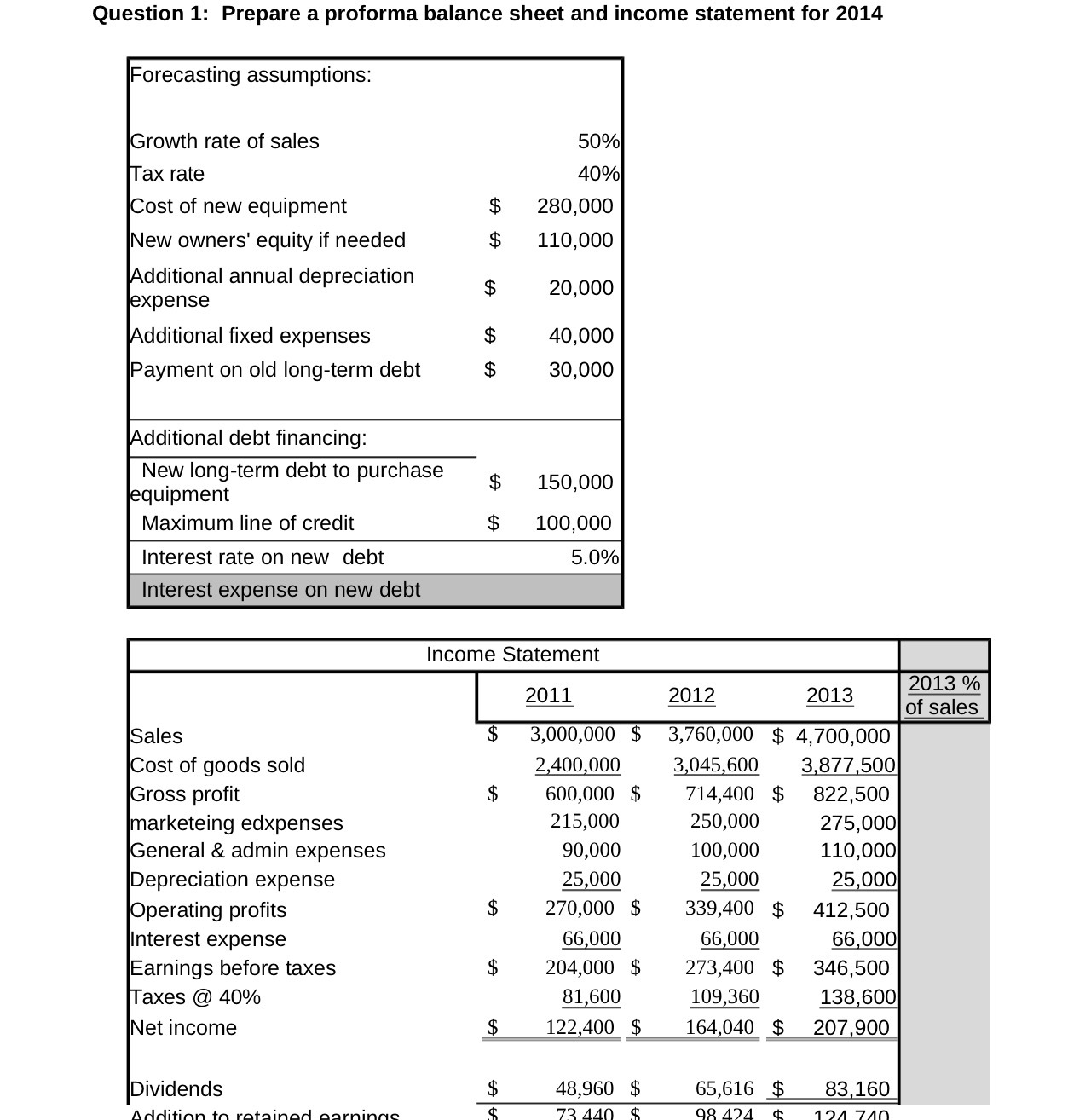

Question 1: Prepare a proforma balance sheet and income statement for 2014 Forecasting assumptions: Growth rate of sales 50% Tax rate 40% Cost of new equipment tA 280,000 New owners' equity if needed 110,000 Additional annual depreciation 20,000 expense Additional fixed expenses 40,000 Payment on old long-term debt 30,000 Additional debt financing: New long-term debt to purchase $ 150,000 equipment Maximum line of credit $ 100,000 Interest rate on new debt 5.0% Interest expense on new debt Income Statement 2011 2012 2013 2013 % of sales Sales EA 3,000,000 $ 3,760,000 $ 4,700,000 Cost of goods sold 2,400,000 3,045,600 3,877,500 Gross profit $ 600,000 $ 714,400 $ 822,500 marketeing edxpenses 215,000 250,000 275,000 General & admin expenses 90,000 100,000 110,000 Depreciation expense 25,000 25,000 25,000 Operating profits $ 270,000 $ 339,400 $ 412,500 Interest expense 66,000 66,000 66,000 Earnings before taxes $ 204,000 $ 273,400 $ 346,500 Taxes @ 40% 81,600 109,360 138,600 Net income $ 122,400 $ 164,040 $ 207,900 Dividends $ 48,960 $ 65,616 $ 83,160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts