Question: Question: 1. Prepare journal entries to record the transactions. Problem 23-6 (AICPA Adapted) Cherish Company provided the following transactions: 1. Exchanged a car from inventory

Question: 1. Prepare journal entries to record the transactions.

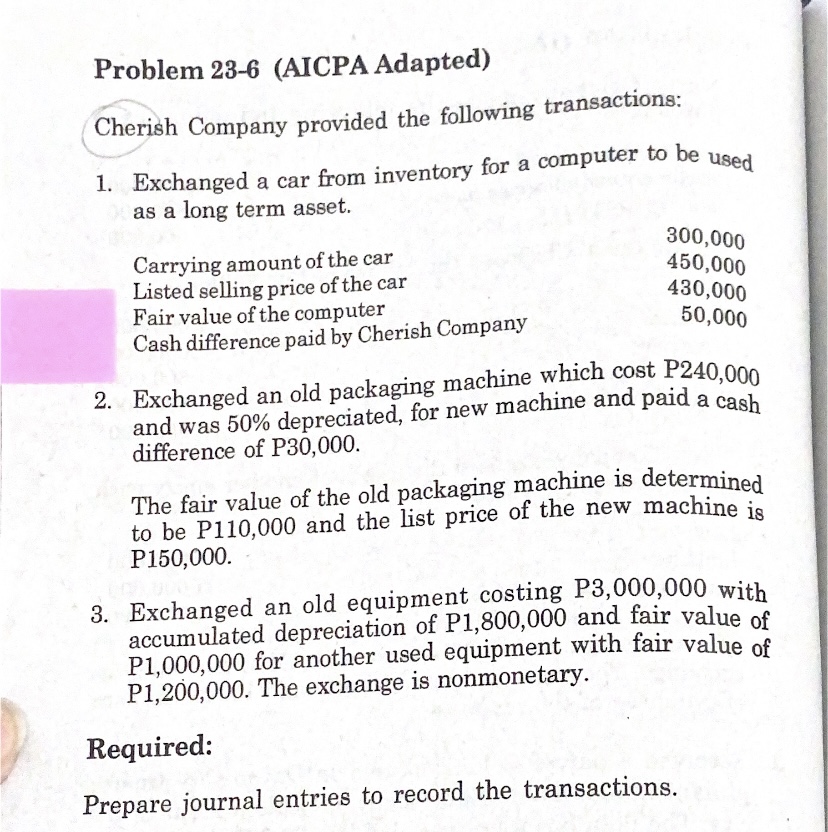

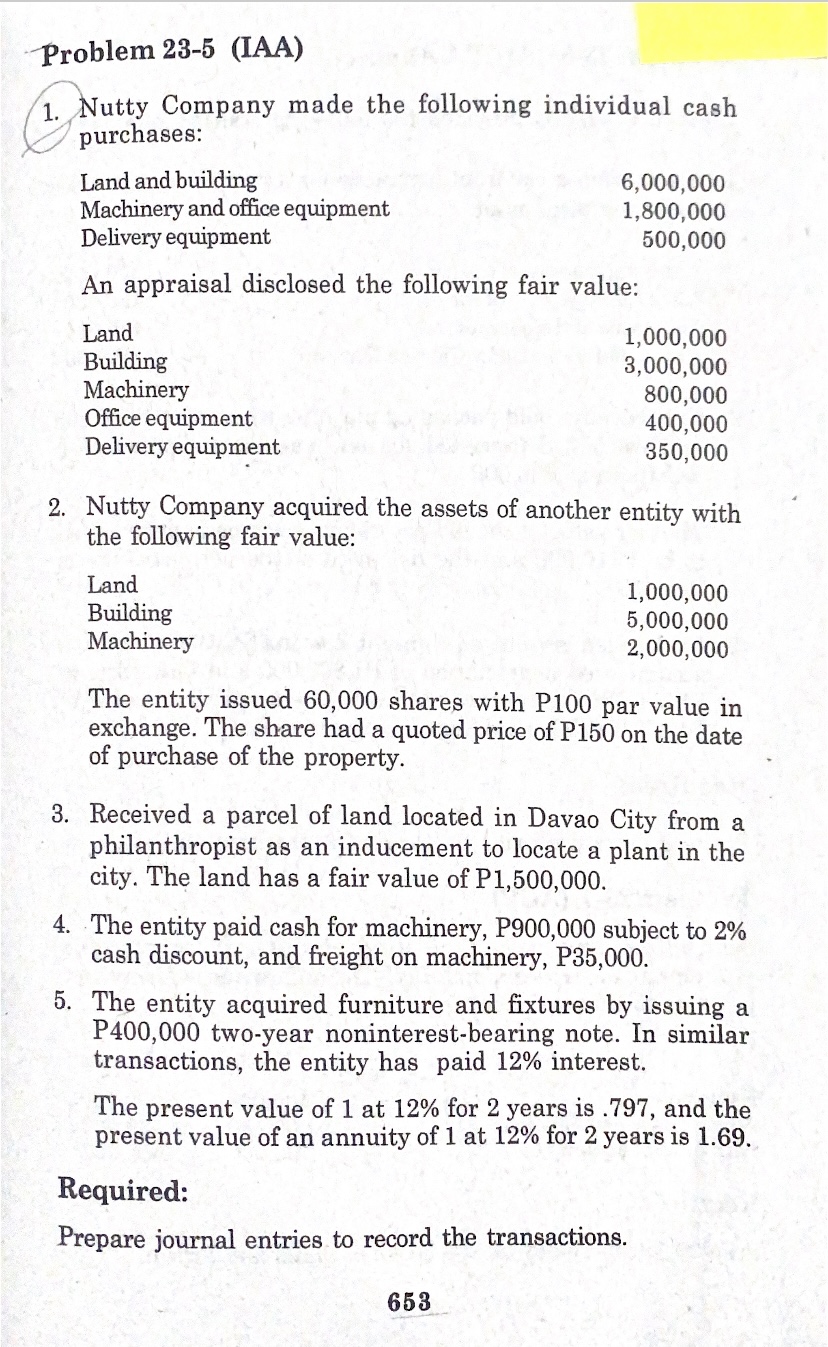

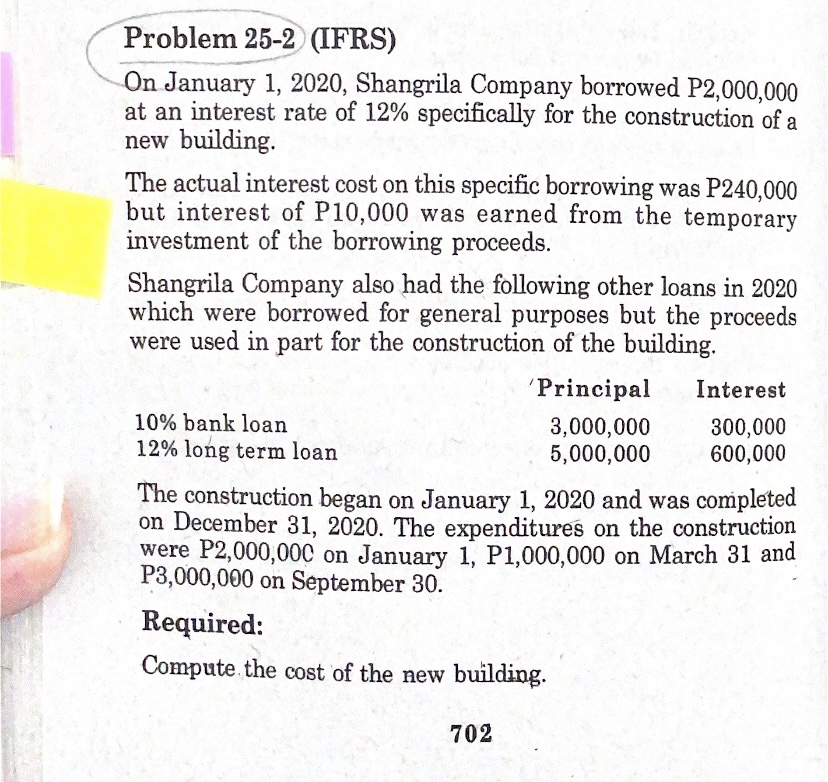

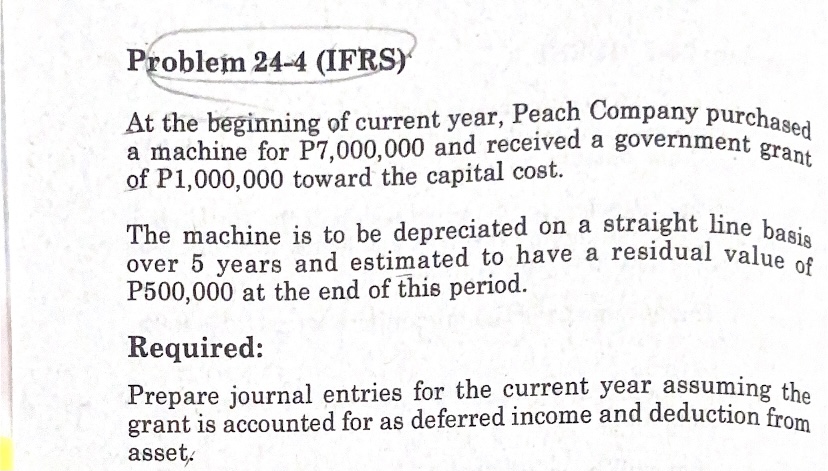

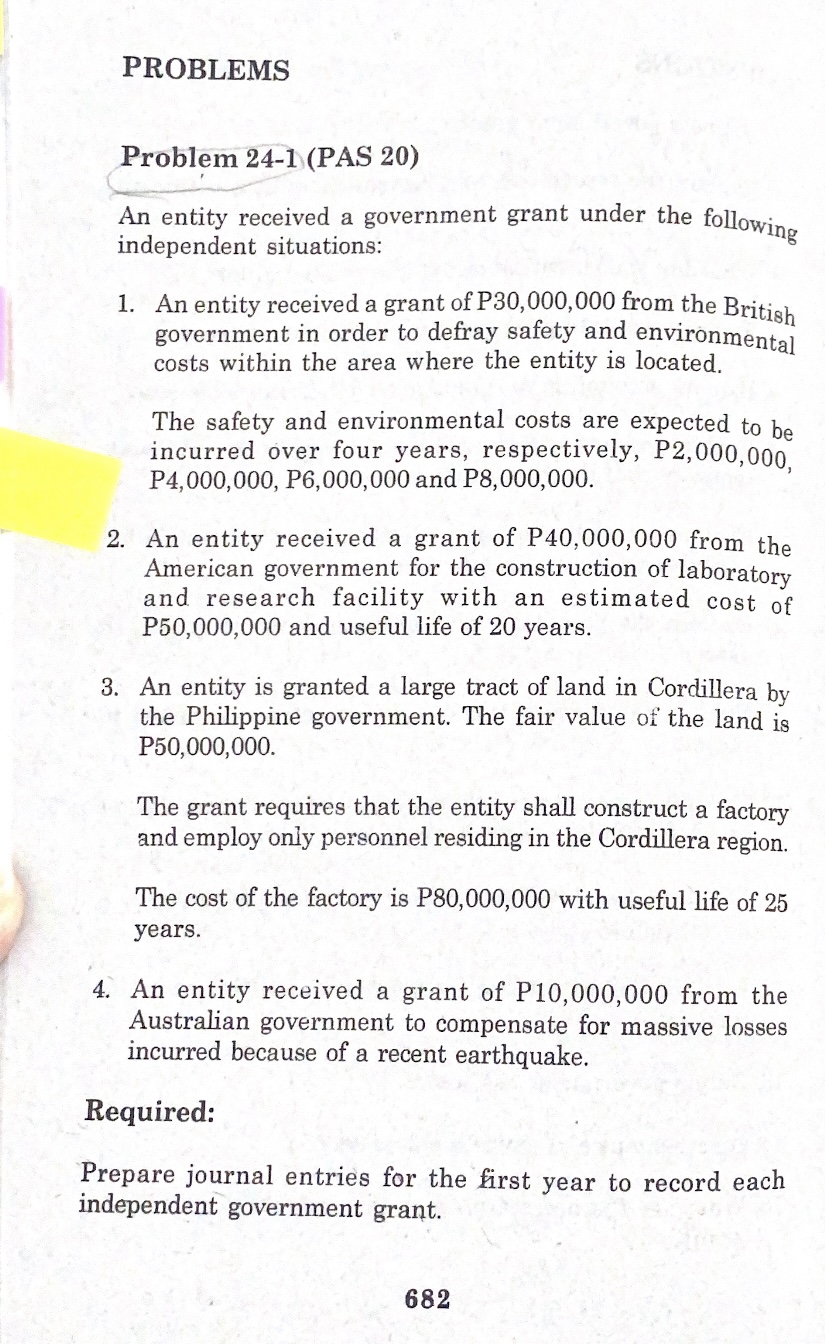

Problem 23-6 (AICPA Adapted) Cherish Company provided the following transactions: 1. Exchanged a car from inventory for a computer to be used as a long term asset. Carrying amount of the car 300,000 Listed selling price of the car 450,000 Fair value of the computer 430,000 Cash difference paid by Cherish Company 50,000 2. Exchanged an old packaging machine which cost P240,000 and was 50% depreciated, for new machine and paid a cash difference of P30,000. The fair value of the old packaging machine is determined to be P110,000 and the list price of the new machine is P150,000. 3. Exchanged an old equipment costing P3,000,000 with accumulated depreciation of P1,800,000 and fair value of P1,000,000 for another used equipment with fair value of P1,200,000. The exchange is nonmonetary. Required: Prepare journal entries to record the transactions.\"Problem 23-5 (1AA) 1. Nutty Company made the following individual cash x\"?! purchases: Land and building 6,000,000 Machinery and oice equipment 1 ,800 , 000 Delivery equipment 500,000 An appraisal disclosed the following fair value: Land ' 1,000,000 Building 3,000,000 Machinery 800,000 Office equipment 400,000 Delivery equipment 350,000 2, Nutty Company acquired the assets of another entity with the following fair value: Land 1,000,000 Building 5,000,000 Machinery 2,000,000 The entity issued 60,000 shares with P100 par value in exchange. The share had a quoted price of P150 on the date of purchase of the property. 3. Received a parcel of land located in Davao City from a philanthropist as an inducement to locate a plant in the city. The land has a fair value of P1,500,000. 4. The entity paid cash for machinery, P900,000 subject to 2% cash discount, and freight on machinery, P35,000. 5. The entity acquired furniture and xtures by issuing a P400,000 two-year noninterest-bearing note. In similar transactions, the entity has paid 12% interest. The present value of 1 at 12% for 2 years is .797, and the present value of an annuity of 1 at 12% for 2 years is 1.69, Required: Frapare journal entries to record the transactions. 5.5 3___ Problem 25-2 (IFRS) On January 1, 2020, Shangrila Company borrowed P2,000,000 at an interest rate of 12% specifically for the construction of a new building. The actual interest cost on this specific borrowing was P240,000 but interest of P10,000 was earned from the temporary investment of the borrowing proceeds. Shangrila Company also had the following other loans in 2020 which were borrowed for general purposes but the proceeds were used in part for the construction of the building. Principal Interest 10% bank loan 3,000,000 300,000 12% long term loan 5,000,000 600,000 The construction began on January 1, 2020 and was completed on December 31, 2020. The expenditures on the construction were P2,000,00C on January 1, P1,000,000 on March 31 and P3,000,000 on September 30. Required: Compute the cost of the new building. 702Problem 24-4 (IFRS) At the beginning of current year, Peach Company purchased a machine for P7,000,000 and received a government grant of P1,000,000 toward the capital cost. The machine is to be depreciated on a straight line basis over 5 years and estimated to have a residual value of P500,000 at the end of this period. Required: Prepare journal entries for the current year assuming the grant is accounted for as deferred income and deduction from assetPROBLEMS Problem 2441x(PAS 20) H_____.-..._.---' ' '~-*-"" '- An entity received a government grant under the following independent situations: 1. An entity received a grant of P30,000,000 from the British government in order to defray safety and envirOnmental costs within the area where the entlty 1s located_ The safety and environmental costs are expected to be incurred ever four years, respectively, 132,000,000! P4,000,000, P6,000,000 and P8,000,000. 2. An entity received a grant of P40,000,000 from the American government for the construction of laboratory and research facility with an estimated Cost of P50,0D0,000 and useful life of 20 years. 3. An entity is granted a large tract of land in Cordillera by the Philippine government. The fair value of the land is _ P50,000,000. The grant requires that the entity shall construct a factory and employ only personnel residing in the Cordillera region, The cost of the factory is P80,000,000 with useful life of 25 years. 4; An entity received a grant of P10,000,000 from the Australian government to compensate for massive losses incurred because of a recent earthquake. Required: Prepare journal entries for the'rst year to record each independent government grant. 682