Question: Question- 1 - Prepare the acquisition analysis at acquisition date. - Prepare the business combination valuation entries and the pre-acquisition entry at acquisition date. -

Question- 1

- Prepare the acquisition analysis at acquisition date.

- Prepare the business combination valuation entries and the pre-acquisition entry at acquisition date.

- Prepare worksheet adjusting journal entries for the consolidation on 30 June 2021, considering 50% of inventory were sold by 30 June 2021 and no other changes in Rod's equity since the acquisition date.

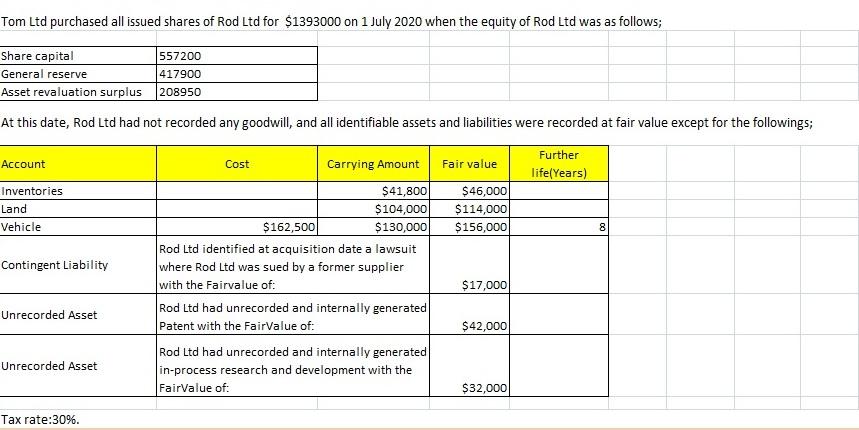

Tom Ltd purchased all issued shares of Rod Ltd for $1393000 on 1 July 2020 when the equity of Rod Ltd was as follows; Share capital 557200 General reserve Asset revaluation surplus 208950 417900 At this date, Rod Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings; Account Fair value Further life(Years) Inventories Land $46,000 $114,000 $156,000 Vehicle 8 Contingent Liability Cost Carrying Amount $41,800 $104,000 $162,500 $130,000 Rod Ltd identified at acquisition date a lawsuit where Rod Ltd was sued by a former supplier with the Fairvalue of: Rod Ltd had unrecorded and internally generated Patent with the FairValue of: Rod Ltd had unrecorded and internally generated in-process research and development with the FairValue of: $17,000 Unrecorded Asset $42,000 Unrecorded Asset $32,000 Tax rate:30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts