Question: QUESTION 1 Problem 1. A five-year bond with a face value of $1000 and 8% coupon at the end of each year yields 8%. Using

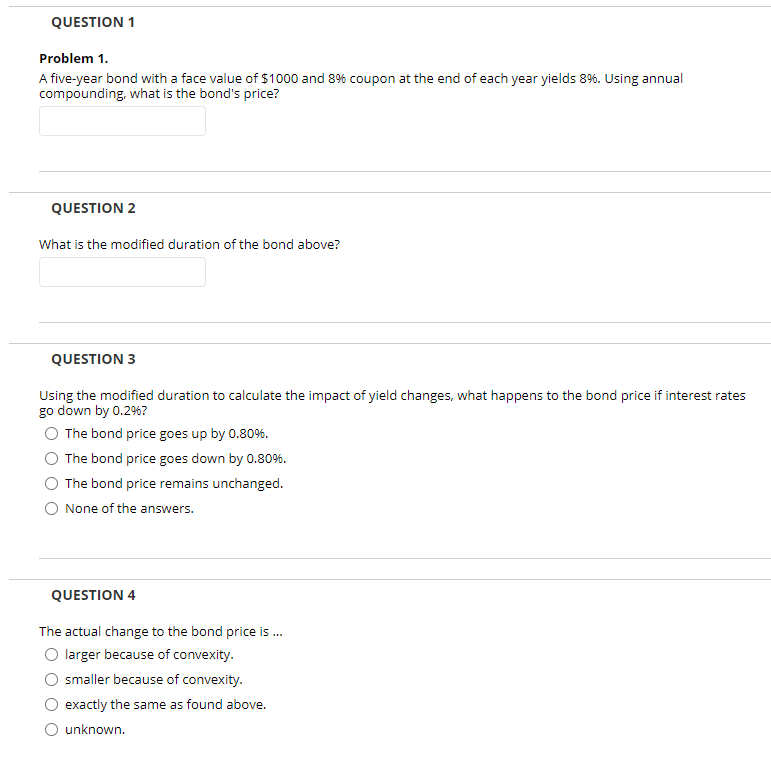

QUESTION 1 Problem 1. A five-year bond with a face value of $1000 and 8% coupon at the end of each year yields 8%. Using annual compounding, what is the bond's price? QUESTION 2 What is the modified duration of the bond above? QUESTION 3 Using the modified duration to calculate the impact of yield changes, what happens to the bond price if interest rates go down by 0.2967 The bond price goes up by 0.80%. The bond price goes down by 0.80%. The bond price remains unchanged. None of the answers. QUESTION 4 The actual change to the bond price is ... larger because of convexity. smaller because of convexity. exactly the same as found above. unknown

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts