Question: QUESTION 1 Problem 1 We consider the sequence of orders submitted by trader for the same security given in Table 1. The order of arrival

QUESTION 1

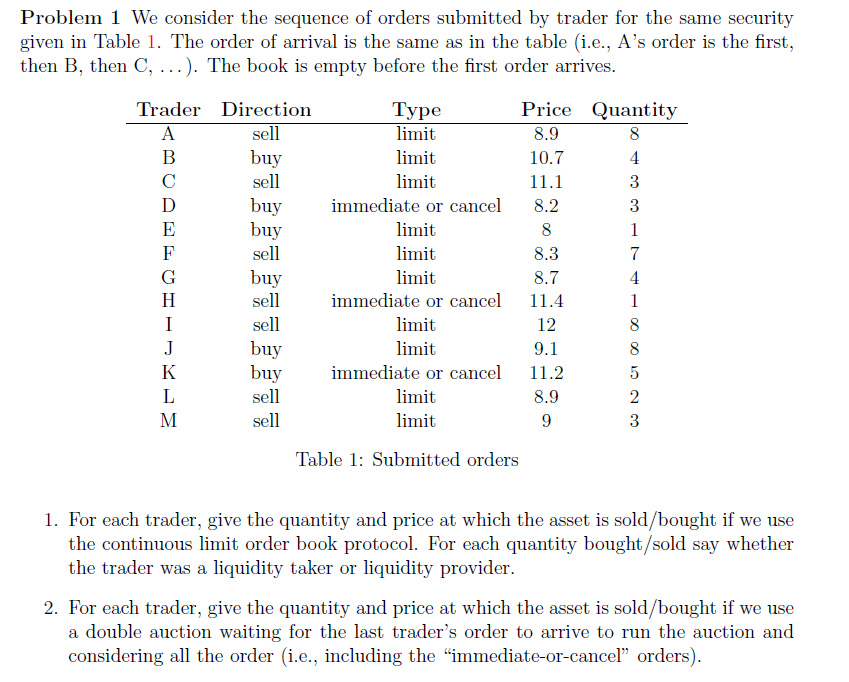

Problem 1 We consider the sequence of orders submitted by trader for the same security given in Table 1. The order of arrival is the same as in the table (i.e., A's order is the rst, then B, then C, . . . ). The book is empty before the rst order arrives. Trader Direction Type Price Quantity A sell limit 8.9 8 B buy limit 10.7 4 C sell limit 11.1 3 D buy immediate or cancel 8.2 3 E buy limit 8 1 F sell limit 8.3 7 G buy limit 8.7 4 H sell immediate or cancel 11.4 1 I sell limit 12 8 J buy limit 9.1 8 K buy immediate or cancel 11.2 5 L sell limit 8.9 2 M sell limit 9 3 Table 1: Submitted orders 1. For each trader, give the quantity and price at which the asset is sold/bought if we use the continuous limit order book protocol. For each quantity bought / sold say whether the trader was a liquidity taker or liquidity provider. 2. For each trader, give the quantity and price at which the asset is sold/bought if we use a double auction waiting for the last trader's order to arrive to run the auction and considering all the order (i.e., including the \"immediateorcancel\" orders)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts