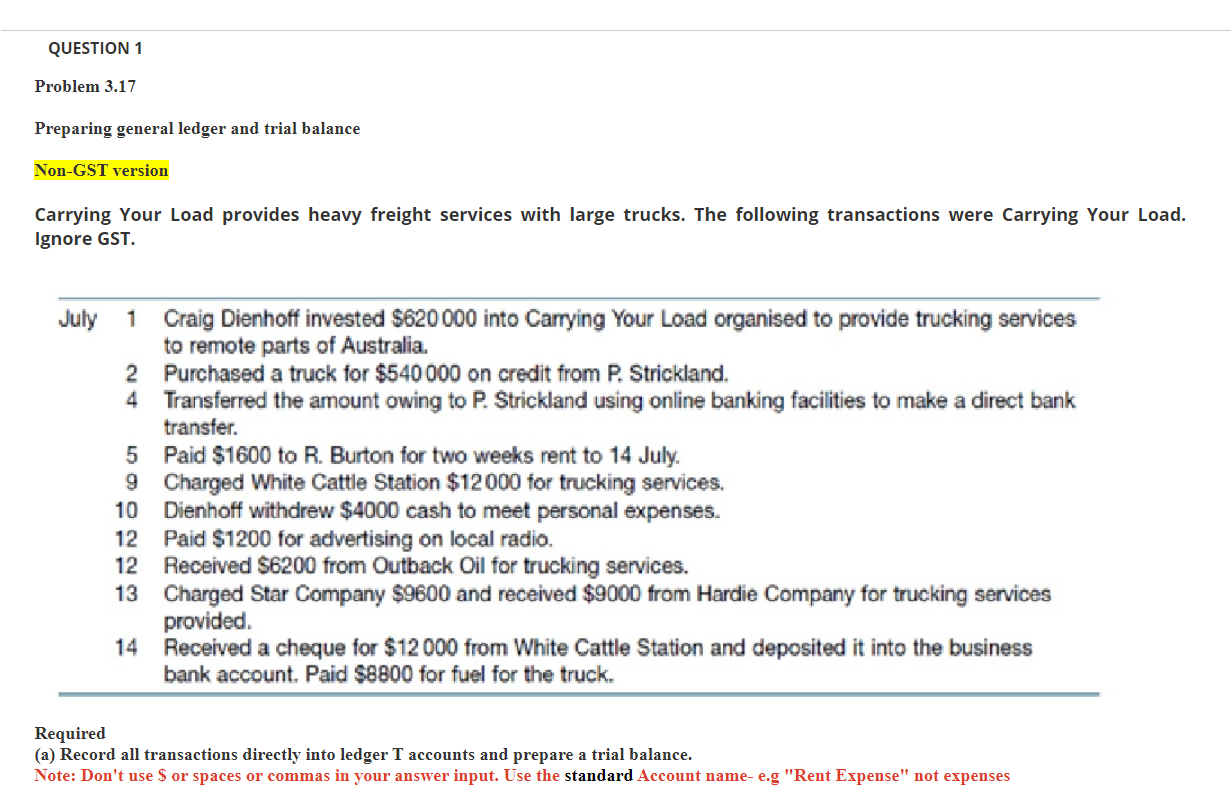

Question: QUESTION 1 Problem 3.17 Preparing general ledger and trial balance Non-GST version Carrying Your Load provides heavy freight services with large trucks. The following transactions

QUESTION 1 Problem 3.17 Preparing general ledger and trial balance Non-GST version Carrying Your Load provides heavy freight services with large trucks. The following transactions were Carrying Your Load. Ignore GST. July 1 Craig Dienhoff invested $620 000 into Carrying Your Load organised to provide trucking services to remote parts of Australia. 2 Purchased a truck for $540 000 on credit from P. Strickland. 4 Transferred the amount owing to P. Strickland using online banking facilities to make a direct bank transfer. 5 Paid $1600 to R. Burton for two weeks rent to 14 July. 9 Charged White Cattle Station $12 000 for trucking services. 10 Dienhoff withdrew $4000 cash to meet personal expenses. 12 Paid $1200 for advertising on local radio. 12 Received $6200 from Outback Oil for trucking services. 13 Charged Star Company $9600 and received $9000 from Hardie Company for trucking services provided. 14 Received a cheque for $12 000 from White Cattle Station and deposited it into the business bank account. Paid $8800 for fuel for the truck. Required (a) Record all transactions directly into ledger T accounts and prepare a trial balance. Note: Don't use $ or spaces or commas in your answer input. Use the standard Account name- e.g "Rent Expense" not expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts