Question: Question 1: Project Evaluation (10 marks) Part A For unconventional cash flows, there will often be multiple IRRs. Under those circumstances, we cannot use IRR

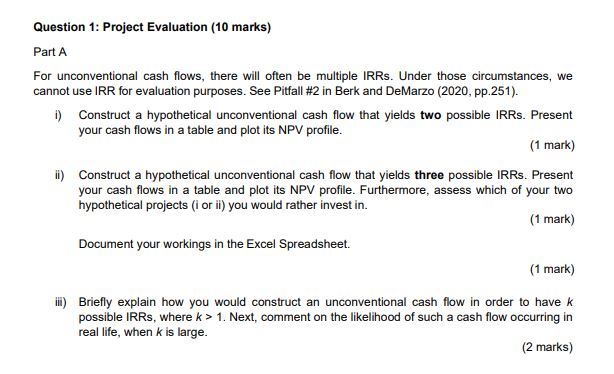

Question 1: Project Evaluation (10 marks) Part A For unconventional cash flows, there will often be multiple IRRs. Under those circumstances, we cannot use IRR for evaluation purposes. See Pitfall \#2 in Berk and DeMarzo (2020, pp.251). i) Construct a hypothetical unconventional cash flow that yields two possible IRRs. Present your cash flows in a table and plot its NPV profile. (1 mark) ii) Construct a hypothetical unconventional cash flow that yields three possible IRRs. Present your cash flows in a table and plot its NPV profile. Furthermore, assess which of your two hypothetical projects (i or ii) you would rather invest in. (1 mark) Document your workings in the Excel Spreadsheet. (1 mark) iii) Briefly explain how you would construct an unconventional cash flow in order to have k possible IRRs, where k>1. Next, comment on the likelihood of such a cash flow occurring in real life, when k is large. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts