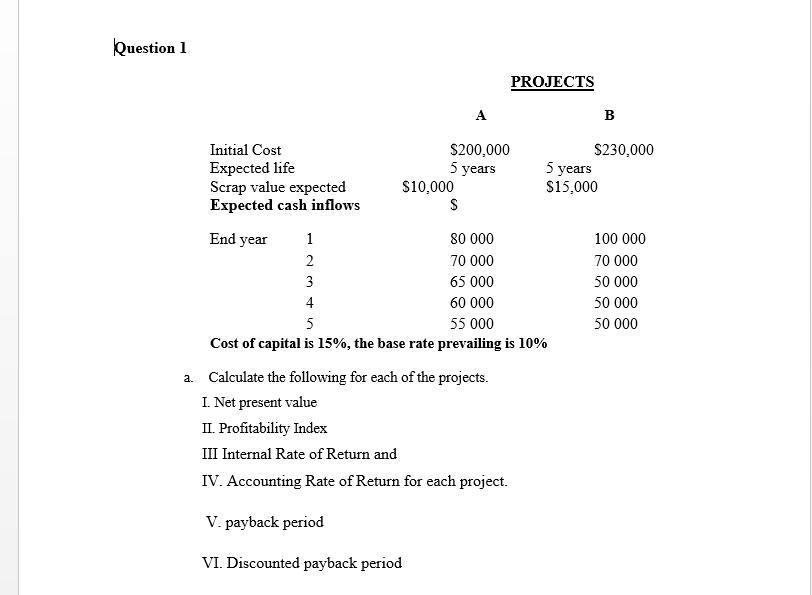

Question: Question 1 PROJECTS B Initial Cost Expected life Scrap value expected Expected cash inflows $200,000 5 years $10,000 $ $230,000 5 years $15,000 End year

Question 1 PROJECTS B Initial Cost Expected life Scrap value expected Expected cash inflows $200,000 5 years $10,000 $ $230,000 5 years $15,000 End year 100 000 70 000 50 000 50 000 50 000 1 80 000 2 70 000 3 65 000 4 60 000 5 55 000 Cost of capital is 15%, the base rate prevailing is 10% a. Calculate the following for each of the projects. I. Net present value II. Profitability Index III Internal Rate of Return and IV. Accounting Rate of Return for each project. V. payback period VI. Discounted payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts