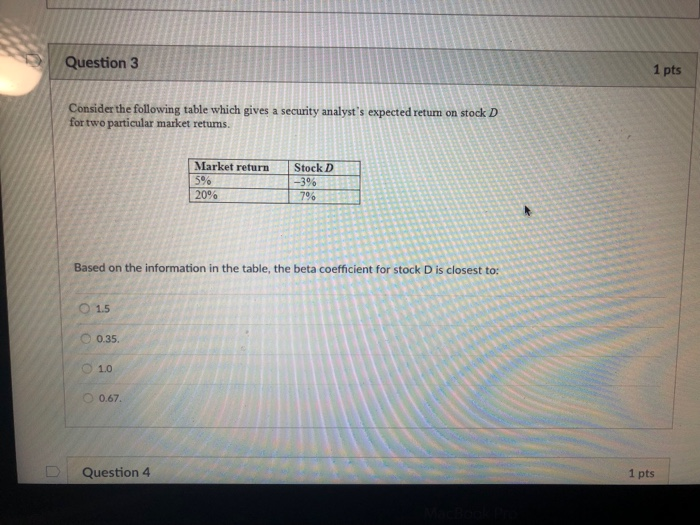

Question: Question 1 pts Consider the following table which gives a security analyst's expected retun on stock D for two particular market retums. Market return Stock

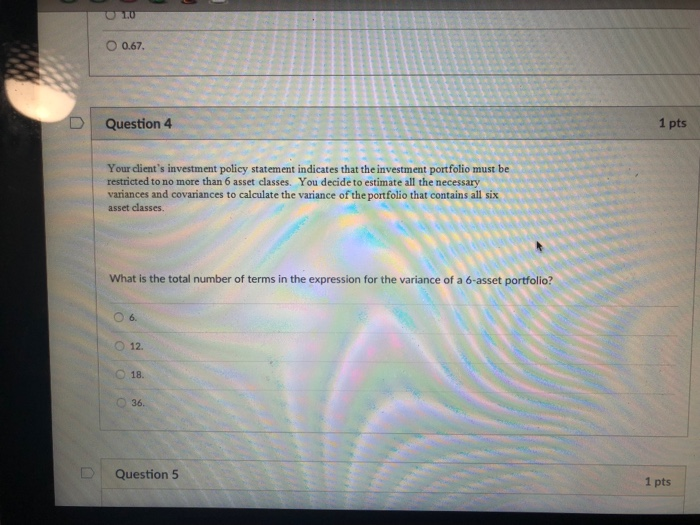

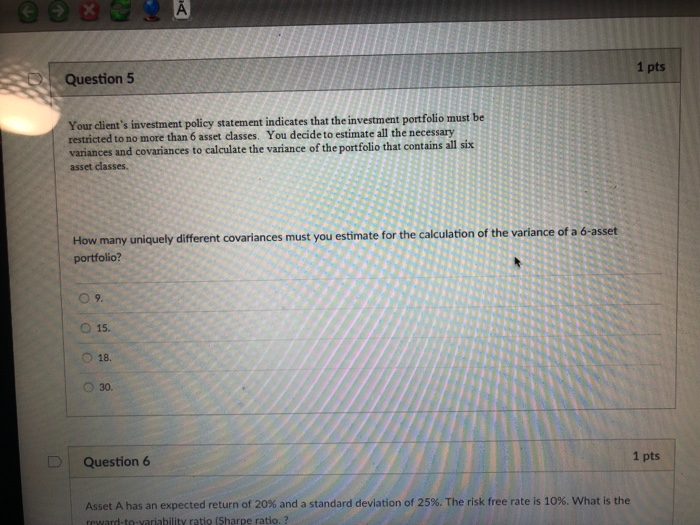

Question 1 pts Consider the following table which gives a security analyst's expected retun on stock D for two particular market retums. Market return Stock D 5% 20% -3% 7% Based on the information in the table, the beta coefficient for stock D is closest to 1.5 0.35. O 10 O 0.67 Question 4 1 pts O 0.67. Question4 1 pts Your client 's investment policy statement indicates that the investment portfolio must be restricted to no more than 6 asset classes. You decide to estimate all the necessary variances and covariances to calculate the variance of the portfolio that contains all six asset classes. What is the total number of terms in the expression for the variance of a 6-asset portfolio? O 12. 18. 36. D Question 5 1 pts 1 pts Question 5 Your dient's investment policy statement indicates that the investment portfolio m restricted to no more than 6 asset classes. You decide to estimate all the necessary variances and covariances to calculate the variance of the portfolio that contains all sie asset classes How many uniquel portfolio? ly different covariances must you estimate for the calculation of the variance of a 6-asset O 9. O 15. O 18. 030 . 1 pts Question 6 Asset A has an expected return of 20% and a standard deviation of 25%. The risk free rate is 10%, what is the reward-to-variability ratio (Sharpe ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts