Question: Question 1 Question 1 options: Cash burn Question 2 Question 2 options: Cash build Question 4 Question 4 options: Total debt-to-Total assets ratio for 2018

Question 1

Question 1 options:

Cash burn

Question 2

Question 2 options:

Cash build

Question 4

Question 4 options:

Total debt-to-Total assets ratio for 2018

Question 5

Question 5 options:

Total debt-to-Total assets ratio for 2019

Question 7

Question 7 options:

Equity multiplier for 2018

Question 8

Question 8 options:

Equity multiplier for 2019

Question 9

Question 9 options:

More/Less Indebt

Question 10

Question 10 options:

Current Ratio for 2018

Question 11

Question 11 options:

Current Ratio for 2019

Question 12

Question 12 options:

More/Less liquid

Question 13

Question 13 options:

Quick Ratio for 2018

Question 14

Question 14 options:

Quick Ratio for 2019

Question 15

Question 15 options:

More/Less liquid

Question 16

Question 16 options:

Net profit margin for 2018

Question 17

Question 17 options:

Net profit margin for 2019

Question 18

Question 18 options:

More/Less profitable

Question 19

Question 19 options:

ROE for 2018

Question 20

Question 20 options:

ROE for 2019

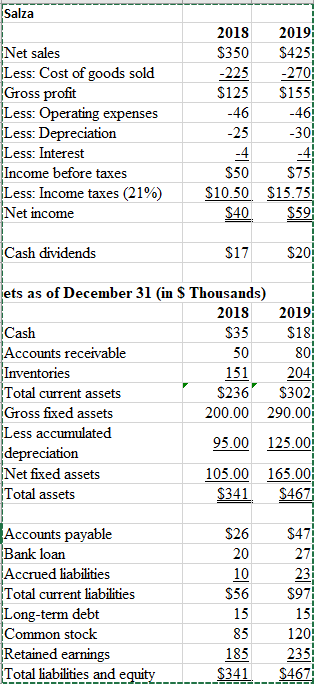

Salza Net sales Less: Cost of goods sold Gross profit Less: Operating expenses Less: Depreciation Less: Interest Income before taxes Less: Income taxes (21%) Net income 2018 2019 $350 $425 -225 -270 $125 $155 -46 -46 -25 -30 -4 -4 $50 $75 $10.50 $15.75 $40 $59 Cash dividends $17 $20 ets as of December 31 (in $ Thousands) 2018 2019 Cash $35 $18 Accounts receivable 50 80- Inventories 151 204 Total current assets $236 $302 Gross fixed assets 200.00 290.00 Less accumulated 95.00 125.00 depreciation Net fixed assets 105.00 165.00 Total assets $341 $467 Accounts payable Bank loan Accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $26 20 10 $56 15 85 185 $341 $47 27 23 $97 15 120- 235 $467

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts