Question: question 1: question 2: 1- Dee Trader opens a brokerage account, and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000

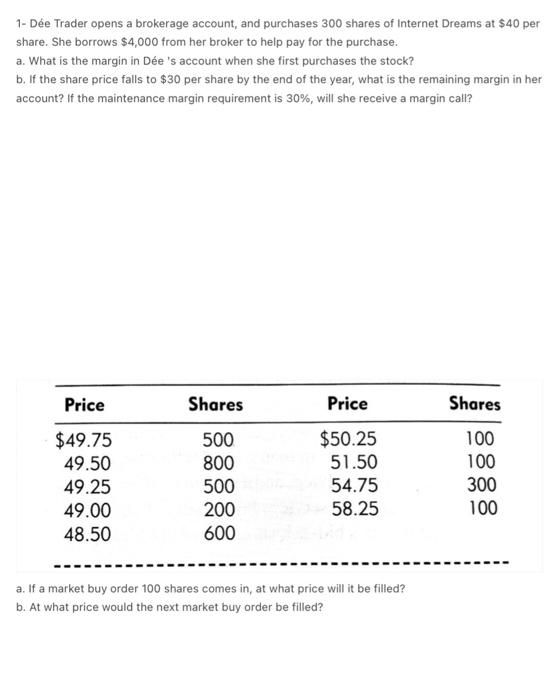

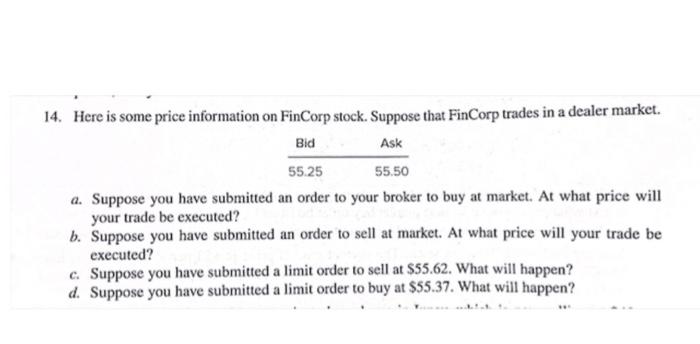

1- Dee Trader opens a brokerage account, and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. a. What is the margin in De 's account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? If the maintenance margin requirement is 30%, will she receive a margin call? Price Shares Price Shares $49.75 49.50 49.25 49.00 48.50 500 800 500 200 600 $50.25 51.50 54.75 58.25 100 100 300 100 a. If a market buy order 100 shares comes in, at what price will it be filled? b. At what price would the next market buy order be filled? Bid 14. Here is some price information on FinCorp stock. Suppose that FinCorp trades in a dealer market. Ask 55.25 55.50 a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $55.62. What will happen? d. Suppose you have submitted a limit order to buy at $55.37. What will happen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts