Question: QUESTION 1 QUESTION 2 A couple thinking about retirement decide to put aside $2,800 each year in a savings plan that earns 8% interest. In

QUESTION 1

QUESTION 2

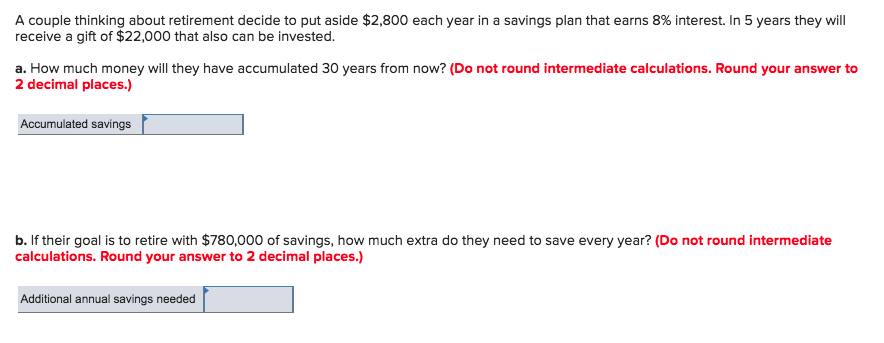

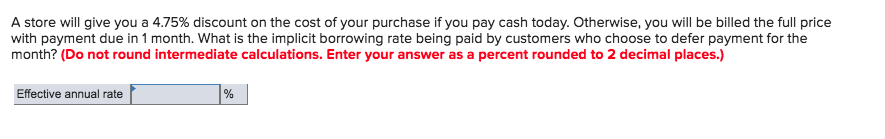

A couple thinking about retirement decide to put aside $2,800 each year in a savings plan that earns 8% interest. In 5 years they will receive a gift of $22,000 that also can be invested. a. How much money will they have accumulated 30 years from now? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Accumulated savings b. If their goal is to retire with $780,000 of savings, how much extra do they need to save every year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Additional annual savings needed A store will give you a 4.75% discount on the cost ofyour purchase if you pay cash today. Otherwise, you will be billed the ful price with payment due in 1 month. What is the implicit borrowing rate being paid by customers who choose to defer payment for the month? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Effective annual rate

Step by Step Solution

There are 3 Steps involved in it

Solution for QUESTION 1 Lets solve this stepbystep Part a Accumulated savings after 30 years The couple is saving 2800 annually for 30 years and their ... View full answer

Get step-by-step solutions from verified subject matter experts