Question: question 1 question 2 answer both these questions accurately On January 1,2017 , Big Rock Brewery purchased a van for $40,000. Big Rock expects the

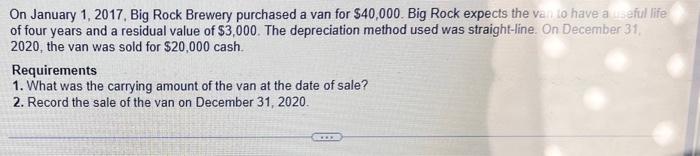

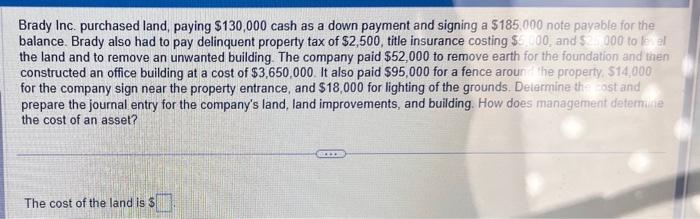

On January 1,2017 , Big Rock Brewery purchased a van for $40,000. Big Rock expects the van to have a weeful life of four years and a residual value of $3,000. The depreciation method used was straight-line. On December 31 , 2020 , the van was sold for $20,000 cash. Requirements 1. What was the carrying amount of the van at the date of sale? 2. Record the sale of the van on December 31,2020 . Brady Inc. purchased land, paying $130,000 cash as a down payment and signing a $185,000 note payable for the balance. Brady also had to pay delinquent property tax of $2,500, title insurance costing $500, and $500 to 1 a the land and to remove an unwanted building. The company paid $52,000 to remove earth for the foundation and then constructed an office building at a cost of $3,650,000. It also paid $95,000 for a fence aroun the property $14,000 for the company sign near the property entrance, and $18,000 for lighting of the grounds. Detarmine the ast and prepare the journal entry for the company's land, land improvements, and building. How does management deternina the cost of an asset? The cost of the land is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts