Question: Question 1 Question 2 drop down option increase or decrease Assuming Crane Corp. has an ROE of 10% and investors require a 8% return on

Question 1

Question 2

drop down option "increase or decrease"

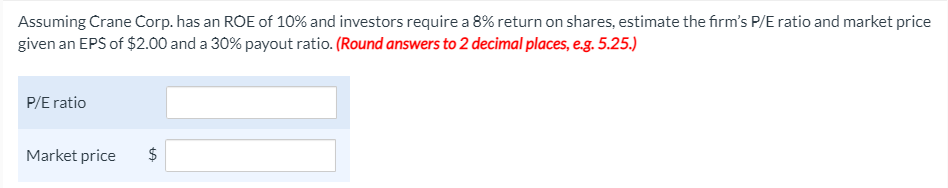

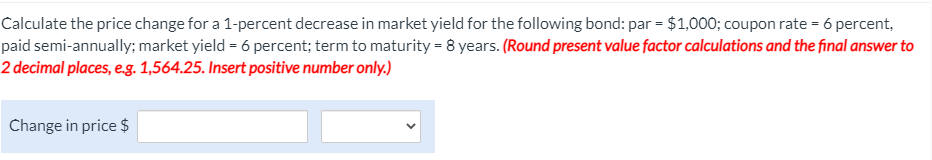

Assuming Crane Corp. has an ROE of 10% and investors require a 8% return on shares, estimate the firm's P/E ratio and market price given an EPS of $2.00 and a 30% payout ratio. (Round answers to 2 decimal places, e.g. 5.25.) P/E ratio Market price $ Calculate the price change for a 1-percent decrease in market yield for the following bond: par = $1,000; coupon rate = 6 percent, paid semi-annually; market yield = 6 percent; term to maturity = 8 years. (Round present value factor calculations and the final answer to 2 decimal places, e.g. 1,564.25. Insert positive number only.) Change in price $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts