Question: QUESTION 1. : QUESTION 2 : Instructions Head-First Company plans to sell 5,100 bicycle helmets at $78 each in the coming year. Variable cost is

QUESTION 1. :

QUESTION 2 :

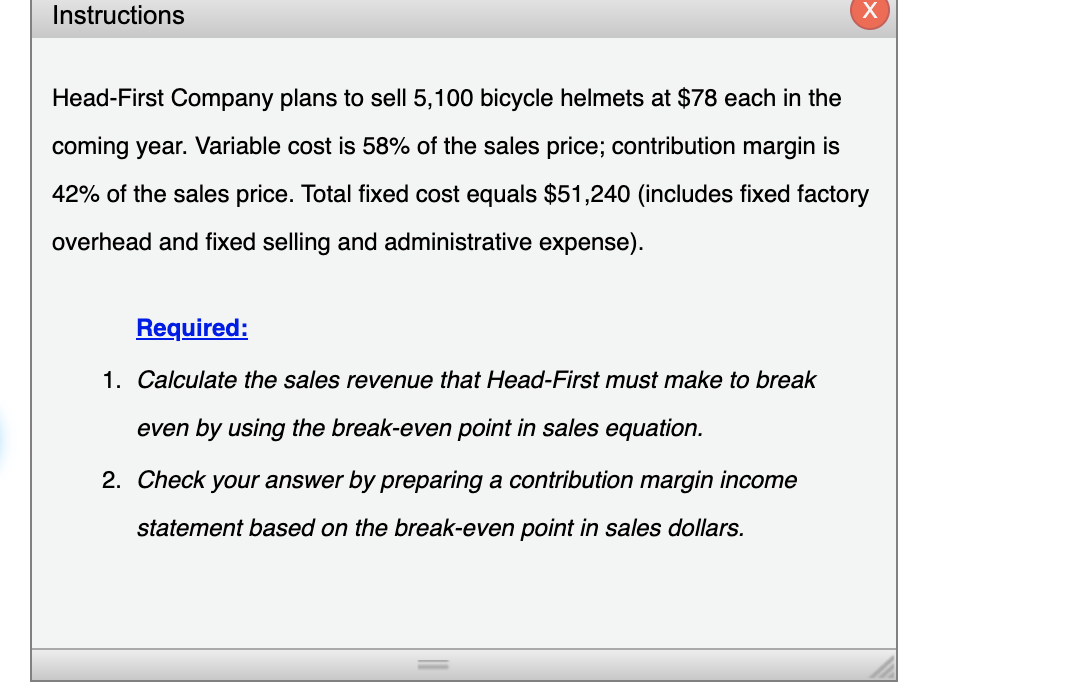

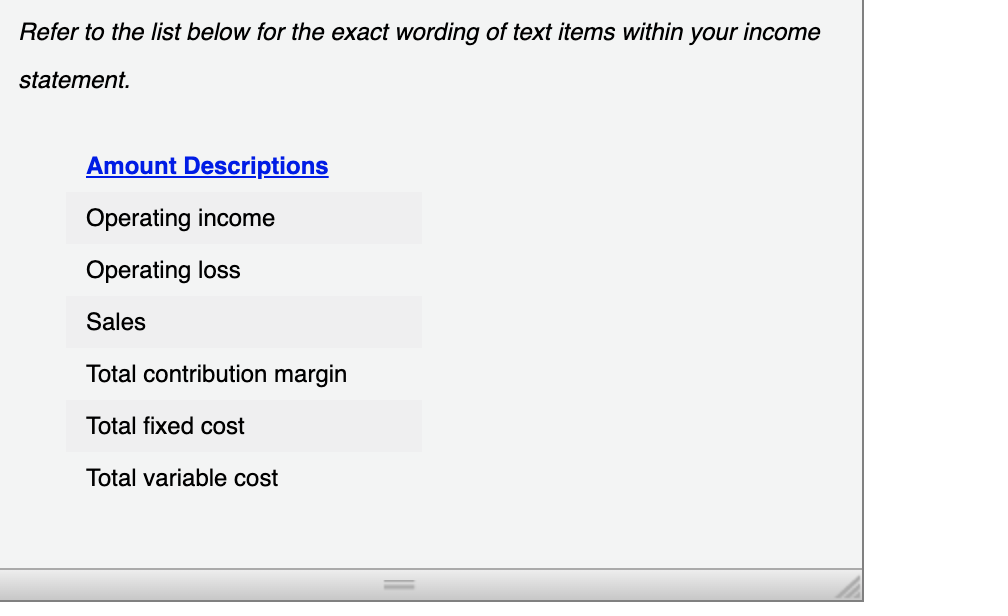

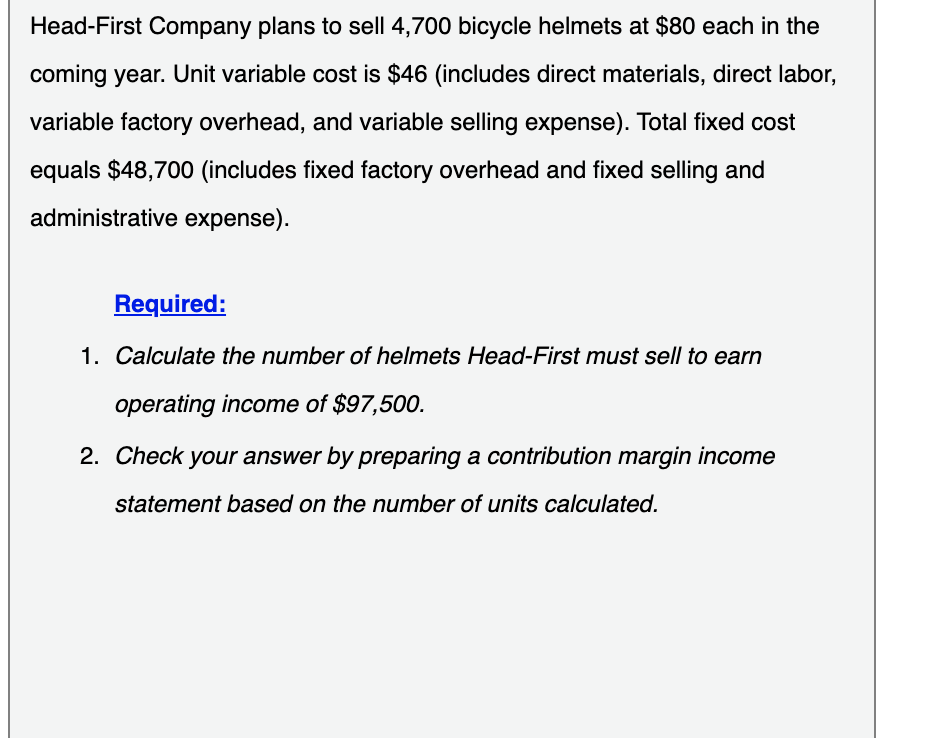

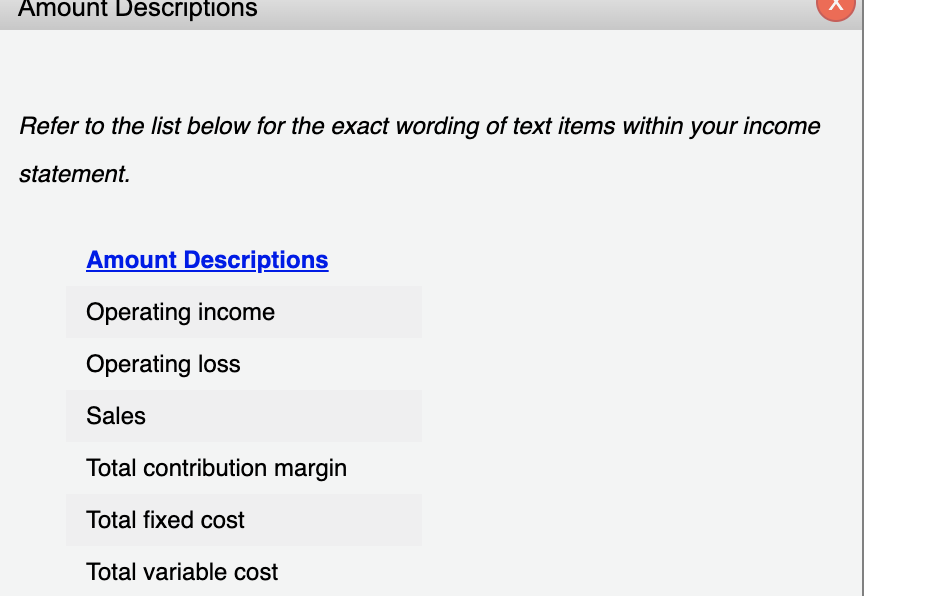

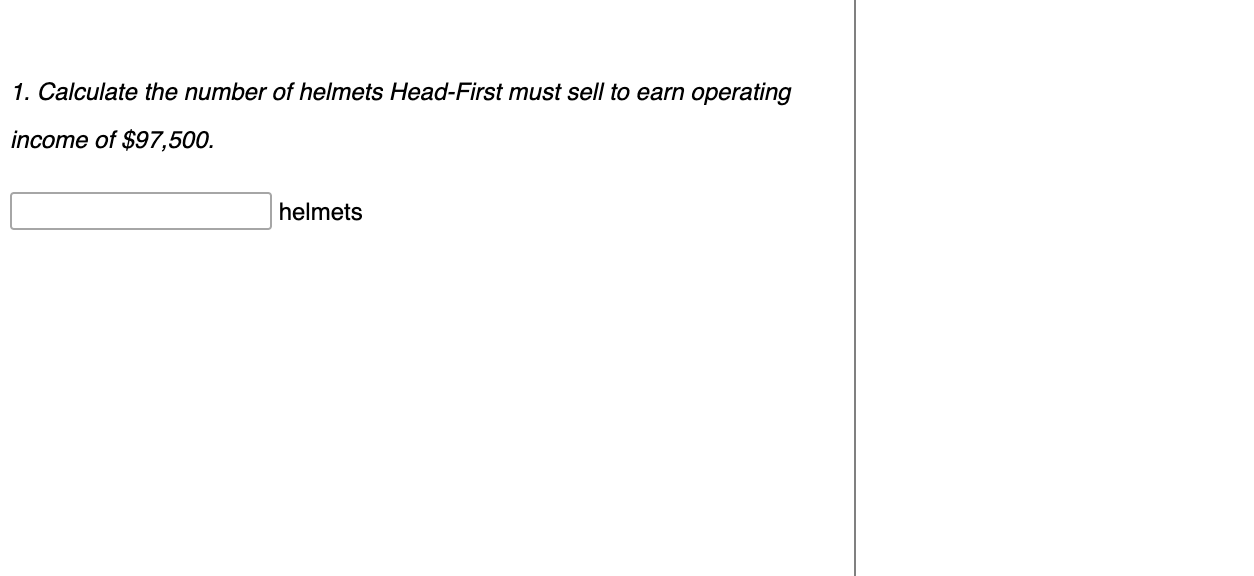

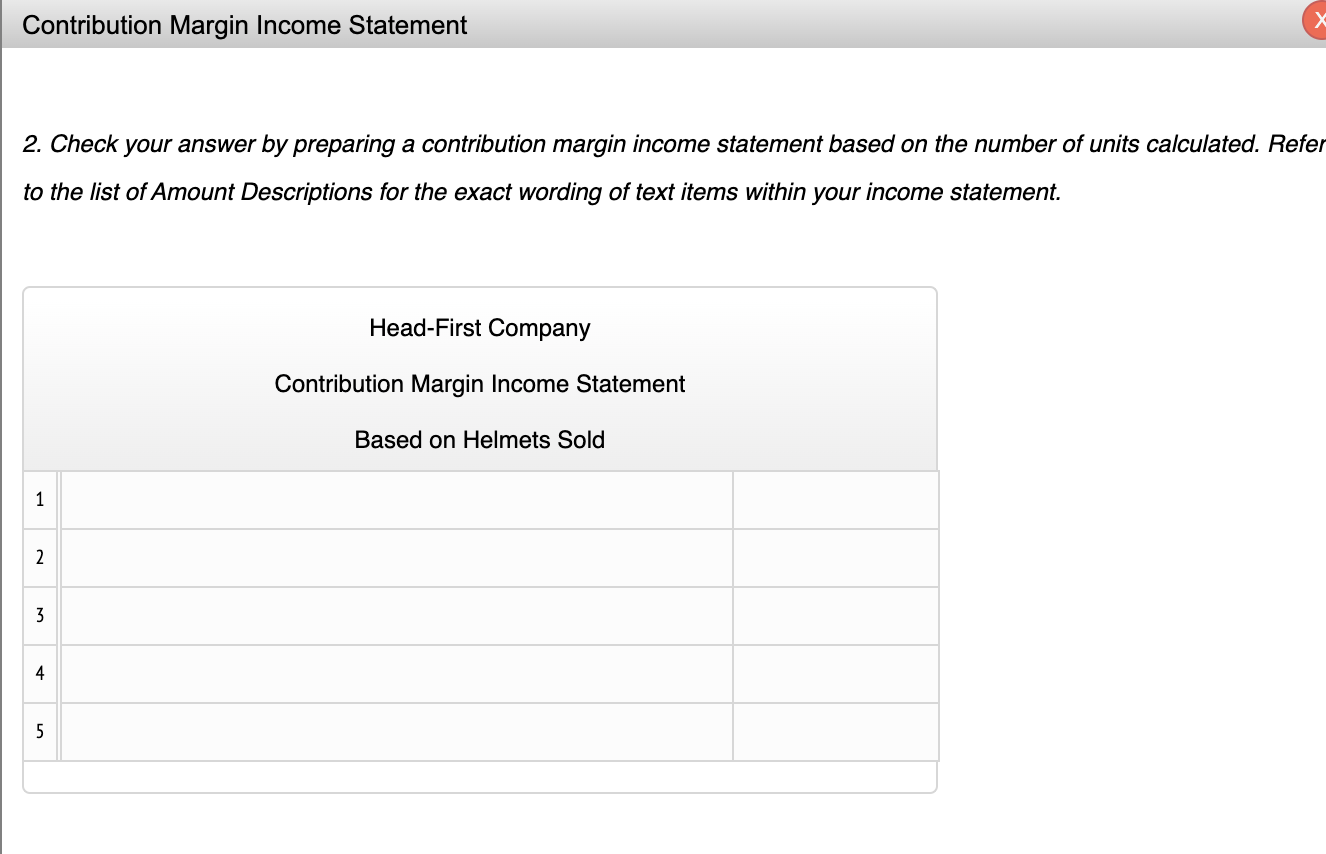

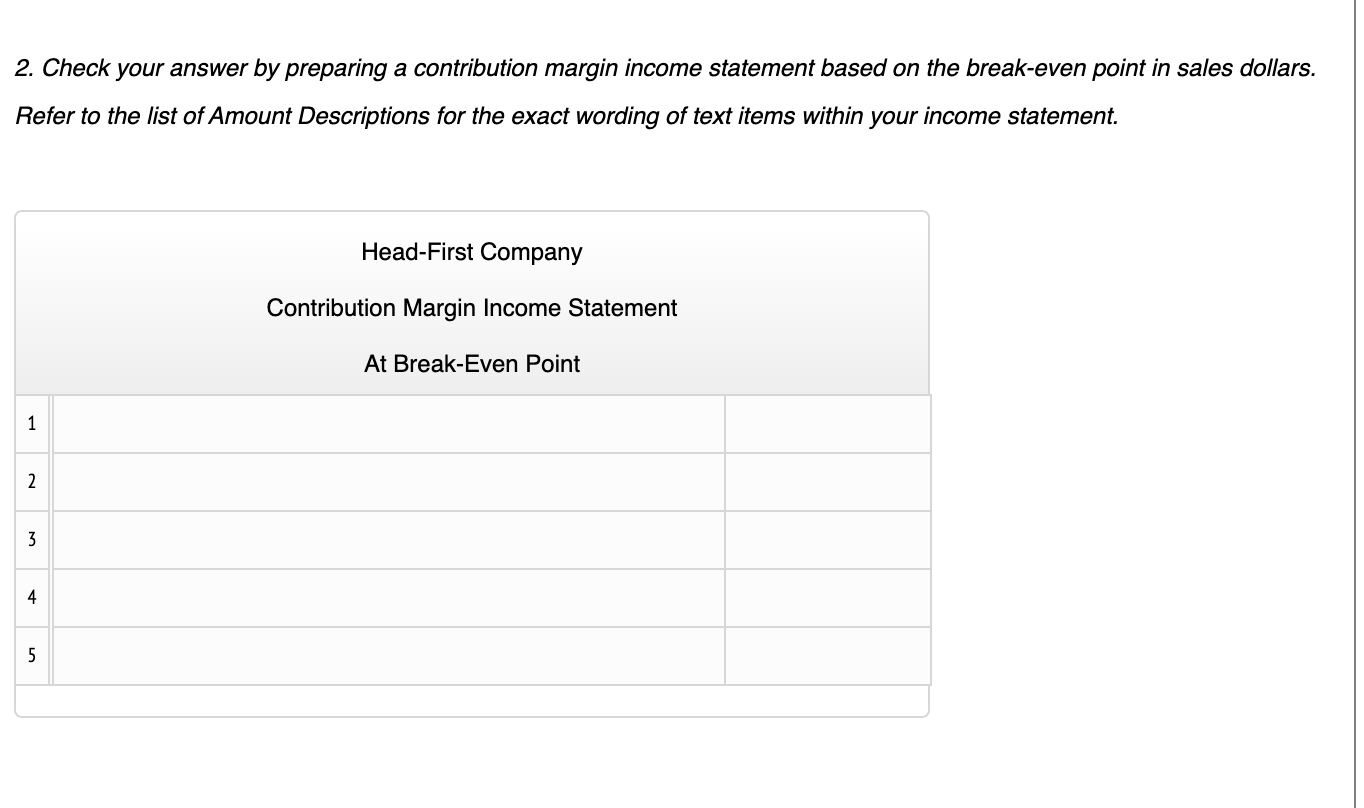

Instructions Head-First Company plans to sell 5,100 bicycle helmets at $78 each in the coming year. Variable cost is 58% of the sales price; contribution margin is 42% of the sales price. Total fixed cost equals $51,240 (includes fixed factory overhead and fixed selling and administrative expense). Required: 1. Calculate the sales revenue that Head-First must make to break even by using the break-even point in sales equation. 2. Check your answer by preparing a contribution margin income statement based on the break-even point in sales dollars. Refer to the list below for the exact wording of text items within your income statement. Amount Descriptions Operating income Operating loss Sales Total contribution margin Total fixed cost Total variable cost 1. Calculate the sales revenue that Head-First must make to break even by using the break-even point in sales equation. $ Head-First Company plans to sell 4,700 bicycle helmets at $80 each in the coming year. Unit variable cost is $46 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $48,700 (includes fixed factory overhead and fixed selling and administrative expense). Required: 1. Calculate the number of helmets Head-First must sell to earn operating income of $97,500. 2. Check your answer by preparing a contribution margin income statement based on the number of units calculated. Amount Descriptions Refer to the list below for the exact wording of text items within your income statement. Amount Descriptions Operating income Operating loss Sales Total contribution margin Total fixed cost Total variable cost Contribution Margin Income Statement 2. Check your answer by preparing a contribution margin income statement based on the number of units calculated. Refer to the list of Amount Descriptions for the exact wording of text items within your income statement. Head-First Company Contribution Margin Income Statement Based on Helmets Sold 1 2 3 4 5 2. Check your answer by preparing a contribution margin income statement based on the break-even point in sales dollars. Refer to the list of Amount Descriptions for the exact wording of text items within your income statement. Head-First Company Contribution Margin Income Statement At Break-Even Point 1 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts