Question: QUESTION 1 QUESTION 2 LOOKING FOR HELP ON THE INCOME FROM CONTINUING OPERATIONS CALCULATION Your answer is partially correct. On January 2, 2015, Cullumber Corporation

QUESTION 1

QUESTION 2

LOOKING FOR HELP ON THE "INCOME FROM CONTINUING OPERATIONS" CALCULATION

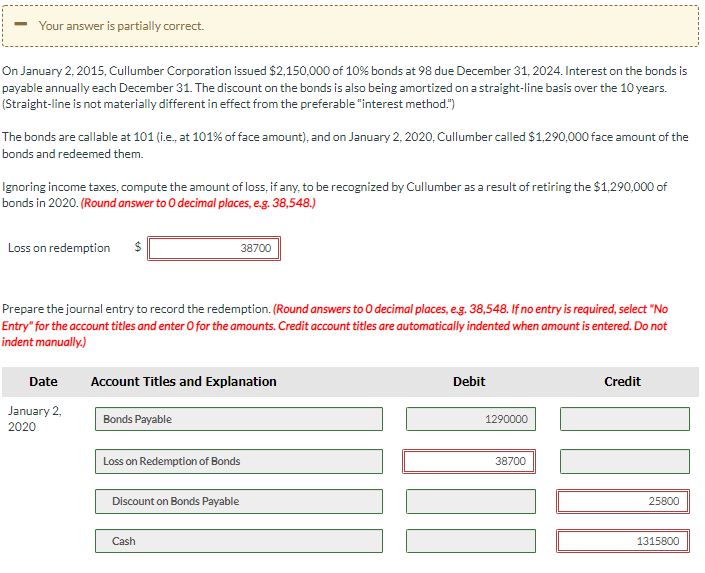

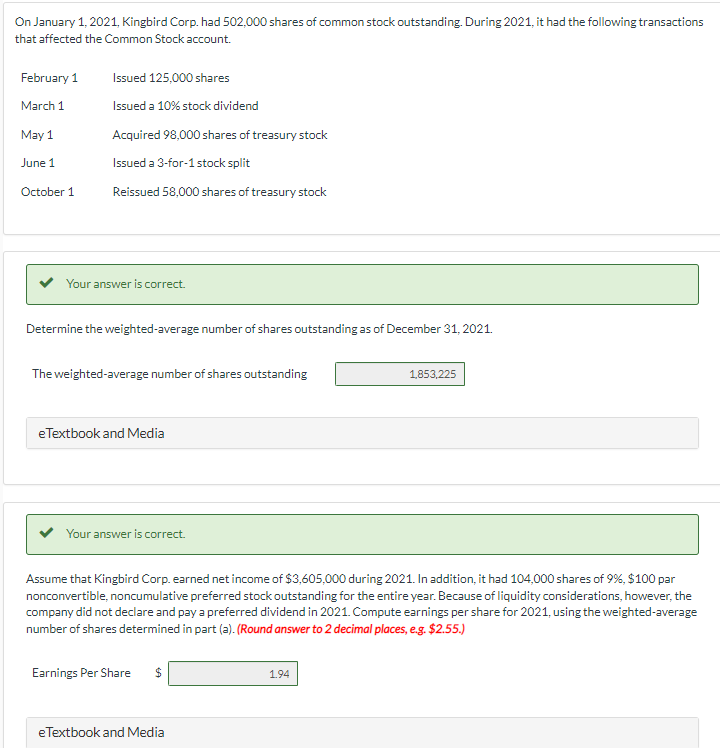

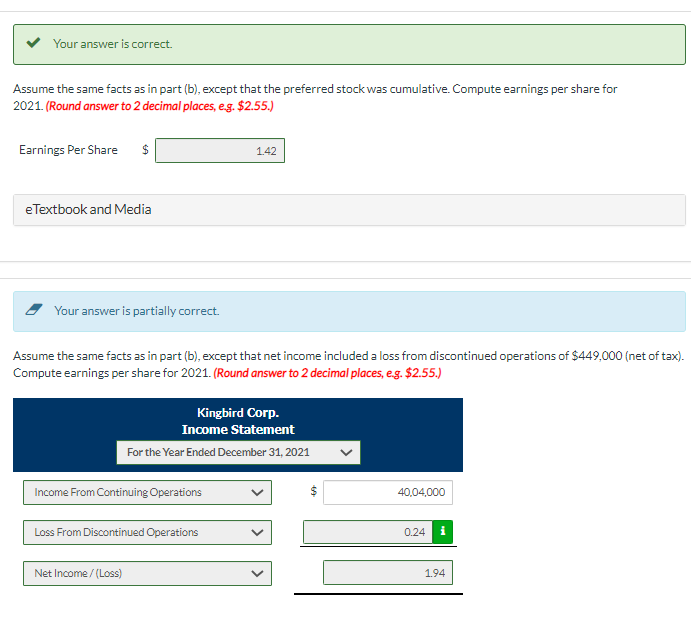

Your answer is partially correct. On January 2, 2015, Cullumber Corporation issued $2,150,000 of 10% bonds at 98 due December 31, 2024. Interest on the bonds is payable annually each December 31. The discount on the bonds is also being amortized on a straight-line basis over the 10 years. (Straight-line is not materially different in effect from the preferable "interest method.") The bonds are callable at 101 (i.e., at 101% of face amount), and on January 2, 2020, Cullumber called $1.290.000 face amount of the bonds and redeemed them. Ignoring income taxes, compute the amount of loss, if any, to be recognized by Cullumber as a result of retiring the $1,290,000 of bonds in 2020. (Round answer to decimal places, e.g. 38,548.) Loss on redemption 38700 Prepare the journal entry to record the redemption (Round answers to decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit January 2, 2020 Bonds Payable 1290000 Loss on Redemption of Bonds 38700 Discount on Bonds Payable 25800 Cash 1315800 On January 1, 2021, Kingbird Corp. had 502,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 March 1 May 1 Issued 125.000 shares Issued a 10% stock dividend Acquired 98,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 58,000 shares of treasury stock June 1 October 1 Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31, 2021. The weighted average number of shares outstanding 1,853,225 e Textbook and Media Your answer is correct Assume that Kingbird Corp.earned net income of $3,605,000 during 2021. In addition, it had 104,000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2021. Compute earnings per share for 2021, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, e.g. $2.55.) Earnings Per Share $ 1.94 eTextbook and Media Your answer is correct. Assume the same facts as in part (b), except that the preferred stock was cumulative. Compute earnings per share for 2021. (Round answer to 2 decimal places, eg. $2.55.) Earnings Per Share $ 1.42 e Textbook and Media Your answer is partially correct. Assume the same facts as in part (b), except that net income included a loss from discontinued operations of $449,000 (net of tax). Compute earnings per share for 2021. (Round answer to 2 decimal places, eg. $2.55.) Kingbird Corp. Income Statement For the Year Ended December 31, 2021 Income From Continuing Operations $ 40.04.000 Loss From Discontinued Operations 0.24 Net Income /(Loss) 1.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts