Question: question 1 question 2 please only answer the first one. I did not mean to post 2 questions here. thanks! Check My Work (1 remaining)

question 1

question 2

please only answer the first one. I did not mean to post 2 questions here. thanks!

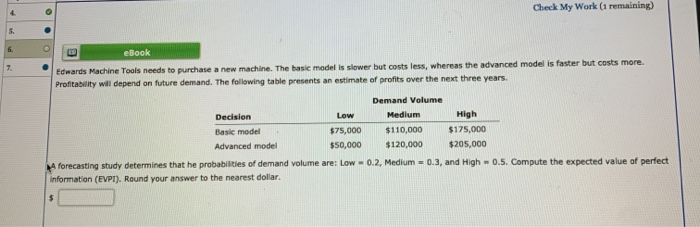

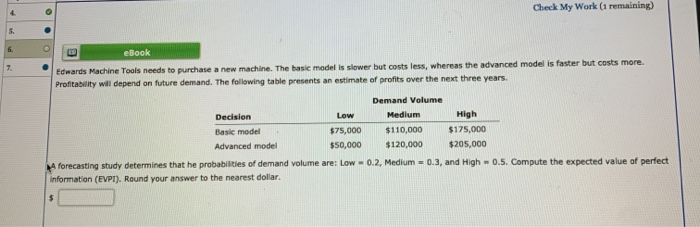

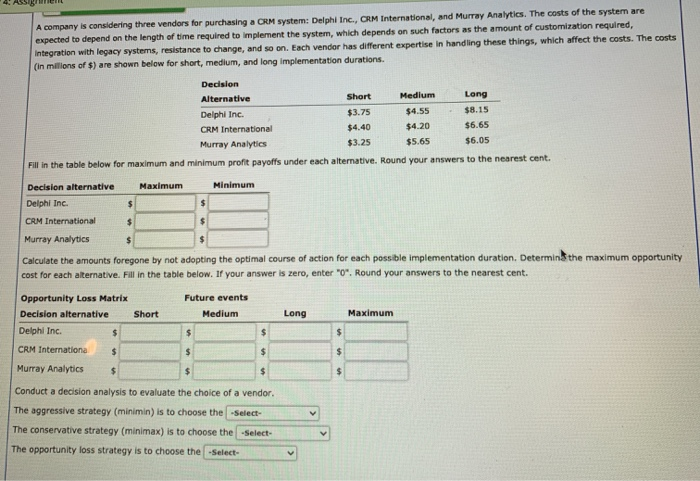

Check My Work (1 remaining) 4 5. 6. 7 eBook Edwards Machine Tools needs to purchase a new machine. The basic model is slower but costs less, whereas the advanced model is faster but costs more. Profitability will depend on future demand. The following table presents an estimate of profits over the next three years. Demand Volume Decision Low Medium High Basic model $75,000 $110,000 $175,000 Advanced model $50,000 $120,000 $205,000 4 forecasting study determines that he probabilities of demand volume are: Low -0.2, Medium = 0.3, and High -0.5. Compute the expected value of perfect information (EVP). Round your answer to the nearest dollar. $ $3.75 A company is considering three vendors for purchasing a CRM system: Delphi Inc., CRM International, and Murray Analytics. The costs of the system are expected to depend on the length of time required to implement the system, which depends on such factors as the amount of customization required, Integration with legacy systems, resistance to change, and so on. Each vendor has different expertise in handling these things, which affect the costs. The costs (in Millions of $) are shown below for short, medium, and long implementation durations. Decision Alternative Short Medium Long Delphi Inc. $4.55 $8.15 CRM International $4.40 $4.20 $6.65 Murray Analytics $3.25 $5.65 $6.05 Fill in the table below for maximum and minimum profit payoffs under each alternative. Round your answers to the nearest cent. Decision alternative Maximum Minimum Delphi Inc $ $ CRM International $ $ Murray Analytics $ Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determin the maximum opportunity cost for each alternative. Fill in the table below. If your answer is zero, enter "0". Round your answers to the nearest cent. Opportunity Loss Matrix Future events Decision alternative Short Medium Long Maximum Delphi Inc. $ $ $ $ CRM Internationa $ $ $ $ Murray Analytics $ $ $ $ Conduct a decision analysis to evaluate the choice of a vendor. The aggressive strategy (minimin) is to choose the -Select- The conservative strategy (minimax) is to choose the -Select- The opportunity loss strategy is to choose the -Select- V Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock