Question: Question 1 Question 2 Question 2 part b) Compute the estimate inventory at May 31, assuming that the Gross Profit is 25% of cost. During

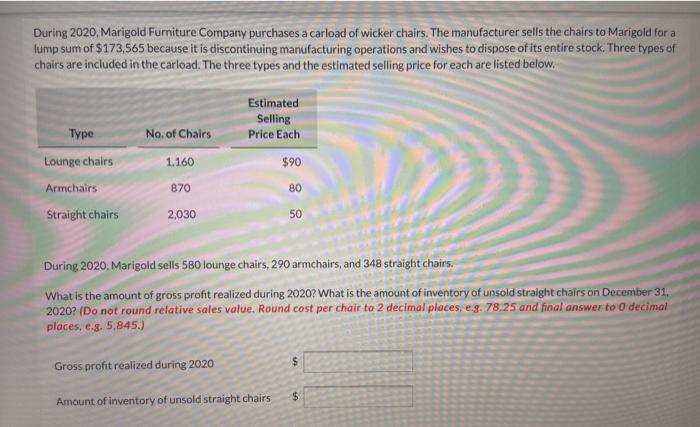

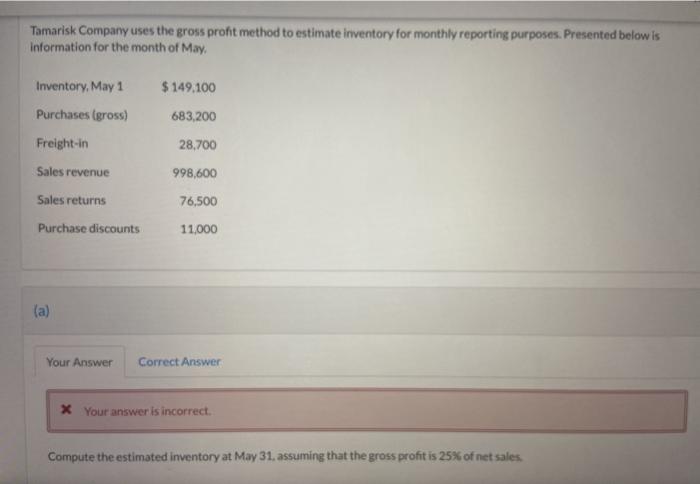

During 2020, Marigold Furniture Company purchases a carload of wicker chairs. The manufacturer sells the chairs to Marigold for a lump sum of $173,565 because it is discontinuing manufacturing operations and wishes to dispose of its entire stock. Three types of chairs are included in the carload. The three types and the estimated selling price for each are listed below. Estimated Selling Price Each Type No. of Chairs Lounge chairs 1,160 $90 Armchairs 870 80 Straight chairs 2,030 50 During 2020. Marigold sells 580 lounge chairs, 290 armchairs, and 348 straight chairs. What is the amount of gross profit realized during 2020? What is the amount of inventory of unsold straight chairs on December 31, 2020? (Do not round relative sales value. Round cost per chair to 2 decimal places, e.g. 78.25 and final answer to decimal places, e 3, 5,845.) $ Gross profit realized during 2020 $ Amount of inventory of unsold straight chairs Tamarisk Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 $149.100 Purchases (gross) 683,200 Freight-in 28,700 Sales revenue 998,600 Sales returns 76,500 Purchase discounts 11.000 (a) Your Answer Correct Answer * Your answer is incorrect. Compute the estimated inventory at May 31, assuming that the gross profit is 25% of net sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts