Question: Question 1 Question 2 Question 3 Central Perk coffee shop has made the purchase of a plot of land in Buffalo 2 years ago at

Question 1

Question 2

Question 3

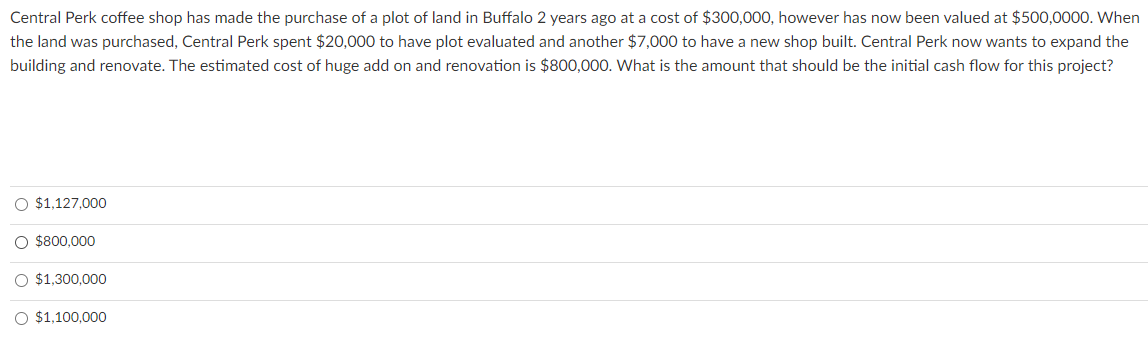

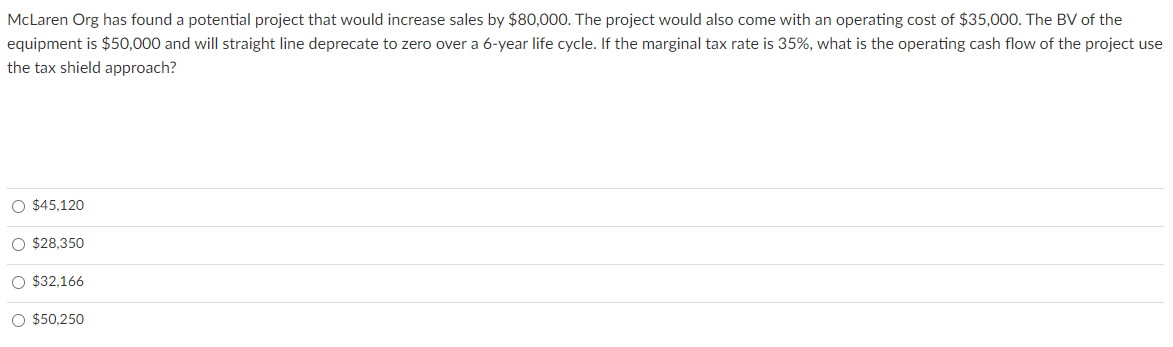

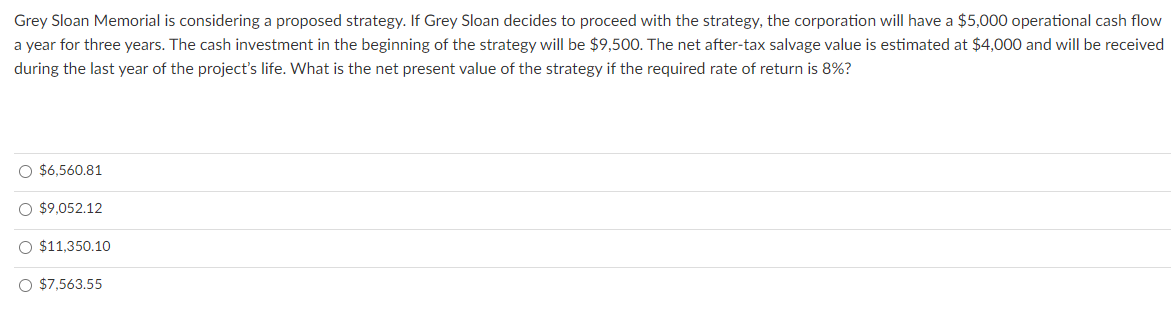

Central Perk coffee shop has made the purchase of a plot of land in Buffalo 2 years ago at a cost of $300,000, however has now been valued at $500,0000. When the land was purchased, Central Perk spent $20,000 to have plot evaluated and another $7,000 to have a new shop built. Central Perk now wants to expand the building and renovate. The estimated cost of huge add on and renovation is $800,000. What is the amount that should be the initial cash flow for this project? $1.127.000 $800,000 O $1,300,000 $1,100,000 McLaren Org has found a potential project that would increase sales by $80,000. The project would also come with an operating cost of $35,000. The BV of the equipment is $50,000 and will straight line deprecate to zero over a 6-year life cycle. If the marginal tax rate is 35%, what is the operating cash flow of the project use the tax shield approach? $45,120 O $28,350 $32,166 O $50,250 Grey Sloan Memorial is considering a proposed strategy. If Grey Sloan decides to proceed with the strategy, the corporation will have a $5,000 operational cash flow a year for three years. The cash investment in the beginning of the strategy will be $9,500. The net after-tax salvage value is estimated at $4,000 and will be received during the last year of the project's life. What is the net present value of the strategy if the required rate of return is 8%? O $6.560.81 O $9,052.12 O $11,350.10 O $7,563.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts