Question: question 1 question 2; question 3: Mitchell received a $25,900 loan from a bank that was charging interest at 4.25% compounded semi-annually. a. How much

question 1

question 2;

question 2;

question 3:

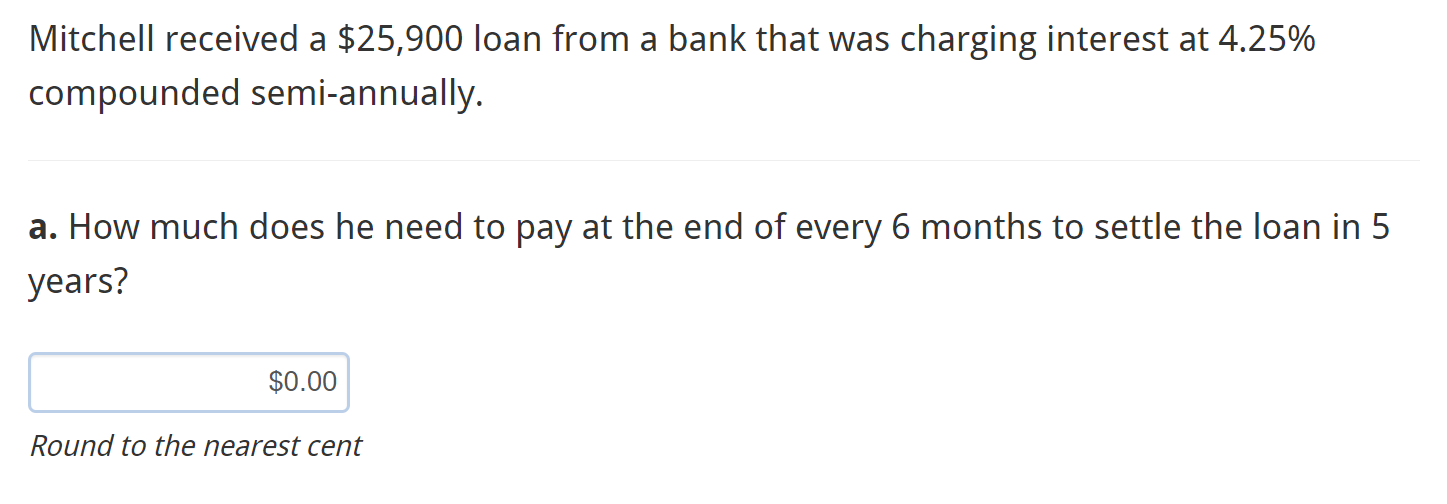

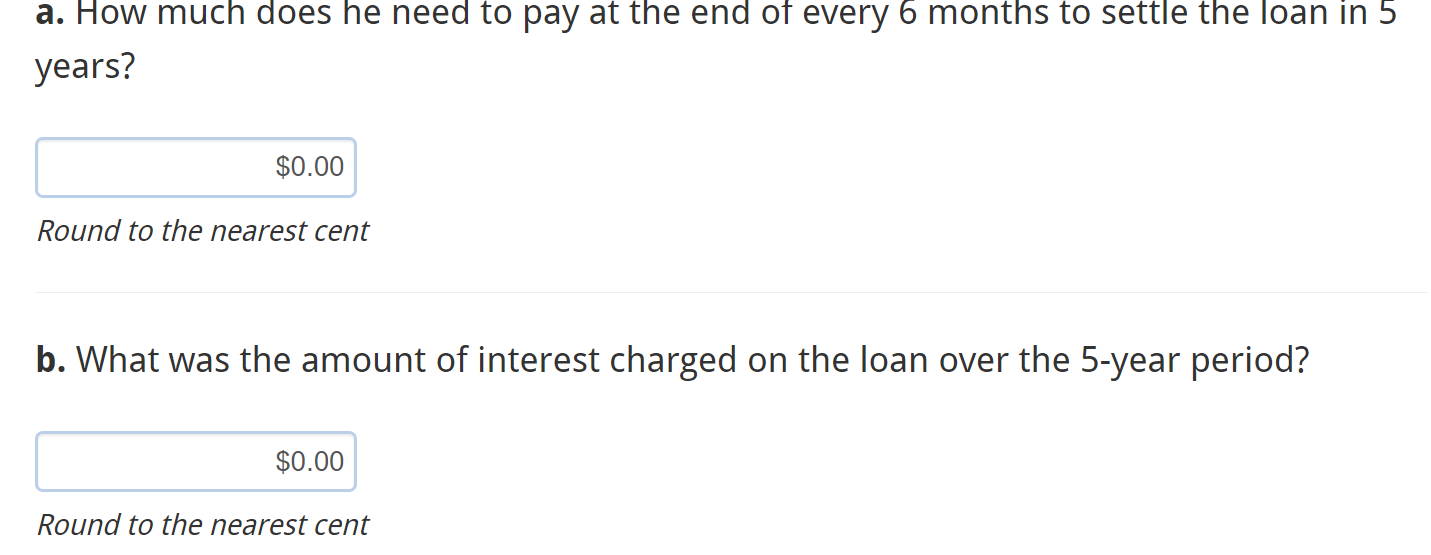

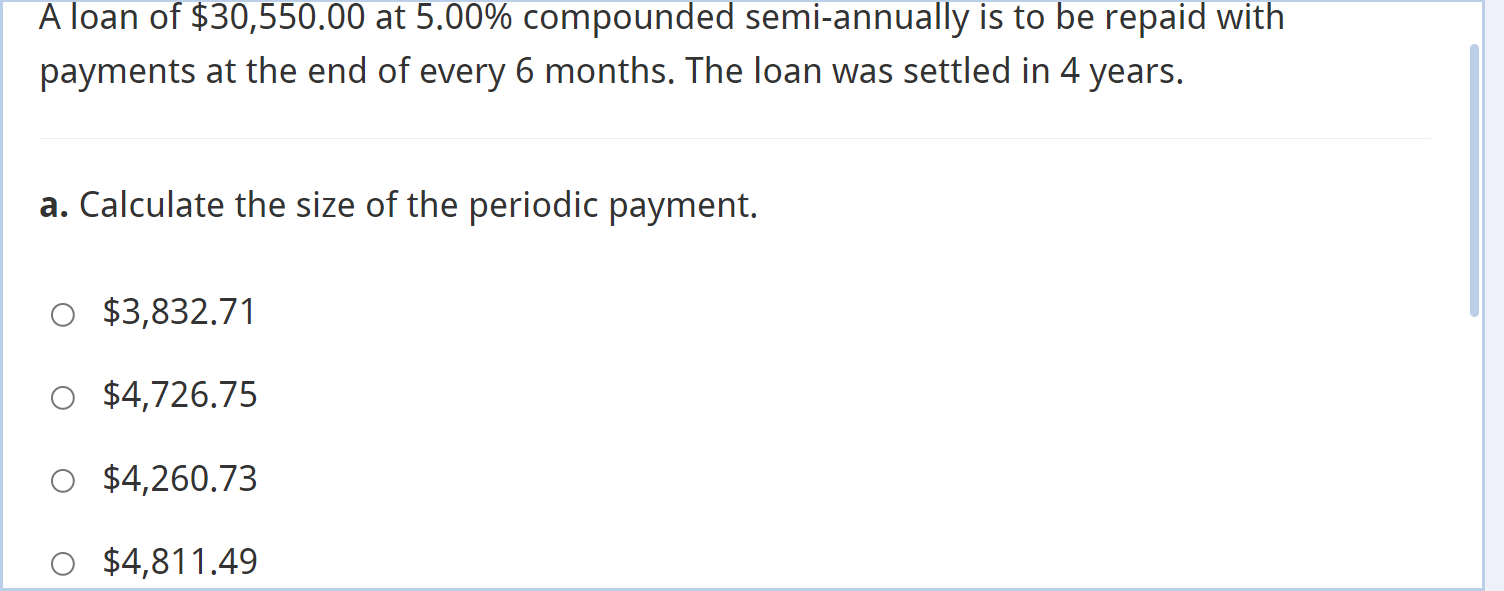

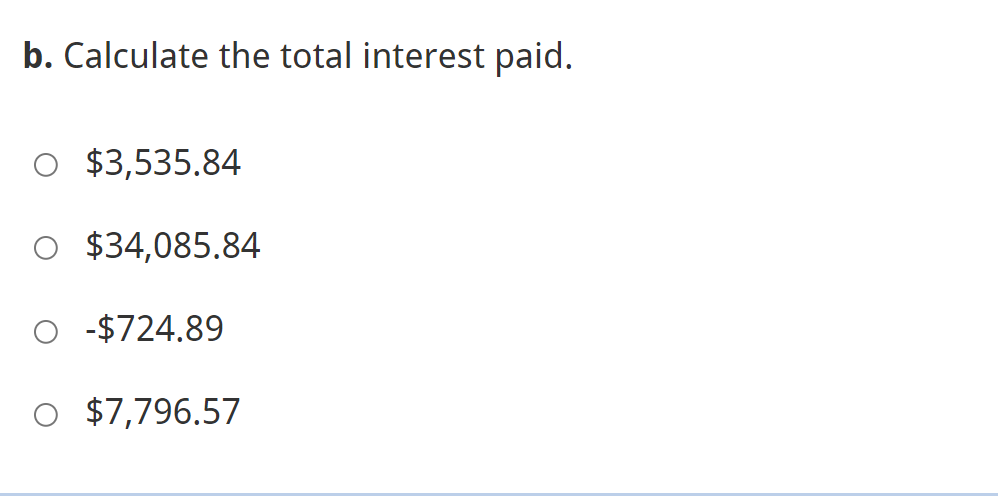

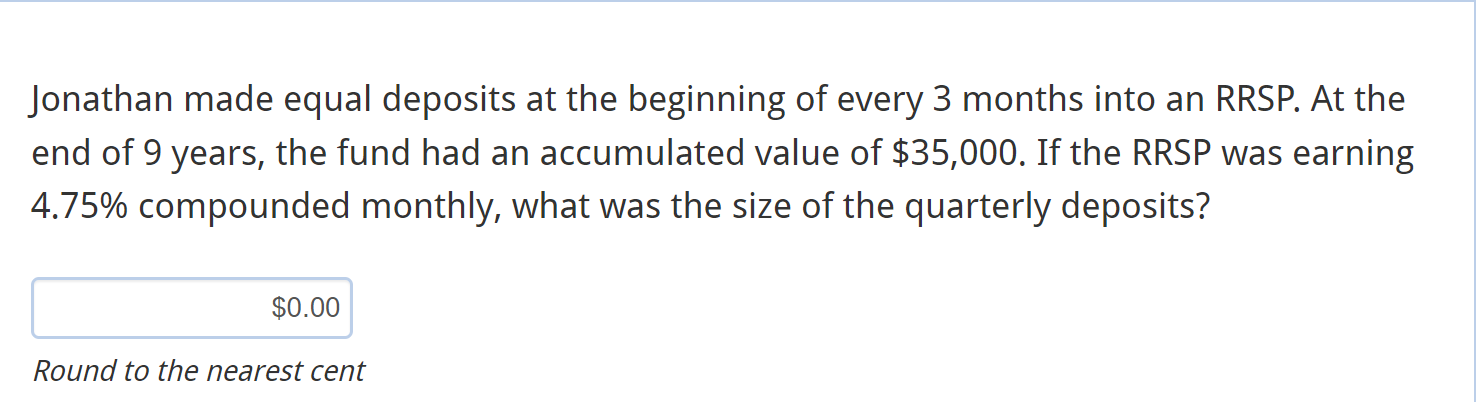

Mitchell received a $25,900 loan from a bank that was charging interest at 4.25% compounded semi-annually. a. How much does he need to pay at the end of every 6 months to settle the loan in 5 years? Round to the nearest cent a. How much does he need to pay at the end of every 6 months to settle the loan in 5 years? Round to the nearest cent b. What was the amount of interest charged on the loan over the 5-year period? Round to the nearest cent A loan of $30,550.00 at 5.00% compounded semi-annually is to be repaid with payments at the end of every 6 months. The loan was settled in 4 years. a. Calculate the size of the periodic payment. $3,832.71$4,726.75$4,260.73$4,811.49 b. Calculate the total interest paid. $3,535.84$34,085.84$724.89$7,796.57 Jonathan made equal deposits at the beginning of every 3 months into an RRSP. At the end of 9 years, the fund had an accumulated value of $35,000. If the RRSP was earning 4.75% compounded monthly, what was the size of the quarterly deposits? Round to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts