Question: Question 1 question 2 Question 3 Ms S Solomon is owner of SS Accountants. On 23 April 20.1 MS S Soloman made an EFT payment

Question 1

question 2

Question 3

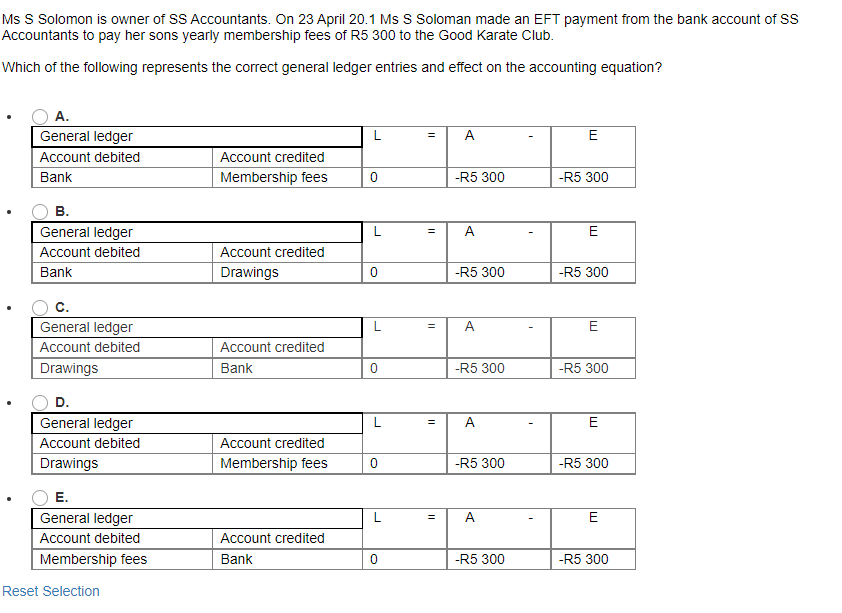

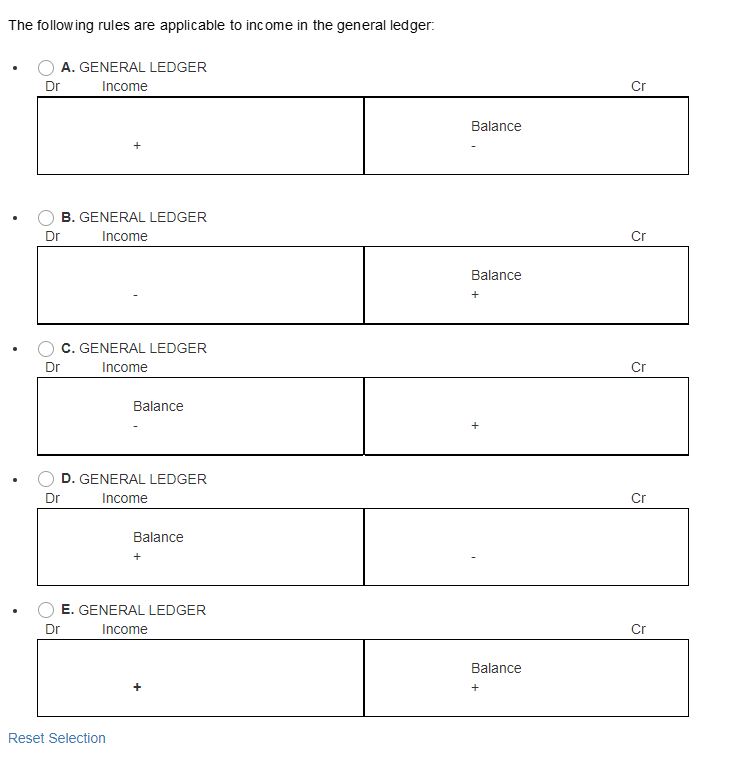

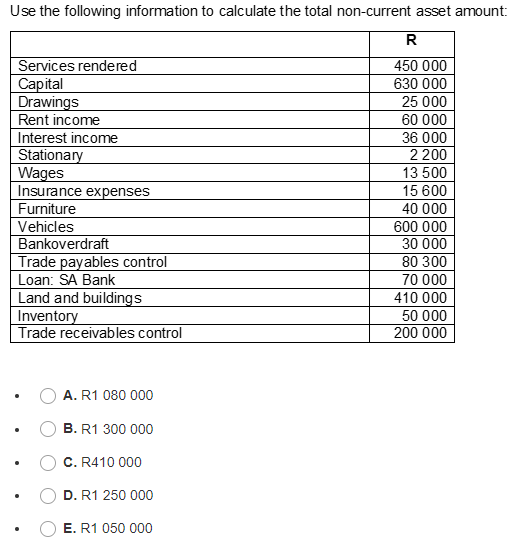

Ms S Solomon is owner of SS Accountants. On 23 April 20.1 MS S Soloman made an EFT payment from the bank account of SS Accountants to pay her sons yearly membership fees of R5 300 to the Good Karate Club. Which of the following represents the correct general ledger entries and effect on the accounting equation? L E A. General ledger Account debited Bank Account credited Membership fees 0 -R5 300 -R5 300 A E B. General ledger Account debited Bank Account credited Drawings 0 -R5 300 -R5 300 L - A E C. General ledger Account debited Drawings Account credited Bank 0 -R5 300 -R5 300 A E D. General ledger Account debited Drawings Account credited Membership fees 0 -R5 300 -R5 300 = A E E. General ledger Account debited Membership fees Account credited Bank 0 -R5 300 -R5 300 Reset Selection The following rules are applicable to income in the general ledger: A. GENERAL LEDGER Dr Income 5 Cr Balance . B. GENERAL LEDGER Dr Income Cr Balance . C. GENERAL LEDGER Dr Income Cr Balance + . D. GENERAL LEDGER Dr Income Cr Balance . E. GENERAL LEDGER Dr Income Cr Balance + Reset Selection Use the following information to calculate the total non-current asset amount: R Services rendered 450 000 Capital 630 000 Drawings 25 000 Rent income 60 000 Interest income 36 000 Stationary 2 200 Wages 13 500 Insurance expenses 15 600 Furniture 40 000 Vehicles 600 000 Bankoverdraft 30 000 Trade payables control 80 300 Loan: SA Bank 70 000 Land and buildings 410 000 Inventory 50 000 Trade receivables control 200 000 A. R1 080 000 B. R1 300 000 C. R410 000 D. R1 250 000 . E. R1 050 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts