Question: Question 1 Question 2 Question 3 O No.2 a) The following table shows betas for several companies. Calculate each stock's expected rate of return using

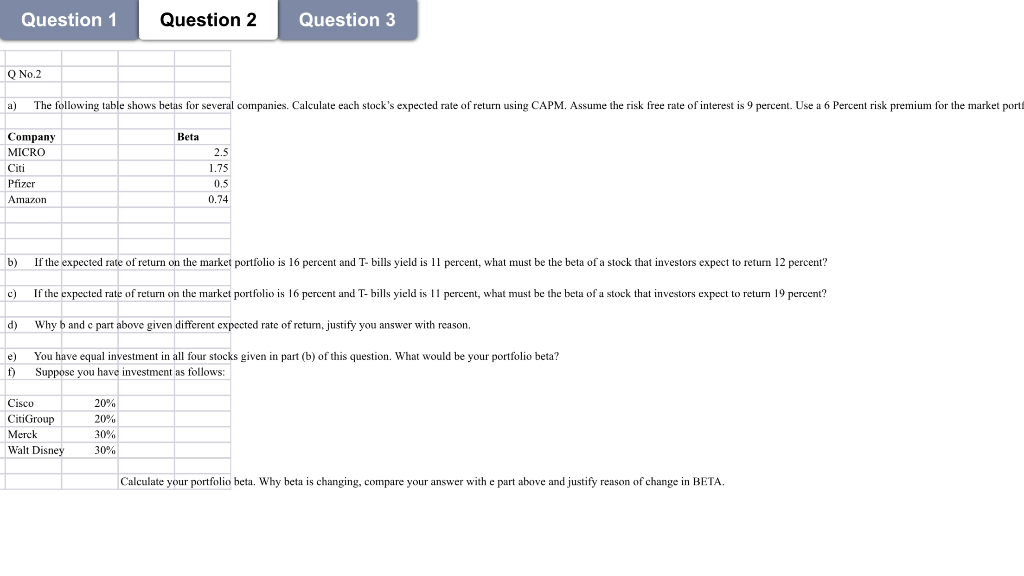

Question 1 Question 2 Question 3 O No.2 a) The following table shows betas for several companies. Calculate each stock's expected rate of return using CAPM. Assume the risk free rate of interest is 9 percent. Use a 6 Percent risk premium for the market port Beta Company MICRO Citi Pfizer Amazon 2.5 1.75 0.5 0.74 b) If the expected rate of return on the market portfolio is 16 percent and T-bills yield is 11 percent, what must be the beta of a stock that investors expect to return 12 percent? c) If the expected rate of return on the market portfolio is 16 percent and T-bills yield is 11 percent, what must be the beta of a stock that investors expect to return 19 percent? d) Why b and c part above given different expected rate of return, justify you answer with reason. e) f) You have equal investment in all four stocks given in part (b) of this question. What would be your portfolio beta? Suppose you have investment as follows: Cisco CitiGroup Merck Walt Disney 20% 20% 30% 30% Calculate your portfolio beta. Why beta is changing, compare your answer with e part above and justify reason of change in BETA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts