Question: Question 1: ________________________________________________________________________________________________________________________________________________ Question 2: ________________________________________________________________________________________________________________________________________________ Question 3: ________________________________________________________________________________________________________________________________________________ Question 4: The following income statement was drawn from the records of Joel Company, a merchandising

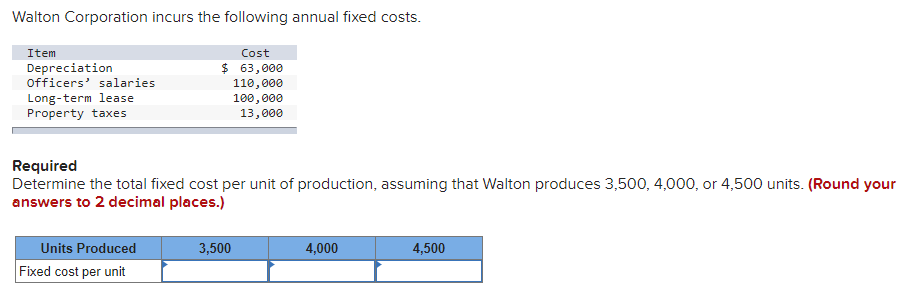

Question 1:

________________________________________________________________________________________________________________________________________________

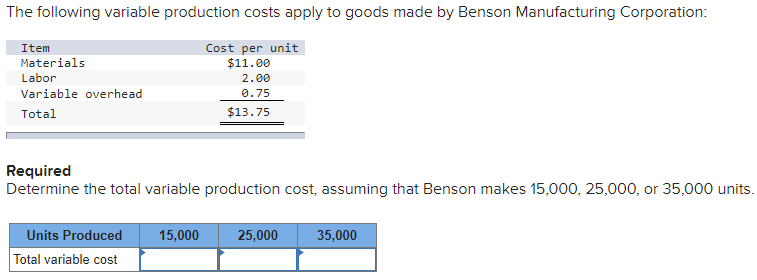

Question 2:

________________________________________________________________________________________________________________________________________________

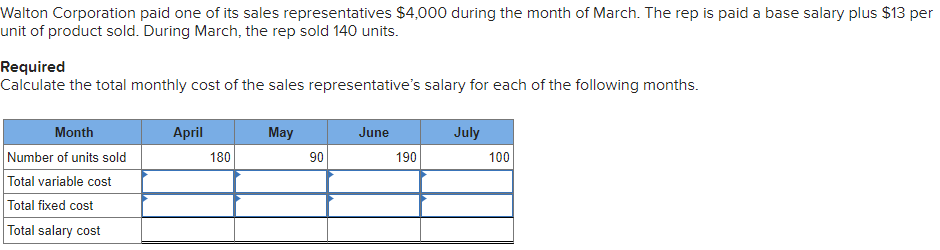

Question 3:

________________________________________________________________________________________________________________________________________________

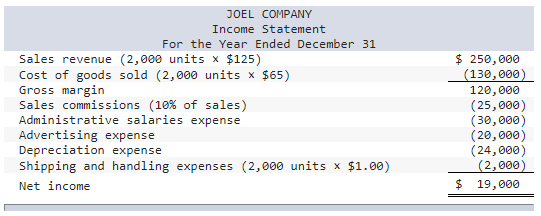

Question 4:

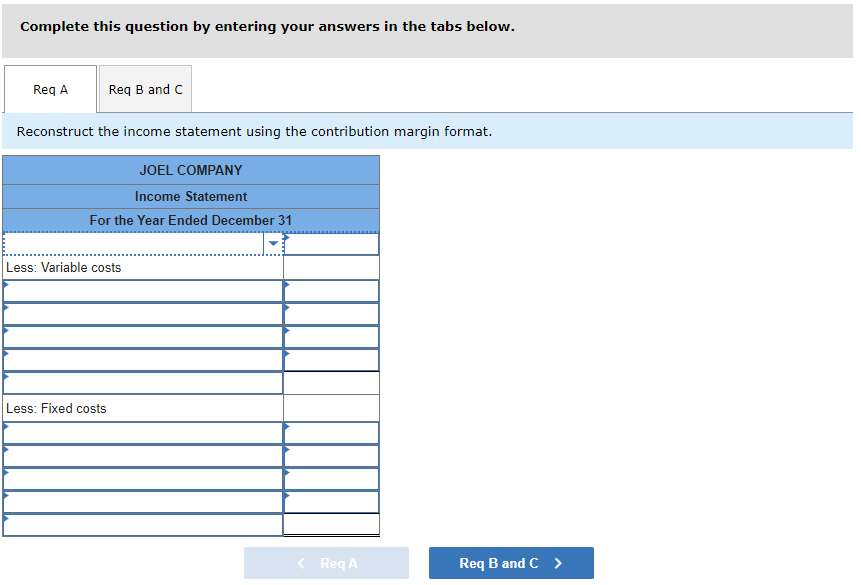

The following income statement was drawn from the records of Joel Company, a merchandising firm.

Required

a. Reconstruct the income statement using the contribution margin format.

Left column answer options:

- Administrative salaries

- Advertising expense

- Cost of goods sold

- Depreciation expense

- Sales commissions

- Sales revenue

- Selling expenses

- Shipping and handling expenses

Left column, final row answer options:

- Net income

- Net loss

Required

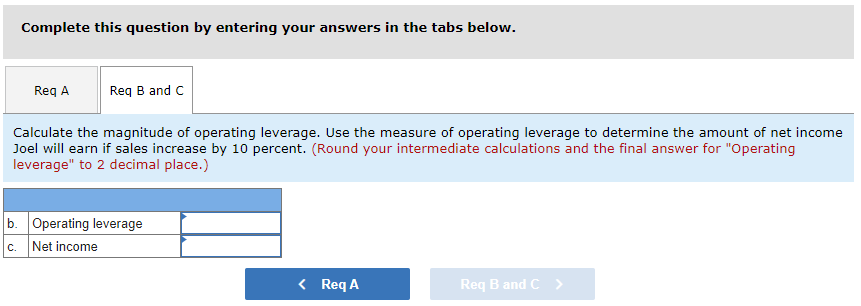

b. Calculate the magnitude of operating leverage.

c. Use the measure of operating leverage to determine the amount of net income Joel will earn if sales increase by 10 percent.

________________________________________________________________________________________________________________________________________________

Question 5:

________________________________________________________________________________________________________________________________________________

Question 6:

________________________________________________________________________________________________________________________________________________

Question 7:

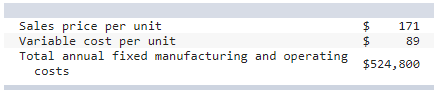

Information concerning a product produced by Ender Company appears here:

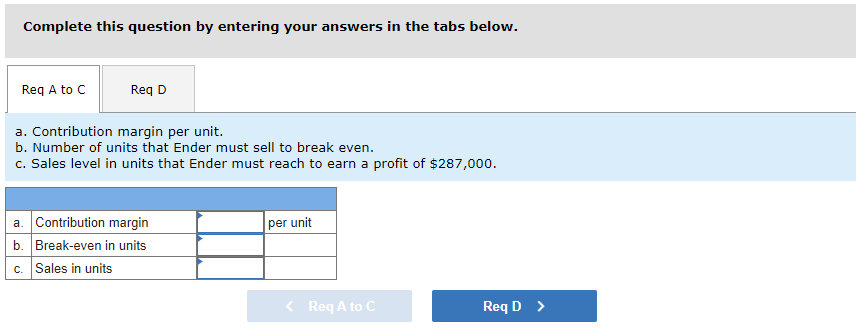

Required

Determine the following:

a. Contribution margin per unit.

b. Number of units that Ender must sell to break even.

c. Sales level in units that Ender must reach to earn a profit of $287,000.

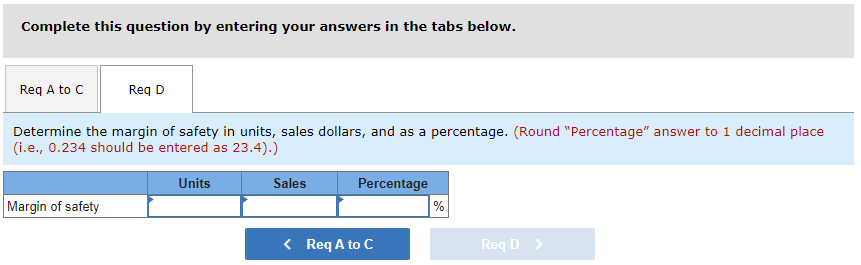

Required

Determine the following:

d. Determine the margin of safety in units, sales dollars, and as a percentage.

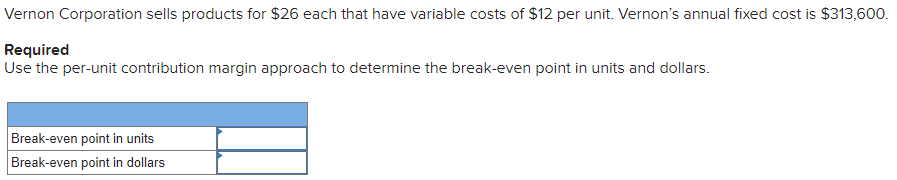

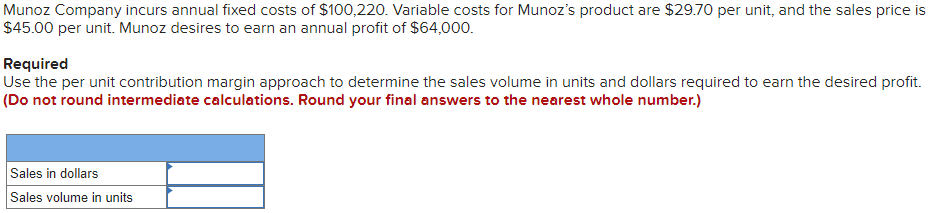

Walton Corporation incurs the following annual fixed costs. Required Determine the total fixed cost per unit of production, assuming that Walton produces 3,500,4,000, or 4,500 units. (Round your answers to 2 decimal places.) Required Determine the total variable production cost, assuming that Benson makes 15,000,25,000, or 35,000 units Walton Corporation paid one of its sales representatives $4,000 during the month of March. The rep is paid a base salary plus $13 per unit of product sold. During March, the rep sold 140 units. Required Calculate the total monthly cost of the sales representative's salary for each of the following months. Complete this question by entering your answers in the tabs below. Reconstruct the income statement using the contribution margin format. Complete this question by entering your answers in the tabs below. Calculate the magnitude of operating leverage. Use the measure of operating leverage to determine the amount of net income Joel will earn if sales increase by 10 percent. (Round your intermediate calculations and the final answer for "Operating leverage" to 2 decimal place.) Vernon Corporation sells products for $26 each that have variable costs of $12 per unit. Vernon's annual fixed cost is $313,600. Required Use the per-unit contribution margin approach to determine the break-even point in units and dollars. Munoz Company incurs annual fixed costs of $100,220. Variable costs for Munoz's product are $29.70 per unit, and the sales price is $45.00 per unit. Munoz desires to earn an annual profit of $64,000. Required Use the per unit contribution margin approach to determine the sales volume in units and dollars required to earn the desired profit. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) SalespriceperunitVariablecostperunitTotalannualfixedmanufacturingandoperatingcosts$$$524,80017189 Complete this question by entering your answers in the tabs below. a. Contribution margin per unit. b. Number of units that Ender must sell to break even. c. Sales level in units that Ender must reach to earn a profit of $287,000. Complete this question by entering your answers in the tabs below. Determine the margin of safety in units, sales dollars, and as a percentage. (Round "Percentage" answer to 1 decimal place (i.e., 0.234 should be entered as 23.4).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts