Question: question 1 question 2 question 3 question 4 A company reports the following: Net income $206,090 Preferred dividends $15,270 29,000 Shares of common stock outstanding

question 1

question 2

question 3

question 4

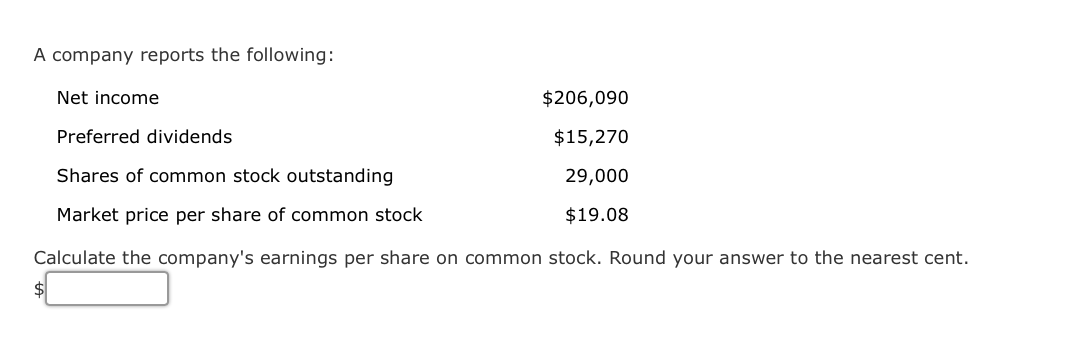

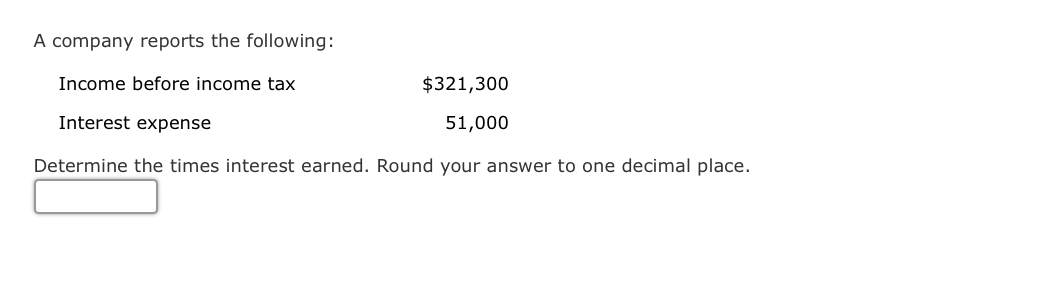

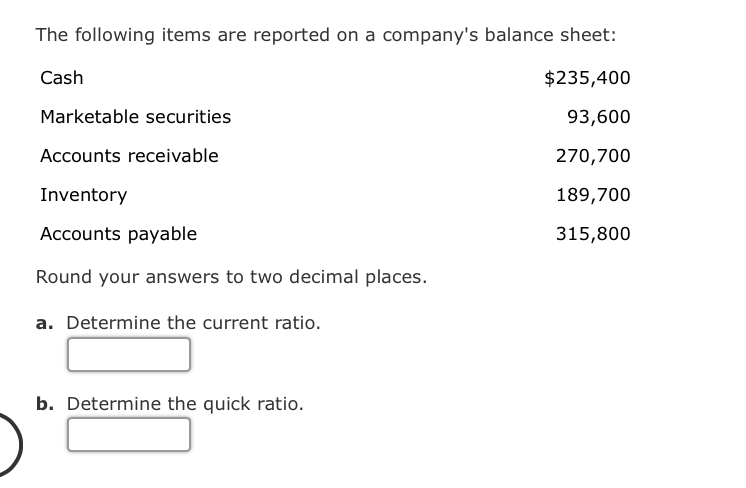

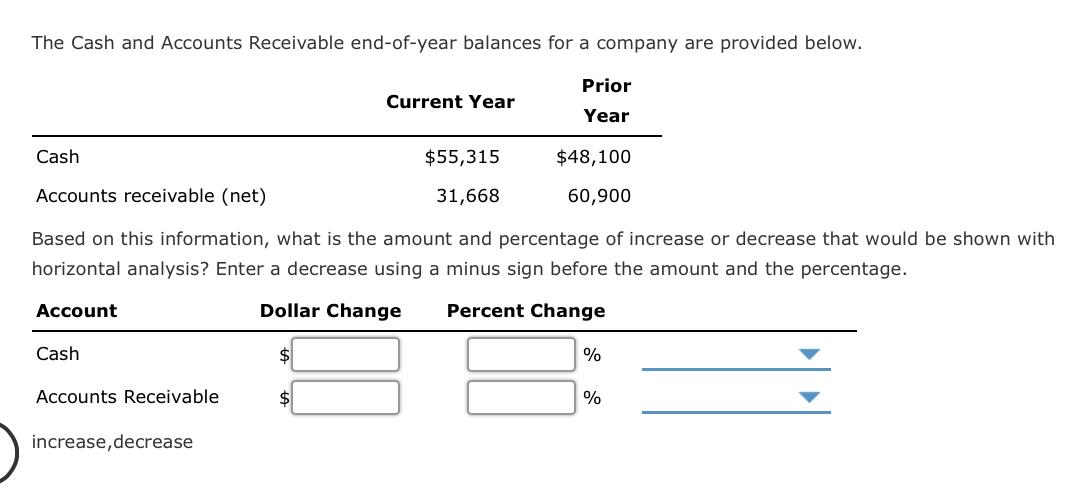

A company reports the following: Net income $206,090 Preferred dividends $15,270 29,000 Shares of common stock outstanding Market price per share of common stock $19.08 Calculate the company's earnings per share on common stock. Round your answer to the nearest cent. A company reports the following: Income before income tax $321,300 Interest expense 51,000 Determine the times interest earned. Round your answer to one decimal place. The following items are reported on a company's balance sheet: Cash $235,400 93,600 Marketable securities Accounts receivable 270,700 Inventory 189,700 Accounts payable 315,800 Round your answers to two decimal places. a. Determine the current ratio. b. Determine the quick ratio. The Cash and Accounts Receivable end-of-year balances for a company are provided below. Prior Current Year Year Cash $55,315 $48,100 Accounts receivable (net) 31,668 60,900 Based on this information, what is the amount and percentage of increase or decrease that would be shown with horizontal analysis? Enter a decrease using a minus sign before the amount and the percentage. Account Dollar Change Percent Change Cash $ % Accounts Receivable $ % increase, decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts