Question: question 1 question 2 question 3 question 4 Accrued Product Warranty Parker Manufacturing Co. warrants its products for one year. The estimated product warranty is

question 1

question 2

question 3

question 4

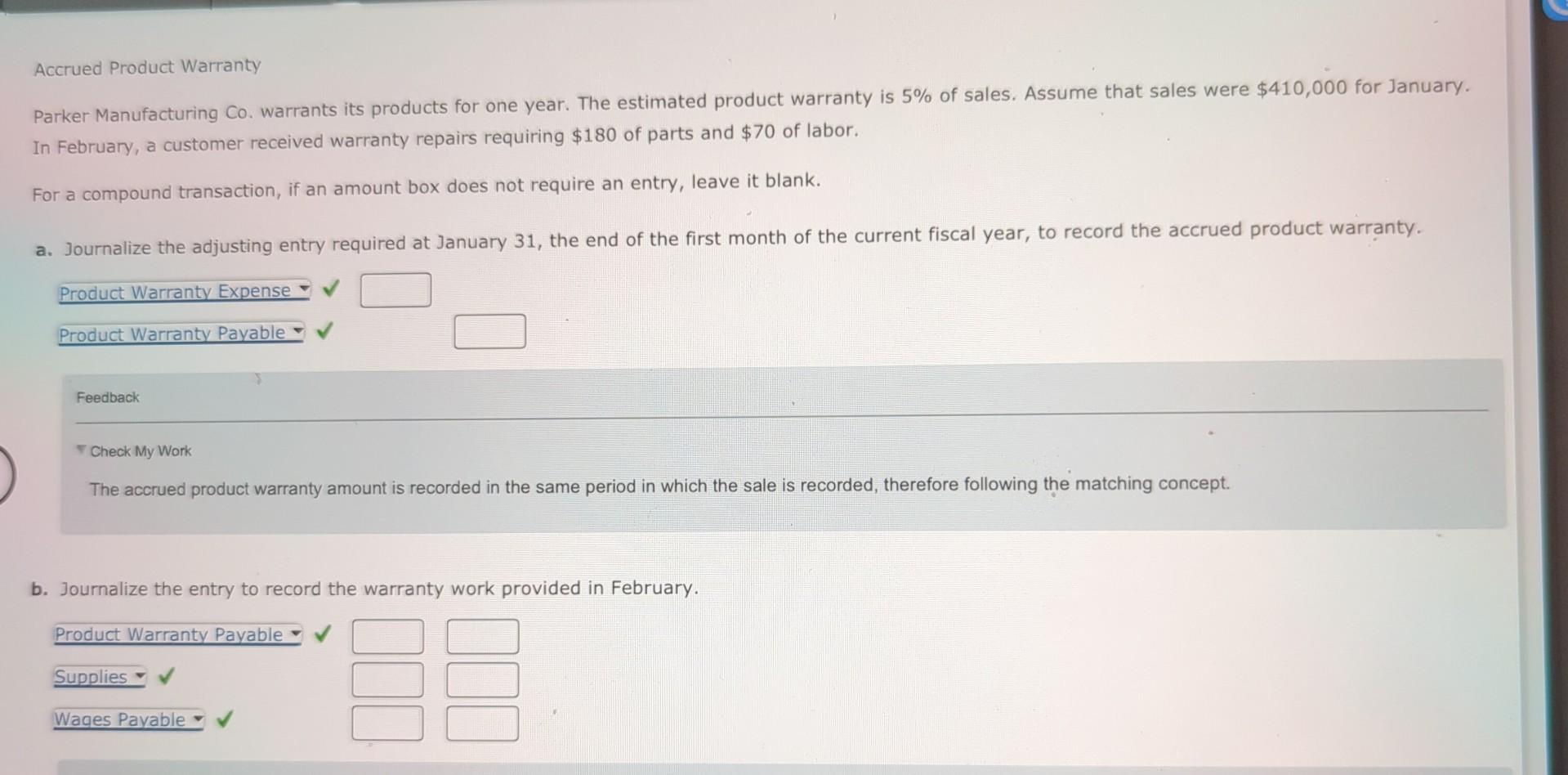

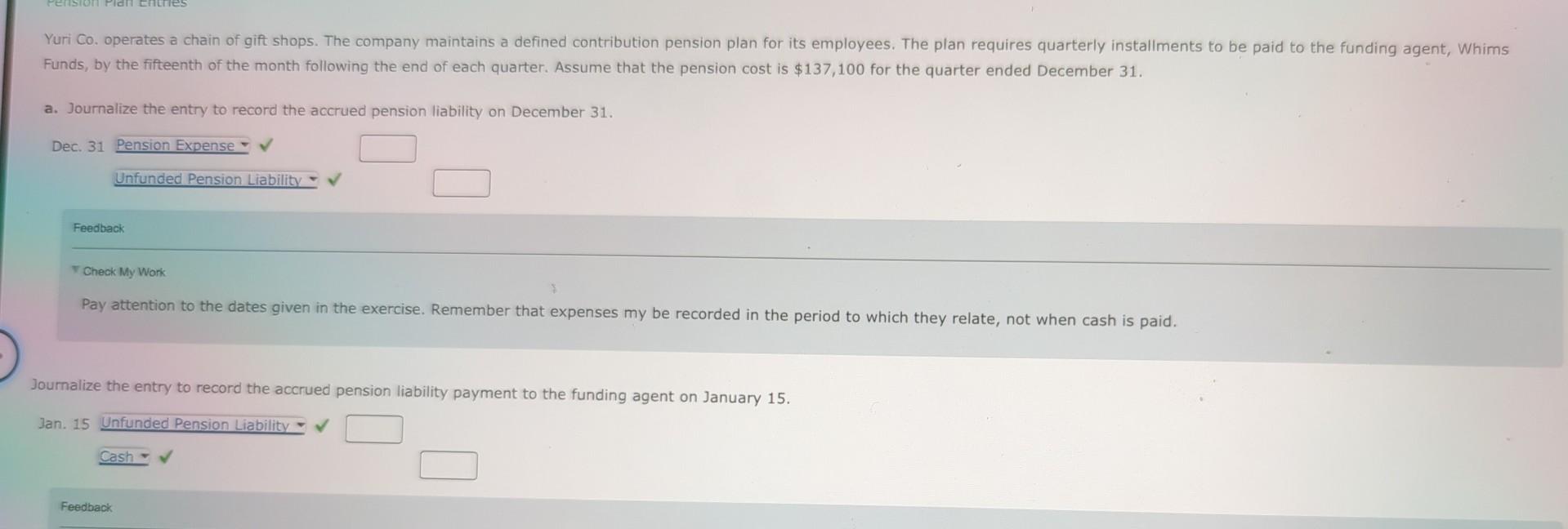

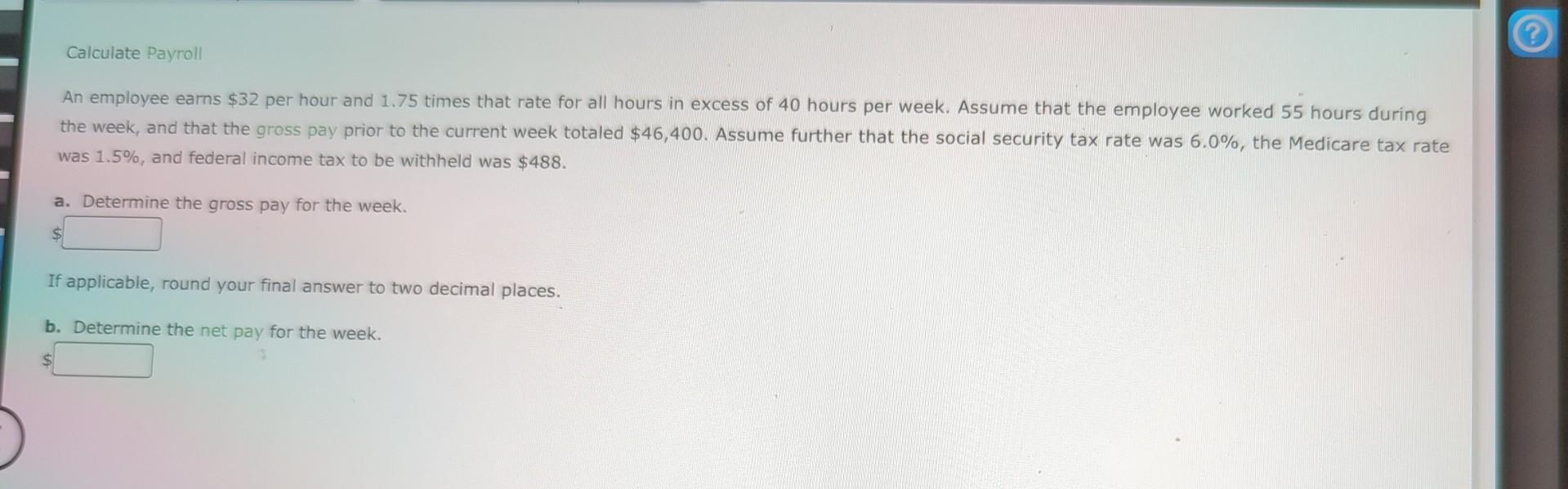

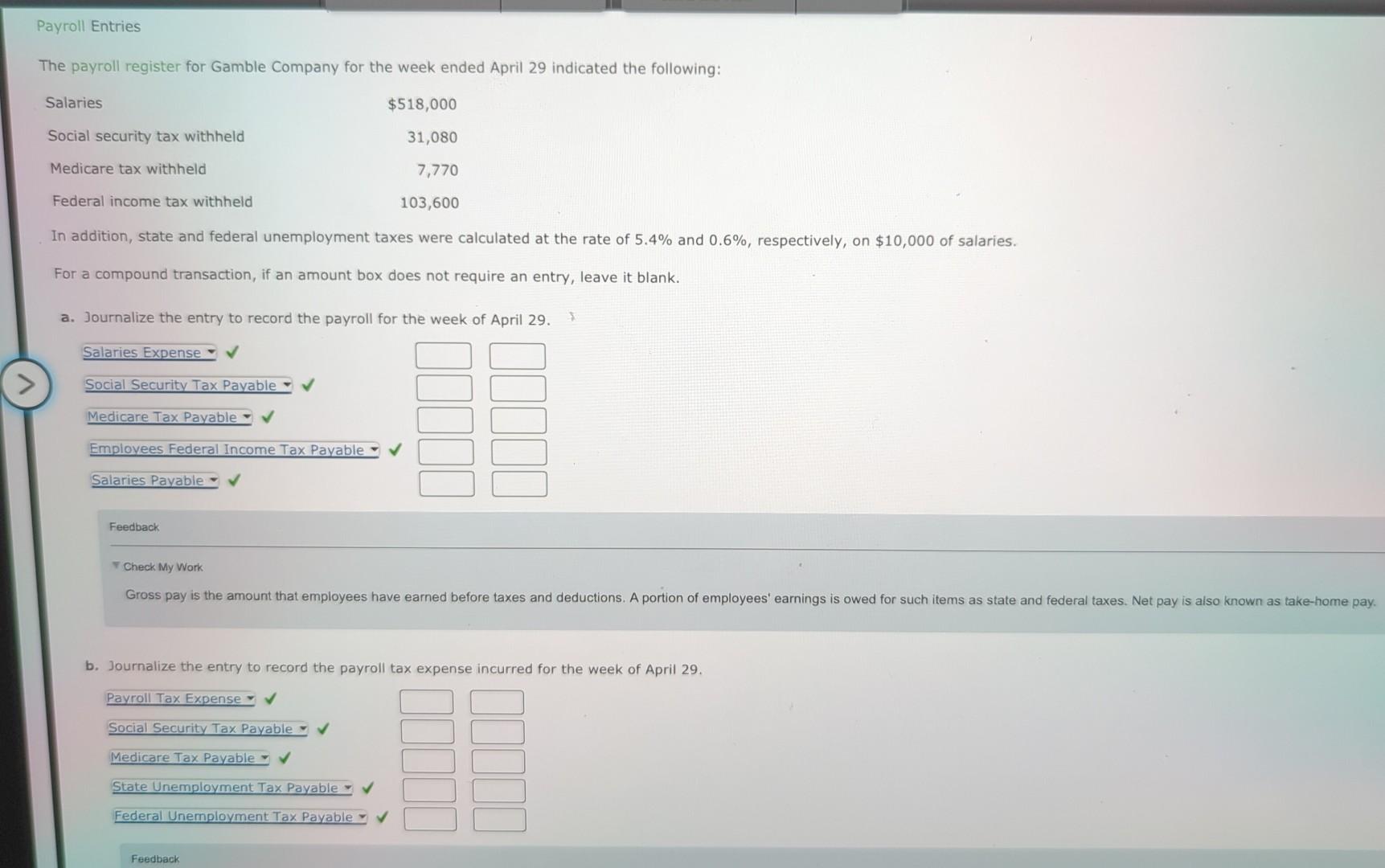

Accrued Product Warranty Parker Manufacturing Co. warrants its products for one year. The estimated product warranty is 5% of sales. Assume that sales were $410,000 for Jary. In February, a customer received warranty repairs requiring $180 of parts and $70 of labor. For a compound transaction, if an amount box does not require an entry, leave it blank. a. Journalize the adjusting entry required at January 31 , the end of the first month of the current fiscal year, to record the accrued product warranty. Feedback Check My Work The accrued product warranty amount is recorded in the same period in which the sale is recorded, therefore following the matching concept. b. Journalize the entry to record the warranty work provided in February. Funds, by the fifteenth of the month following the end of each quarter. Assume that the pension cost is $137,100 for the quarter ended December 31 . a. Journalize the entry to record the accrued pension liability on December 31 . Dec. 31 Feedback * Check My Work Joumalize the entry to record the accrued pension liability payment to the funding agent on January 15 . Jan. 15 An employee earns $32 per hour and 1.75 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 55 hours during the week, and that the gross pay prior to the current week totaled $46,400. Assume further that the social security tax rate was 6.0%, the Medicare tax rate was 1.5%, and federal income tax to be withheld was $488. a. Determine the gross pay for the week. If applicable, round your final answer to two decimal places. b. Determine the net pay for the week. Payroll Entries The payroll register for Gamble Company for the week ended April 29 indicated the following: In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.6%, respectively, on $10,000 of salaries. For a compound transaction, if an amount box does not require an entry, leave it blank. a. Journalize the entry to record the payroll for the week of April 29 . Feedback Check My Work b. Journalize the entry to record the payroll tax expense incurred for the week of April 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts