Question: question 1 question 2 question 3 question 4 On May 10, 2023, Blossom Co, enters into a contract to deliver a product to Bridgeport Inc.

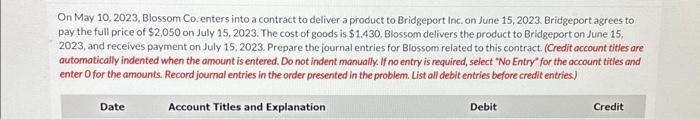

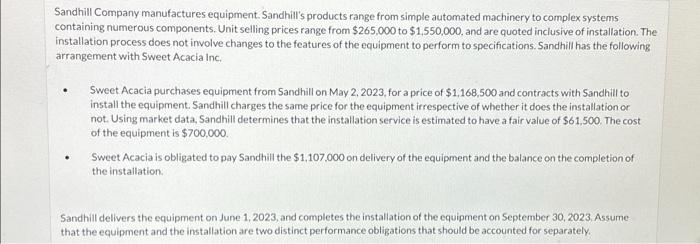

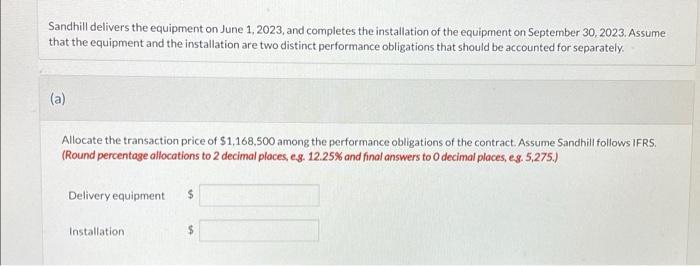

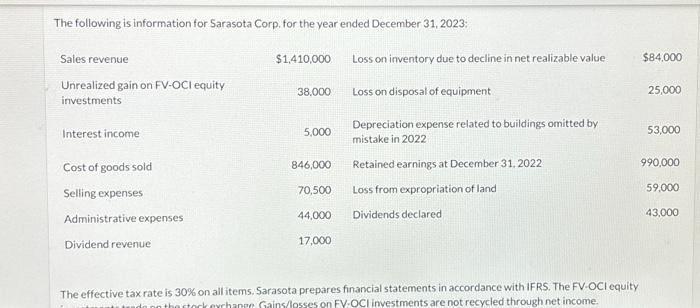

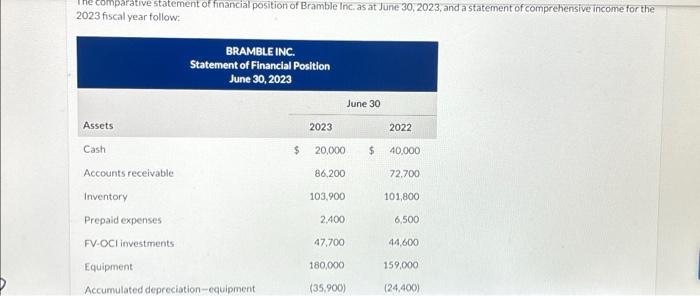

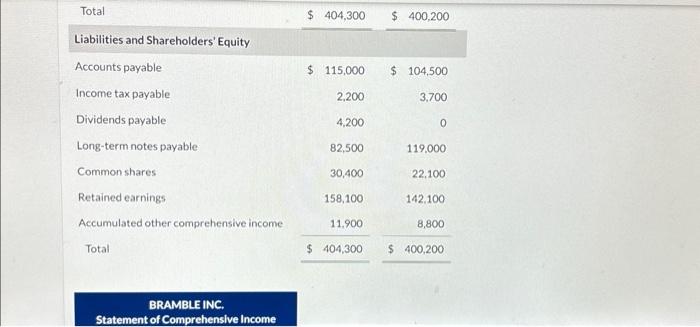

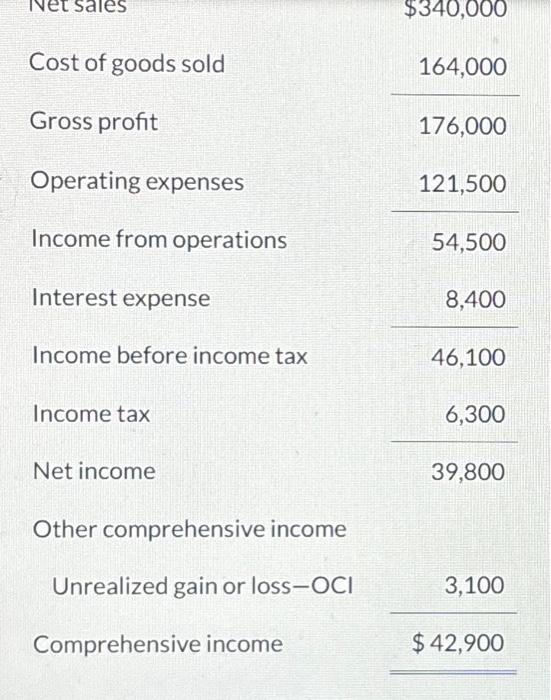

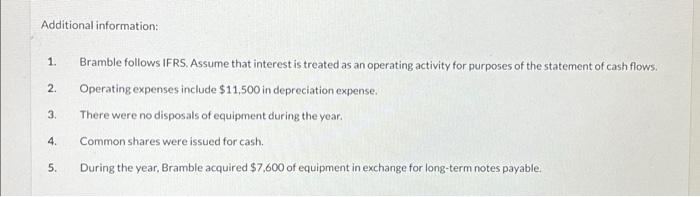

On May 10, 2023, Blossom Co, enters into a contract to deliver a product to Bridgeport Inc. on June 15, 2023. Bridgeport agrees to pay the full price of $2,050 on July 15, 2023. The cost of goods is $1,430. Blossom defivers the product to Bridgeport on June 15, 2023, and receives payment on July 15, 2023. Prepare the journal entries for Blossom related to this contract. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Additional information: 1. Bramble follows IFRS. Assume that interest is treated as an operating activity for purposes of the statement of cash flows. 2. Operating expenses include $11,500 in depreciation expense. 3. There were no disposals of equipment during the yoar. 4. Common shares were issued for cash. 5. During the year, Bramble acquired $7,600 of equipment in exchange for long-term notes payable. The following is information for Sarasota Corp, for the year ended December 31, 2023: The effective tax rate is 30% on all items. Sarasota prepares financial statements in accordance with IFRS. The FV-OCI equity \begin{tabular}{lr} Cost of goods sold & 164,000 \\ Gross profit & 176,000 \\ Operating expenses & 121,500 \\ \hline Income from operations & 84,500 \\ \hline Interest expense & 86,400 \\ \hline Income before income tax & 6,300 \\ \hline Income tax & 39,800 \end{tabular} Other comprehensive income \begin{tabular}{lr} Unrealized gain or loss-OCl & 3,100 \\ \cline { 2 - 2 } Comprehensive income & $42,900 \\ \hline \end{tabular} Sandhill delivers the equipment on June 1,2023, and completes the installation of the equipment on September 30, 2023. Assume that the equipment and the installation are two distinct performance obligations that should be accounted for separately. (a) Allocate the transaction price of $1,168,500 among the performance obligations of the contract. Assume Sandhil follows IFRS. (Round percentage allocations to 2 decimal places, es. 12.25\% and final answers to 0 decimal places, es. 5,275.) Delivery equipment Installation $ Sandhill Company manufactures equipment. Sandhill's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $265,000 to $1,550,000, and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment to perform to specifications. Sandhill has the following arrangement with Sweet Acacia Inc. - Sweet Acacia purchases equipment from Sandhill on May 2, 2023, for a price of $1,168,500 and contracts with Sandhill to install the equipment. Sandhill charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Sandhill determines that the installation service is estimated to have a fair value of $61,500. The cost of the equipment is $700,000. - Sweet Acacia is obligated to pay Sandhill the $1,107,000 on delivery of the equipment and the balance on the completion of the installation. Sandhill delivers the equipment on June 1,2023, and completes the installation of the equipment on September 30, 2023, Assume that the equipment and the installation are two distinct performance obligations that should be accounted for separately. 2023 fiscal year follow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts