Question: Question 1: Question 2: Question 3: Question 4: Question 5: Which of the following statements is correct? O Recapture occurs when an asset's value has

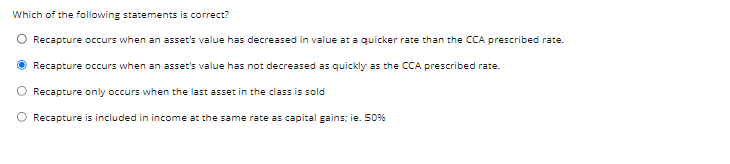

Question 1:

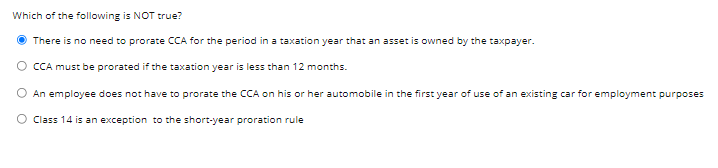

Question 2:

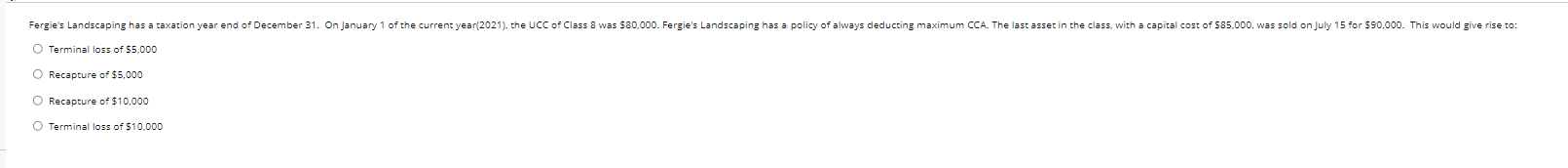

Question 3:

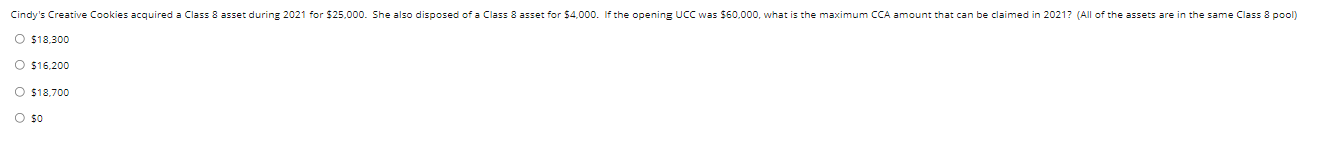

Question 4:

Question 4:

Question 5:

Question 5:

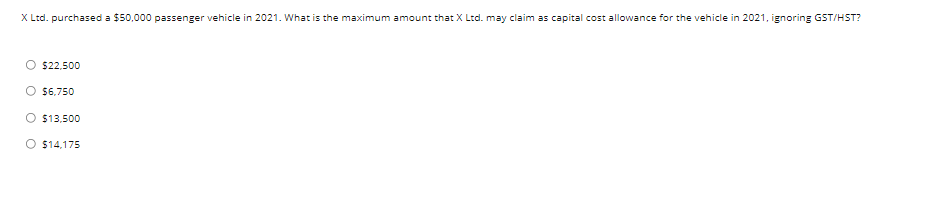

Which of the following statements is correct? O Recapture occurs when an asset's value has decreased in value at a quicker rate than the CCA prescribed rate. Recapture occurs when an asset's value has not decreased as quickly as the CCA prescribed rate. O Recapture only occurs when the last asset in the class is sold O Recapture is included in income at the same rate as capital gains: ie. 50% Which of the following is NOT true? There is no need to prorate CCA for the period in a taxation year that an asset is owned by the taxpayer. CCA must be prorated if the taxation year is less than 12 months. An employee does not have to prorate the CCA on his or her automobile in the first year of use of an existing car for employment purposes O Class 14 is an exception to the short-year proration rule Fergie's Landscaping has a taxation year end of December 31. On January 1 of the current year(2021), the UCC of Class 8 was $80,000. Fergie's Landscaping has a policy of always deducting maximum CCA. The last asset in the class, with a capital cost of $85,000, was sold on July 15 for $90,000. This would give rise to: Terminal loss of $5,000 O Recapture of $5,000 Recapture of $10,000 O Terminal loss of $10,000 Cindy's Creative Cookies acquired a Class 8 asset during 2021 for $25,000. She also disposed of a Class 3 asset for 54,000. If the opening UCC was $60,000, what is the maximum CCA amount that can be claimed in 2021? (All of the assets are in the same Class 8 pool) O $18,300 O $16,200 O $18,700 O $0 X Ltd. purchased a $50,000 passenger vehicle in 2021. What is the maximum amount that X Ltd. may claim as capital cost allowance for the vehicle in 2021, ignoring GST/HST? X $22.500 56.750 O $13,500 O $14,175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts