Question: Question 1 Question 2 Question 3 Question 4 Question 5 A company has the following budgeted costs and revenues: N$ per unit Sales 50 Variable

Question 1

Question 2

Question 3

Question 4

Question 5

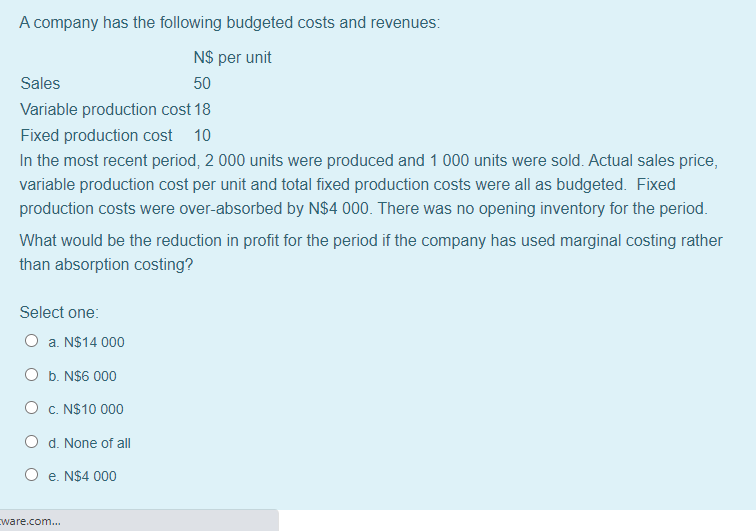

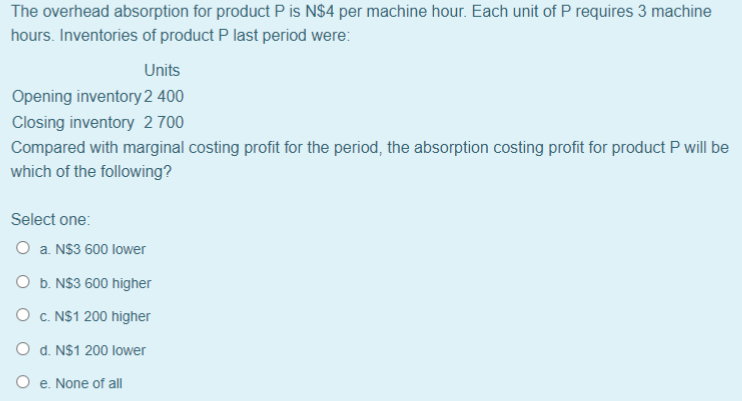

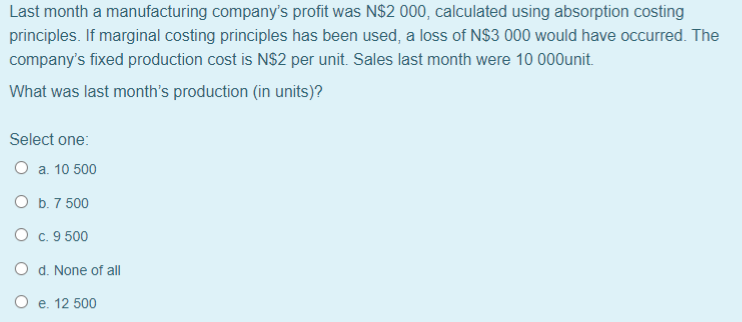

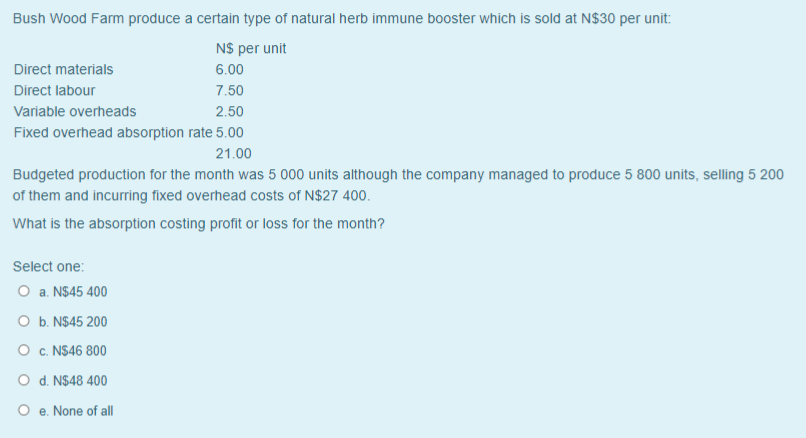

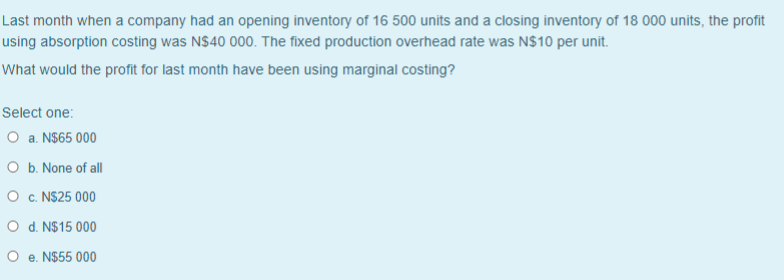

A company has the following budgeted costs and revenues: N$ per unit Sales 50 Variable production cost 18 Fixed production cost 10 In the most recent period, 2 000 units were produced and 1 000 units were sold. Actual sales price, variable production cost per unit and total fixed production costs were all as budgeted. Fixed production costs were over-absorbed by N$4 000. There was no opening inventory for the period. What would be the reduction in profit for the period if the company has used marginal costing rather than absorption costing? Select one: O a. N$14 000 O b. N$6 000 0 C. N$10 000 O d. None of all O e. N$4 000 ware.com... The overhead absorption for product P is N$4 per machine hour. Each unit of P requires 3 machine hours. Inventories of product Plast period were: Units Opening inventory 2 400 Closing inventory 2 700 Compared with marginal costing profit for the period, the absorption costing profit for product P will be which of the following? Select one: O a. N$3 600 lower O b. N$3 600 higher O c. N$1 200 higher O d. N$1 200 lower O e. None of all Last month a manufacturing company's profit was N$2 000, calculated using absorption costing principles. If marginal costing principles has been used, a loss of N$3 000 would have occurred. The company's fixed production cost is N$2 per unit. Sales last month were 10 000 unit. What was last month's production (in units)? Select one: O a. 10 500 O b. 7500 O c. 9 500 O d. None of all O e. 12 500 Bush Wood Farm produce a certain type of natural herb immune booster which is sold at N$30 per unit: N$ per unit Direct materials 6.00 Direct labour 7.50 Variable overheads 2.50 Fixed overhead absorption rate 5.00 21.00 Budgeted production for the month was 5 000 units although the company managed to produce 5 800 units, selling 5 200 of them and incurring fixed overhead costs of N$27 400 What is the absorption costing profit or loss for the month? Select one: O a. N$45 400 O b. N$45 200 O c. N$46 800 0 d. N$48 400 O e. None of all Last month when a company had an opening inventory of 16 500 units and a closing inventory of 18 000 units, the profit using absorption costing was N$40 000. The fixed production overhead rate was N$10 per unit. What would the profit for last month have been using marginal costing? Select one: O a N$65 000 O b. None of all 0 c. N$25 000 0 d. N$15 000 O e. N$55 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts