Question: Question 1 Question 2 Question 3 Question 4 Question 5 The most recent financial statements for Burnaby Co are shown here. Statement of Comprehensive Income

Question 1

Question 2

Question 3

Question 4

Question 5

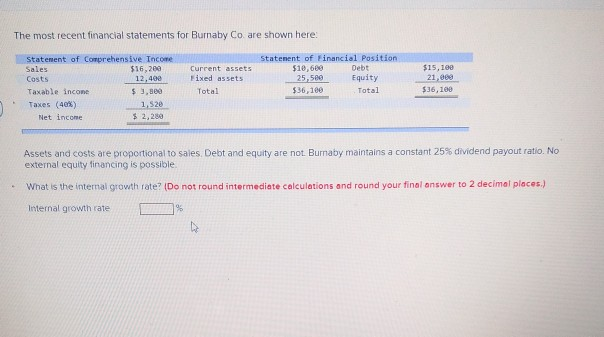

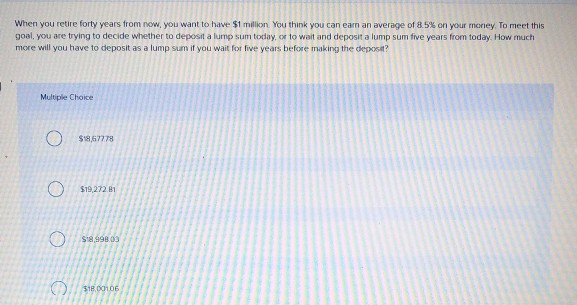

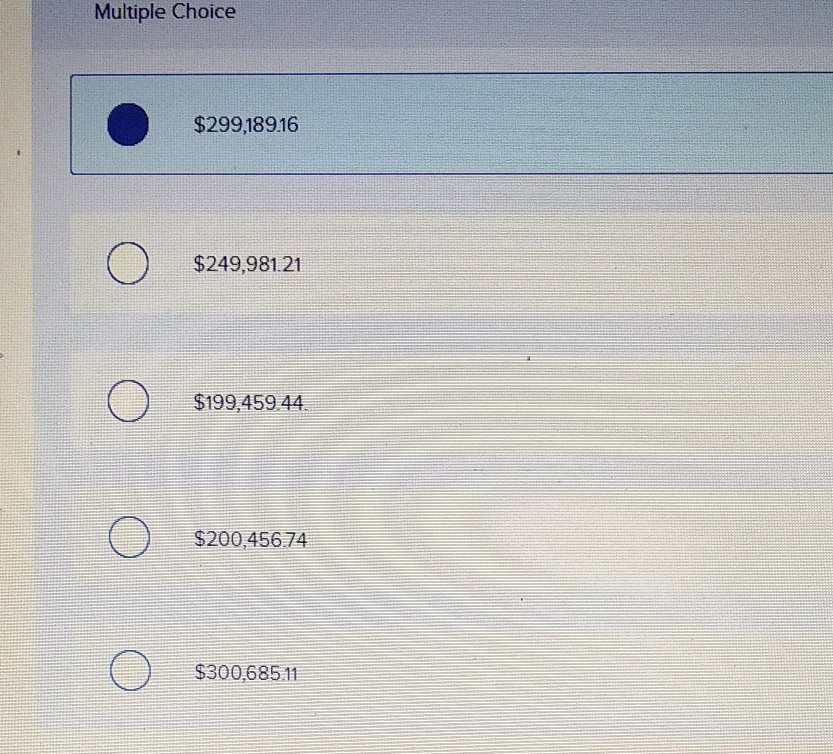

The most recent financial statements for Burnaby Co are shown here. Statement of Comprehensive Income Sales $16,200 Costs 12,400 Taxable income $ 3.500 Taxes (40%) 1,52 Net income $ 2,280 Current assets Fixed assets Total Statement of Financial Position $10,680 Debt 25,500 Equity $36,100 Total $15,100 21,089 $36,100 Assets and costs are proportional to sales Debt and equity are not Burnaby maintains a constant 25% dividend payout ratio. No external equity financing is possible What is the internal growth rate? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Internal growth rate % The future value will increase the lower the rate of interest. True or False True False The future value of a single sum will increase more rapidly when the interest rate increases True or False True False When you retire forty years from now, you want to have $1 million You think you can earn an average of 8.5% on your money to meet this goal, you are trying to decide whether to deposit a lump sum today, or to wait and deposit a lump sum five years from today. How much more will you have to deposit as a lump sum if you wait for five years before making the deposit? Multiple Choice $18.67778 O $19,272.81 O $ 8,998 03 $180106 Multiple Choice O $18,677.78 O $19,272.81 $18,998.03 $18,00106 $21,036.83 Today is January 1 Starting today, Sam is going to contribute $140 on the first of each month to his retirement account. His employer contributes an additional 50% of the amount contributed by Sam. If both Sam and his employer continue to do this and Sam can eam a monthly rate of 0.5%, how much will he have his retirement account 35 years from now Multiple Choice $29918916 $249,98121 O $199.459.44 520045674 Multiple Choice $299,189.16 $249,981.21 $199,459.44 $200,456.74 $300,685.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts